Abercrombie & Fitch 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

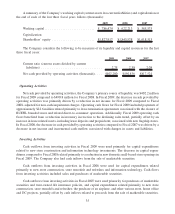

Policy Effect if Actual Results Differ from Assumptions

Equity Compensation Expense

The Company’s equity compensation expense

related to stock options and stock appreciation

rights is estimated using the Black-Scholes option-

pricing model to determine the fair value of the

stock option and stock appreciation right grants,

which requires the Company to estimate the

expected term of the stock option and stock

appreciation right grants and expected future stock

price volatility over the expected term.

The Company does not expect material changes in

the near term to the underlying assumptions used

to calculate equity compensation expense for the

fifty-two weeks ended January 30, 2010. However,

changes in these assumptions do occur, and, should

those changes be significant, they could have a

material impact on the Company’s equity

compensation expense.

A 10% increase in term would yield a 4% increase

in the Black-Scholes valuation for stock options

and stock appreciation rights, while a 10%

increase in volatility would yield a 9% increase in

the Black-Scholes valuation for stock options and

a 10% increase for stock appreciation rights.

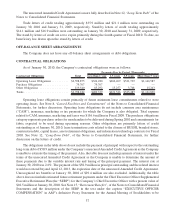

Supplemental Executive Retirement Plan

Effective February 2, 2003, the Company

established a Chief Executive Officer

Supplemental Executive Retirement Plan (the

“SERP”) to provide additional retirement income

to its Chairman and Chief Executive Officer

(“CEO”). Subject to service requirements, the CEO

will receive a monthly benefit equal to 50% of his

final average compensation (as defined in the

SERP) for life. The final average compensation

used for the calculation is based on actual

compensation, base salary and cash incentive

compensation for the past three fiscal years.

The Company’s accrual for the SERP requires

management to make assumptions and judgments

related to the CEO’s final average compensation,

life expectancy and discount rate.

The Company does not expect material changes in

the near term to the underlying assumptions used

to determine the accrual for the SERP as of

January 30, 2010. However, changes in these

assumptions do occur, and, should those changes

be significant, the Company may be exposed to

gains or losses that could be material.

A 10% increase in final average compensation as

of January 30, 2010 would increase the SERP

accrual by approximately $1.0 million. A 50 basis

point increase in the discount rate as of January

30, 2010 would decrease the SERP accrual by

approximately $0.3 million.

44