Abercrombie & Fitch 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

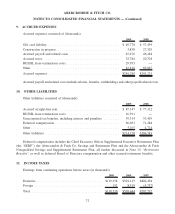

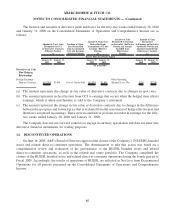

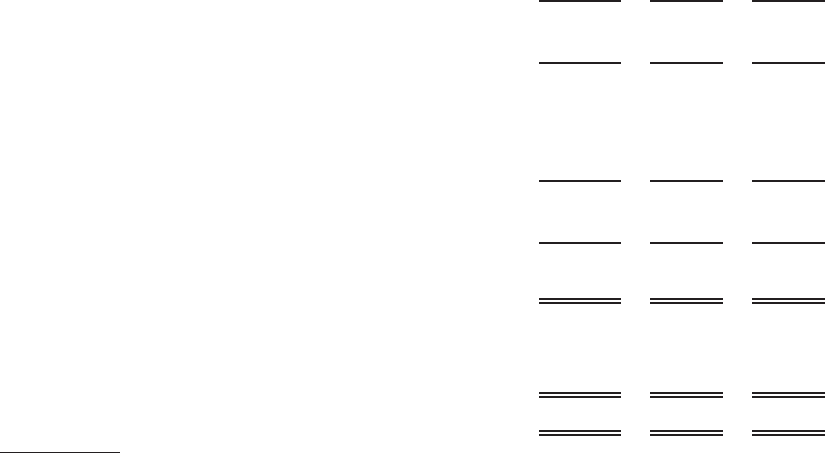

The table below presents the significant components of RUEHL’s results included in Net Loss from

Discontinued Operations on the Consolidated Statements of Operations and Comprehensive Income for fiscal

years ended January 30, 2010, January 31, 2009 and February 2, 2008.

2009 2008 2007

NET SALES .................................. $ 48,393 $ 56,218 $ 50,192

Cost of Goods Sold ............................. 22,037 25,621 26,990

GROSS PROFIT ............................... 26,356 30,597 23,202

Stores and Distribution Expense.................... 146,826 75,148 42,668

Marketing, General and Administrative Expense ........ 8,556 14,411 18,978

Other Operating Income, Net ...................... (11) (86) (28)

NET LOSS BEFORE INCOME TAXES(1) ........... $(129,016) $(58,876) $(38,416)

Income Tax Benefit ............................. (50,316) (22,962) (14,982)

NET LOSS FROM DISCONTINUED OPERATIONS,

NETOFTAX............................... $ (78,699) $(35,914) $(23,434)

NET LOSS PER SHARE FROM DISCONTINUED

OPERATIONS:

BASIC .................................... $ (0.90) $ (0.41) $ (0.27)

DILUTED .................................. $ (0.89) $ (0.40) $ (0.26)

(1) Includes non-cash pre-tax asset impairment charges of approximately $51.5 million and $22.3 million

during the fifty-two weeks ended January 30, 2010 and January 31, 2009, respectively, and net costs

associated with the closure of the RUEHL business, primarily net lease termination costs of approx-

imately $53.9 million and severance and other charges of $2.2 million during the fifty-two weeks ended

January 30, 2010.

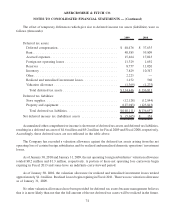

15. RETIREMENT BENEFITS

The Company maintains the Abercrombie & Fitch Co. Savings & Retirement Plan, a qualified plan. All

U.S. associates are eligible to participate in this plan if they are at least 21 years of age and have completed a

year of employment with 1,000 or more hours of service. In addition, the Company maintains the

Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan. Participation in this plan

is based on service and compensation. The Company’s contributions are based on a percentage of associates’

eligible annual compensation. The cost of the Company’s contributions to these plans was $17.8 million in

Fiscal 2009, $24.7 million in Fiscal 2008 and $21.0 million in Fiscal 2007.

Effective February 2, 2003, the Company established a Chief Executive Officer Supplemental Executive

Retirement Plan (the “SERP”) to provide additional retirement income to its Chairman and Chief Executive

Officer (“CEO”). Subject to service requirements, the CEO will receive a monthly benefit equal to 50% of his

final average compensation (as defined in the SERP) for life. The final average compensation used for the

82

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)