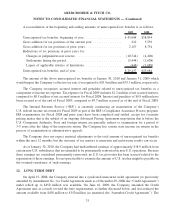

Abercrombie & Fitch 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

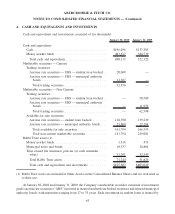

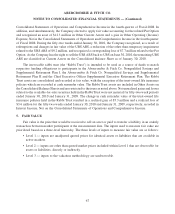

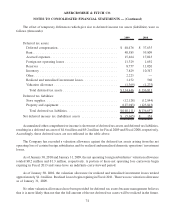

flows from operating activities requires significant estimates of factors that include future sales, gross margin

performance and operating expenses. In instances where the discounted cash flow analysis indicated a

negative value at the store level, the market exit price based on historical experience was used to determine the

fair value by asset type. The Company had store related assets measured at fair value of $19.3 million on the

Consolidated Balance Sheet at January 30, 2010.

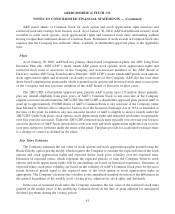

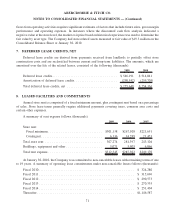

7. DEFERRED LEASE CREDITS, NET

Deferred lease credits are derived from payments received from landlords to partially offset store

construction costs and are reclassified between current and long-term liabilities. The amounts, which are

amortized over the life of the related leases, consisted of the following (thousands):

2009 2008

Deferred lease credits .................................... $546,191 $ 514,041

Amortization of deferred lease credits ........................ (290,542) (259,705)

Total deferred lease credits, net ............................ $255,649 $ 254,336

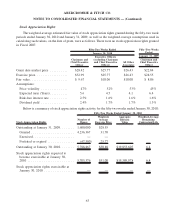

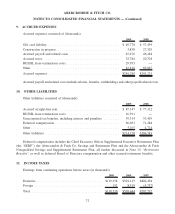

8. LEASED FACILITIES AND COMMITMENTS

Annual store rent is comprised of a fixed minimum amount, plus contingent rent based on a percentage

of sales. Store lease terms generally require additional payments covering taxes, common area costs and

certain other expenses.

A summary of rent expense follows (thousands):

2009 2008 2007

Store rent:

Fixed minimum .............................. $301,138 $267,108 $221,651

Contingent.................................. 6,136 14,289 21,453

Total store rent ................................ 307,274 281,397 243,104

Buildings, equipment and other .................... 5,071 5,905 6,066

Total rent expense .............................. $312,345 $287,302 $249,170

At January 30, 2010, the Company was committed to non-cancelable leases with remaining terms of one

to 19 years. A summary of operating lease commitments under non-cancelable leases follows (thousands):

Fiscal 2010 ..................................................... $ 324,280

Fiscal 2011 ..................................................... $ 315,696

Fiscal 2012 ..................................................... $ 290,573

Fiscal 2013 ..................................................... $ 270,335

Fiscal 2014 ..................................................... $ 251,404

Thereafter ...................................................... $1,146,587

71

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)