Abercrombie & Fitch 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

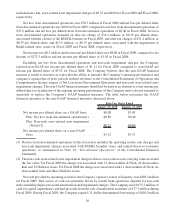

increase in interest expense in Fiscal 2008 was due to borrowings made under the Company’s unsecured

amended credit agreement in Fiscal 2008.

The effective tax rate for Fiscal 2008 was 39.5% compared to 37.4% for Fiscal 2007. Fiscal 2008

included a $9.9 million charge related to the execution of the Chairman and Chief Executive Officer’s new

employment agreement, which resulted in certain non-deductible amounts pursuant to Section 162(m) of the

Internal Revenue Code.

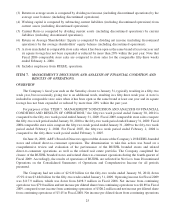

Net Loss from Discontinued Operations

Net loss from discontinued operations, net of tax, was $35.9 million and $23.4 million for Fiscal 2008

and Fiscal 2007, respectively. The results for Fiscal 2008 included $13.6 million of after-tax non-cash asset

impairment charges related to RUEHL assets as a result of the determination that the carrying value of the

assets exceeded the fair value of those assets.

Refer to Note 14, “Discontinued Operations” of the Notes to Consolidated Financial Statements for

further discussion.

Net Income and Net Income per Share

Net income for Fiscal 2008 was $272.3 million compared to $475.7 million for Fiscal 2007. Net income

per diluted weighted-average share was $3.05 in Fiscal 2008 versus $5.20 in Fiscal 2007. For Fiscal 2008, net

income per diluted share included $0.40 of net loss per diluted share from discontinued operations and an

after-tax charge of approximately $0.06 per diluted share associated with the impairment of store-related

assets. Fiscal 2007 included $0.26 of net loss per diluted share from discontinued operations.

FINANCIAL CONDITION

Liquidity and Capital Resources

The Company had $680.1 million in cash and equivalents available as of January 30, 2010, as well as an

additional $299.1 million available (less outstanding letters of credit of $50.0 million) under its unsecured

Amended Credit Agreement (as amended in June 2009) and $26.3 million available under the UBS Credit

Line, both described in Note 12, “Long-Term Debt” of the Notes to Consolidated Financial Statements. The

unsecured Amended Credit Agreement contains financial covenants that require the Company to maintain a

minimum coverage ratio and a maximum leverage ratio and also limits the Company’s consolidated capital

expenditures to $325 million in Fiscal 2010 plus the unused portion from Fiscal 2009 of $99.5 million, all

defined in the Amended Credit Agreement. If circumstances occur that would lead to the Company failing to

meet the covenants under the Amended Credit Agreement and the Company is unable to obtain a waiver or

amendment, an event of default would result and the lenders could declare outstanding borrowings imme-

diately due and payable. The Company believes it is likely that it would either obtain a waiver or amendment

in advance of a default, or would have sufficient cash available to repay borrowings in the event a waiver was

not obtained.

34