Abercrombie & Fitch 2009 Annual Report Download - page 78

Download and view the complete annual report

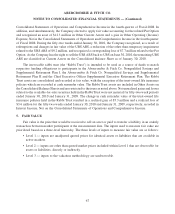

Please find page 78 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operation and conduct of the business of A&F and its subsidiaries. Upon an event of default, the lenders will

not be obligated to make loans or other extensions of credit and may, among other things, terminate their

commitments to the Company, and declare any then outstanding loans due and payable immediately.

The Amended Credit Agreement will mature on April 12, 2013. Trade letters of credit totaling

approximately $35.9 million and $21.1 million were outstanding on January 30, 2010 and January 31,

2009, respectively. Stand-by letters of credit totaling approximately $14.1 million and $16.9 million were

outstanding on January 30, 2010 and January 31, 2009, respectively. The stand-by letters of credit are set to

expire primarily during the fourth quarter of Fiscal 2010. To date, no beneficiary has drawn upon the stand-by

letters of credit.

The Company had $50.9 million and $100.0 million outstanding under the Amended Credit Agreement

as of January 30, 2010, and January 31, 2009, respectively. The $50.9 million outstanding under the Amended

Credit Agreement as of January 30, 2010 was denominated in Japanese Yen. At January 30, 2010, the

Company also had $20.3 million of long-term debt related to the landlord financing obligation for certain

leases where the Company is deemed the owner of the project for accounting purposes, as substantially all of

the risk of ownership during construction of a leased property is held by the Company. The landlord financing

obligation is amortized over the life of the related lease.

As of January 30, 2010, the carrying value of the Company’s long-term debt approximated fair value.

Total interest expense was $6.6 million and $3.4 million for Fiscal 2009 and Fiscal 2008, respectively. The

average interest rate for the long-term debt recorded under the Amended Credit Agreement was 2.0% for the

fifty-two week period ended January 30, 2010.

On March 6, 2009, the Company entered a secured, uncommitted demand line of credit (“UBS Credit

Line”) under which up to $26.3 million was available at January 30, 2010. The amount available under the

UBS Credit Line is subject to adjustment from time-to-time based on the market value of the Company’s UBS

ARS as determined by UBS. The UBS Credit Line is to be used for general corporate purposes. Being a

demand line of credit, the UBS Credit Line does not have a stated maturity date.

As security for the payment and performance of the Company’s obligations under the UBS Credit Line,

the UBS Credit Line provides that the Company grants a security interest to UBS Bank USA, as lender, in

each account of the Company at UBS Financial Services Inc. that is identified as a Collateral Account (as

defined in the UBS Credit Line), as well as any and all money, credit balances, securities, financial assets and

other investment property and other property maintained from time-to-time in any Collateral Account, any

over-the-counter options, futures, foreign exchange, swap or similar contracts between the Company and

UBS Financial Services Inc. or any of its affiliates, any and all accounts of the Company at UBS Bank USA or

any of its affiliates, any and all supporting obligations and other rights relating to the foregoing property, and

any and all interest, dividends, distributions and other proceeds of any of the foregoing property, including

proceeds of proceeds.

Because certain of the Collateral consists of ARS (as defined in the UBS Credit Line), the UBS Credit

Line provides further that the interest rate payable by the Company will reflect any changes in the

composition of such ARS Collateral (as defined in the UBS Credit Line) as may be necessary to cause

77

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)