Abercrombie & Fitch 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

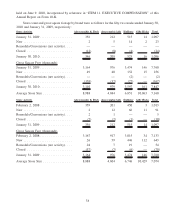

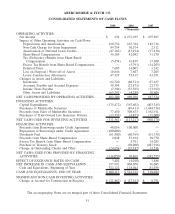

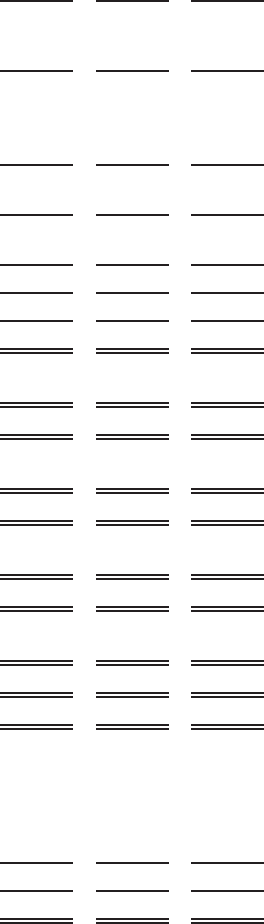

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

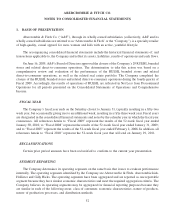

ABERCROMBIE & FITCH CO.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

2009 2008 2007

(Thousands, except per share amounts)

NET SALES .................................................. $2,928,626 $3,484,058 $3,699,656

Cost of Goods Sold ............................................ 1,045,028 1,152,963 1,211,490

GROSS PROFIT . . ............................................. 1,883,598 2,331,095 2,488,166

Stores and Distribution Expense . ................................... 1,425,950 1,436,363 1,344,178

Marketing, General & Administrative Expense . ......................... 353,269 405,248 376,780

Other Operating Income, Net . . . ................................... (13,533) (8,778) (11,702)

OPERATING INCOME . . . ........................................ 117,912 498,262 778,909

Interest Income, Net . . . ........................................ (1,598) (11,382) (18,827)

INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES . . ..... 119,510 509,644 797,737

Income Tax Expense from Continuing Operations ........................ 40,557 201,475 298,610

NET INCOME FROM CONTINUING OPERATIONS . . . .................... $ 78,953 $ 308,169 $ 499,127

NET LOSS FROM DISCONTINUED OPERATIONS (net of taxes) .............. $ (78,699) $ (35,914) $ (23,430)

NET INCOME . . . ............................................. $ 254 $ 272,255 $ 475,697

NET INCOME PER SHARE FROM CONTINUING OPERATIONS:

BASIC . . .................................................. $ 0.90 $ 3.55 $ 5.72

DILUTED .................................................. $ 0.89 $ 3.45 $ 5.45

NET LOSS PER SHARE FROM DISCONTINUED OPERATIONS:

BASIC . . .................................................. $ (0.90) $ (0.41) $ (0.27)

DILUTED .................................................. $ (0.89) $ (0.40) $ (0.26)

NET INCOME PER SHARE:

BASIC . . .................................................. $ 0.00 $ 3.14 $ 5.45

DILUTED .................................................. $ 0.00 $ 3.05 $ 5.20

WEIGHTED-AVERAGE SHARES OUTSTANDING:

BASIC . . .................................................. 87,874 86,816 87,248

DILUTED .................................................. 88,609 89,291 91,523

DIVIDENDS DECLARED PER SHARE . .............................. $ 0.70 $ 0.70 $ 0.70

OTHER COMPREHENSIVE INCOME

Foreign Currency Translation Adjustments ............................. $ 5,942 $ (13,173) $ 7,328

Unrealized Gains (Losses) on Marketable Securities, net of taxes of $(4,826), $10,312

and $(584) for Fiscal 2009, Fiscal 2008 and Fiscal 2007, respectively .......... 8,217 (17,518) 912

Unrealized (Loss) Gain on Derivative Financial Instruments, net of taxes of $265,

$(621) and $82 for Fiscal 2009, Fiscal 2008 and Fiscal 2007, respectively . . ..... (451) 892 (128)

Other Comprehensive Income (Loss) . . . .............................. $ 13,708 $ (29,799) $ 8,112

COMPREHENSIVE INCOME . . . ................................... $ 13,962 $ 242,456 $ 483,809

The accompanying Notes are an integral part of these Consolidated Financial Statements.

48