Abercrombie & Fitch 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

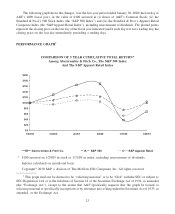

The following measurements are among the key business indicators reviewed by various members of

management to gauge the Company’s results:

• Comparable store sales by brand, by product, and by store, defined as year-over-year sales for a store

that has been open as the same brand at least one year and its square footage has not been expanded or

reduced by more than 20% within the past year;

• Direct-to-consumer sales growth;

• International and flagship store performance;

• Store productivity;

• Initial Mark Up (“IMU”);

• Markdown rate;

• Gross profit rate;

• Selling margin, defined as sales price less original cost, by brand and by product category;

• Stores and distribution expense as a percentage of net sales;

• Marketing, general and administrative expense as a percentage of net sales;

• Operating income and operating income as a percentage of net sales;

• Net income;

• Inventory per gross square foot;

• Cash flow and liquidity determined by the Company’s current ratio and cash provided by

operations; and

• Store metrics such as sales per gross square foot, sales per selling square foot, average unit retail,

average number of transactions per store, average transaction values, store contribution (defined as

store sales less direct costs of running the store), and average units per transaction.

While not all of these metrics are disclosed publicly by the Company due to the proprietary nature of the

information, the Company publicly discloses and discusses many of these metrics as part of its “Financial

Summary” and in several sections within this Management’s Discussion and Analysis of Financial Condition

and Results of Operations.

FISCAL 2009 COMPARED TO FISCAL 2008

Net Sales

Net sales for Fiscal 2009 were $2.929 billion, a decrease of 15.9% from Fiscal 2008 net sales of

$3.484 billion. The net sales decrease was attributed primarily to a 23% decrease in comparable store sales

and a 5.6% decrease in net direct-to-consumer sales, including shipping and handling revenue.

Comparable store sales by brand for Fiscal 2009 were as follows: Abercrombie & Fitch decreased 19%

with men’s decreasing by a low double-digit and women’s decreasing by a mid twenty; abercrombie kids

decreased 23% with boys’ decreasing by a mid teen and girls’ decreasing by a mid twenty; and Hollister

decreased 27% with dudes’ decreasing by a high teen and bettys’ decreasing by a low thirty.

30