Abercrombie & Fitch 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

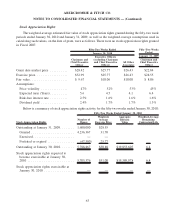

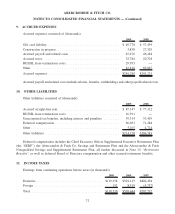

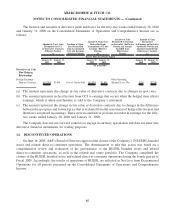

The provision for income taxes from continuing operations consisted of (thousands):

2009 2008 2007

Currently Payable:

Federal..................................... $33,212 $166,327 $254,089

State ...................................... 4,003 17,467 38,649

Foreign .................................... 5,086 8,112 2,805

$ 42,301 $191,906 $295,543

Deferred:

Federal..................................... $10,055 $ 14,028 $ 4,611

State ...................................... (147) 2,480 459

Foreign .................................... (11,652) (6,939) (2,003)

$ (1,744) $ 9,569 $ 3,067

Total provision ................................. $40,557 $201,475 $298,610

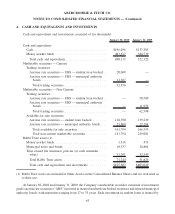

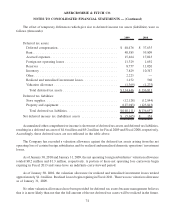

Reconciliation between the statutory federal income tax rate and the effective tax rate for continuing

operations is as follows:

2009 2008 2007

Federal income tax rate .................................. 35.0% 35.0% 35.0%

State income tax, net of federal income tax effect............... 2.1 2.5 3.2

Tax effect of foreign earnings ............................. (4.4) (0.1) 0.4

Internal Revenue Code (“IRC”) Section 162(m) ................ 1.5 2.5 0.2

Other items, net........................................ (0.3) (0.4) (1.4)

Total ................................................ 33.9% 39.5% 37.4%

Amounts paid directly to taxing authorities were $27.1 million, $198.2 million and $259.0 million in

Fiscal 2009, Fiscal 2008, and Fiscal 2007, respectively.

73

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)