Abercrombie & Fitch 2009 Annual Report Download - page 62

Download and view the complete annual report

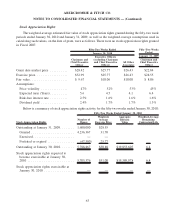

Please find page 62 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A&F issues shares of Common Stock for stock option and stock appreciation right exercises and

restricted stock unit vestings from treasury stock. As of January 30, 2010, A&F had sufficient treasury stock

available to settle stock options, stock appreciation rights and restricted stock units outstanding without

having to repurchase additional shares of Common Stock. Settlement of stock awards in Common Stock also

requires that the Company has sufficient shares available in shareholder-approved plans at the applicable

time.

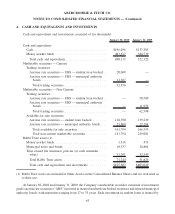

Plans

As of January 30, 2010, A&F had two primary share-based compensation plans: the 2005 Long-Term

Incentive Plan (the “2005 LTIP”), under which A&F grants stock options, stock appreciation rights and

restricted stock units to associates of the Company and non-associate members of the A&F Board of

Directors, and the 2007 Long-Term Incentive Plan (the “2007 LTIP”), under which A&F grants stock options,

stock appreciation rights and restricted stock units to associates of the Company. A&F also has four other

share-based compensation plans under which it granted stock options and restricted stock units to associates

of the Company and non-associate members of the A&F Board of Directors in prior years.

The 2007 LTIP, a shareholder-approved plan, permits A&F to grant up to 2.0 million shares annually,

plus any unused eligibility from prior years, of A&F’s Common Stock to any associate of the Company

eligible to receive awards under the 2007 LTIP. The 2005 LTIP, a shareholder-approved plan, permits A&F to

grant up to approximately 250,000 shares of A&F’s Common Stock to any associate of the Company (other

than Michael S. Jeffries) who is subject to Section 16 of the Securities Exchange Act of 1934, as amended, at

the time of the grant. In addition, any non-associate director of A&F is eligible to receive awards under the

2005 LTIP. Under both plans, stock options, stock appreciation rights and restricted stock units vest primarily

over four years for associates. Under the 2005 LTIP, restricted stock units typically vest over one year for non-

associate directors of A&F. Stock options have a ten-year term and stock appreciation rights have up to a ten-

year term, subject to forfeiture under the terms of the plans. The plans provide for accelerated vesting if there

is a change of control as defined in the plans.

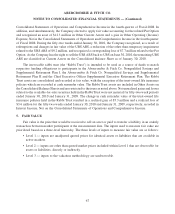

Fair Value Estimates

The Company estimates the fair value of stock options and stock appreciation rights granted using the

Black-Scholes option-pricing model, which requires the Company to estimate the expected term of the stock

options and stock appreciation rights and expected future stock price volatility over the expected term.

Estimates of expected terms, which represent the expected periods of time the Company believes stock

options and stock appreciation rights will be outstanding, are based on historical experience. Estimates of

expected future stock price volatility are based on the volatility of A&F’s Common Stock price for the most

recent historical period equal to the expected term of the stock option or stock appreciation right, as

appropriate. The Company calculates the volatility as the annualized standard deviation of the differences in

the natural logarithms of the weekly stock closing price, adjusted for stock splits and dividends.

In the case of restricted stock units, the Company calculates the fair value of the restricted stock units

granted as the market price of the underlying Common Stock on the date of grant adjusted for anticipated

dividend payments during the vesting period.

61

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)