Abercrombie & Fitch 2009 Annual Report Download - page 68

Download and view the complete annual report

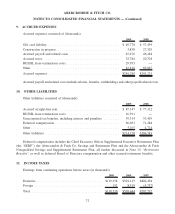

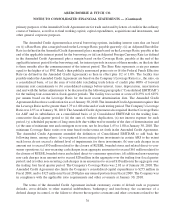

Please find page 68 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Statements of Operations and Comprehensive Income in the fourth quarter of Fiscal 2008. In

addition, and simultaneously, the Company elected to apply fair value accounting for the related Put Option

and recognized an asset of $12.3 million in Other Current Assets and a gain in Other Operating (Income)

Expense, Net in the Consolidated Statements of Operations and Comprehensive Income in the fourth quarter

of Fiscal 2008. During the fifty-two weeks ended January 30, 2010, the Company recognized, as a result of

redemptions and changes in fair value of the UBS ARS, a reduction of the other-than-temporary impairment

related to the UBS ARS of $9.2 million, and recognized a corresponding loss of $7.7 million related to the Put

Option. As the Company has the right to sell the UBS ARS back to UBS on June 30, 2010, the remaining UBS

ARS are classified as Current Assets on the Consolidated Balance Sheet as of January 30, 2010.

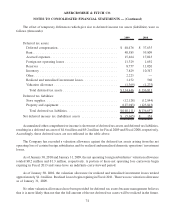

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match

respective funding obligations to participants in the Abercrombie & Fitch Co. Nonqualified Savings and

Supplemental Retirement Plan I, the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental

Retirement Plan II and the Chief Executive Officer Supplemental Executive Retirement Plan. The Rabbi

Trust assets are consolidated and recorded at fair value, with the exception of the trust-owned life insurance

policies which are recorded at cash surrender value. The Rabbi Trust assets are included in Other Assets on

the Consolidated Balance Sheets and are restricted to their use as noted above. Net unrealized gains and losses

related to the available-for-sale securities held in the Rabbi Trust were not material for fifty-two week periods

ended January 30, 2010 and January 31, 2009. The change in cash surrender value of the trust-owned life

insurance policies held in the Rabbi Trust resulted in a realized gain of $5.3 million and a realized loss of

$3.6 million for the fifty-two weeks ended January 30, 2010 and January 31, 2009, respectively, recorded in

Interest Income, Net on the Consolidated Statements of Operations and Comprehensive Income.

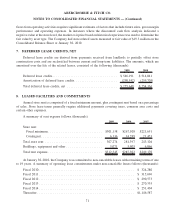

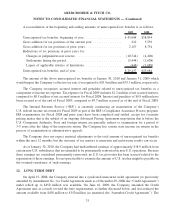

5. FAIR VALUE

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The inputs used to measure fair value are

prioritized based on a three-level hierarchy. The three levels of inputs to measure fair value are as follows:

• Level 1 — inputs are unadjusted quoted prices for identical assets or liabilities that are available in

active markets.

• Level 2 — inputs are other than quoted market prices included within Level 1 that are observable for

assets or liabilities, directly or indirectly.

• Level 3 — inputs to the valuation methodology are unobservable.

67

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)