Abercrombie & Fitch 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

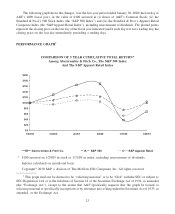

On a regional basis for Fiscal 2008, comparable store sales were down in all U.S. regions and Canada.

Comparable store sales were stronger in the flagship stores, particularly in the United Kingdom.

Direct-to-consumer net merchandise sales in Fiscal 2008 were $264.3 million, an increase of 2.1% over

Fiscal 2007 net merchandise sales of $258.8 million. Shipping and handling revenue was $42.9 million in

Fiscal 2008 and $39.1 million in Fiscal 2007. The direct-to-consumer business, including shipping and

handling revenue, accounted for 8.8% of total net sales in Fiscal 2008 compared to 8.1% of total net sales in

Fiscal 2007.

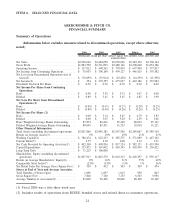

Gross Profit

Gross profit for Fiscal 2008 decreased to $2.331 billion from $2.488 billion in Fiscal 2007. The gross

profit rate for Fiscal 2008 was 66.9% versus 67.2% the previous year, a decrease of 30 basis points. The

decrease in gross profit rate was attributable to a higher IMU rate being more than offset by an increase in

markdown rate versus Fiscal 2007. The higher markdown rate resulted from the need to clear through

seasonal merchandise as a result of declining sales and the Company’s limited ability to reduce fourth quarter

of Fiscal 2008 deliveries.

Stores and Distribution Expense

Stores and distribution expense for Fiscal 2008 was $1.436 billion compared to $1.344 billion for Fiscal

2007. For Fiscal 2008, the stores and distribution expense rate was 41.2% compared to 36.3% for Fiscal 2007.

The increase in rate resulted primarily from the Company’s limited ability to leverage fixed expenses due to

negative comparable store sales. Additionally, stores and distribution expense in Fiscal 2008 also included

additional direct expenses related to flagship pre-opening rent expenses, as well as minimum wage and

manager salary increases and an $8.3 million non-cash impairment charge associated with store-related

assets.

Marketing, General and Administrative Expense

Marketing, general and administrative expense for Fiscal 2008 increased 7.5% to $405.2 million

compared to $376.8 million in Fiscal 2007. The increase in expense reflected investments in home office

resources necessary for flagship and international expansion, partially offset by savings in incentive

compensation and benefits and other home office expenses in the second half of Fiscal 2008. The marketing,

general and administrative expense rate was 11.6% for Fiscal 2008, an increase of 1.4 percentage points

compared to 10.2% for Fiscal 2007.

Other Operating Income, Net

Other operating income for Fiscal 2008 was $8.8 million compared to $11.7 million for Fiscal 2007. The

decrease was primarily driven by losses on foreign currency transactions for Fiscal 2008 compared to gains on

foreign currency transactions for Fiscal 2007, as well as a decrease in income related to gift cards for which

the Company has determined the likelihood of redemption to be remote.

Interest Income, Net and Income Tax Expense

Fiscal 2008 interest income was $14.8 million, offset by interest expense of $3.4 million compared to

interest income of $19.8 million, offset by interest expense of $1.0 million for Fiscal 2007. The decrease in

interest income in Fiscal 2008 was primarily due to a lower average rate of return on investments. The

33