Abercrombie & Fitch 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

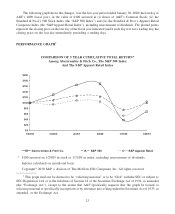

to continue to fluctuate in the future. During the past three fiscal years, comparable sales results have

fluctuated as follows: (a) from (23)% to (1)% for annual results; (b) from (30)% to 1% for quarterly results;

and (c) from (34%) to 8% for monthly results. The Company’s comparable store sales were adversely affected

by, among other factors, the economy and competitors’ promotional activities throughout Fiscal 2008 and

Fiscal 2009. The Company believes that a variety of factors affect comparable store sales results including,

but not limited to, fashion trends, actions by competitors, economic conditions, weather conditions, opening

and/or closing of Company stores near each other, and the calendar shifts of tax free and holiday periods.

Comparable store sales fluctuations may impact the Company’s ability to leverage fixed direct expenses,

including store rent and store asset depreciation, which may adversely affect the Company’s financial

condition or results of operations.

In addition, comparable store sales fluctuations may have been an important factor in the volatility of the

price of the Company’s Class A Common Stock in the past, and it is likely that future comparable store sales

fluctuations will contribute to stock price volatility in the future.

The Company’s Net Sales are Affected by Direct-to-Consumer Sales.

The Company sells merchandise over the Internet through its websites: www.abercrombie.com;

www.abercrombiekids.com; www.hollisterco.com; and www.gillyhicks.com. The Company’s Internet oper-

ations may be affected by reliance on third-party hardware and software providers, technology changes, risks

related to the failure of computer systems that operate the Internet business, telecommunications failures,

electronic break-ins, security breaches and similar disruptions. Furthermore, the Company’s ability to

conduct business on the Internet may be affected by liability for on-line content and state, federal and

international privacy laws. The Company’s failure to successfully respond to these risks might adversely

affect sales in the Company’s Internet business, as well as damage the Company’s reputation and brands.

The Company May be Exposed to Risks and Costs Associated with Credit Card Fraud and Identity

Theft.

The Company collects certain customer data during the course of business, such as credit card

information. The Company and other parties involved in processing customer transactions must be able

to transmit confidential information, including credit card information, securely over public networks.

Although the Company has security measures related to its systems and the privacy of its customers, the

Company cannot guarantee these measures will effectively prevent a security breach of customer transaction

data. A security breach could cause customers to lose confidence in the security of the Company’s systems

and could expose the Company to risks of data loss, litigation and liability and could seriously disrupt

operations and harm the Company’s reputation, any of which could adversely affect the Company’s financial

condition or results of operations.

In addition, states and federal government are enacting laws and regulations to protect consumers against

identity theft. These laws will likely increase the costs of doing business and if the Company fails to

implement appropriate security measures, the Company could be subject to potential claims for damages and

other remedies, which could adversely affect the Company’s business or results from operations.

14