Abercrombie & Fitch 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) the U.S. government under the Federal Family Education Loan Program, (2) a private insurer, or (3) a

combination of both. The percentage coverage of the outstanding principal and interest of the ARS varies by

security.

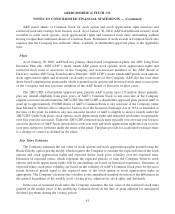

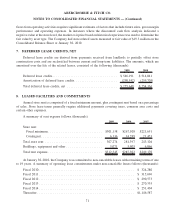

The par and fair values, and related cumulative impairment charges for the Company’s marketable

securities as of January 30, 2010 were as follows:

(In thousands) Par Value

Temporary

Impairment

Other-Than-Temporary

Impairment (“OTTI”) Fair Value

Trading securities:

Auction rate securities — UBS —

student loan backed ........... $ 22,100 $ — $(2,051) $ 20,049

Auction rate securities — UBS —

municipal authority bonds ....... 15,000 — (2,693) 12,307

Total trading securities ......... 37,100 — (4,744) 32,356

Available-for-sale securities:

Auction rate securities — student

loan backed ................. 128,099 (9,709) — 118,390

Auction rate securities — municipal

authority bonds............... 28,575 (5,171) — 23,404

Total available-for-sale securities. . 156,674 (14,880) — 141,794

Total ...................... $193,774 $(14,880) $(4,744) $174,150

See Note 5, “Fair Value,” for further discussion on the valuation of the ARS.

The temporary impairment related to available-for-sale ARS was reduced by $13.3 million for the fifty-

two weeks ended January 30, 2010 due to redemptions and changes in fair value. An impairment is considered

to be other-than-temporary if an entity (i) intends to sell the security, (ii) more likely than not will be required

to sell the security before recovering its amortized cost basis, or (iii) does not expect to recover the security’s

entire amortized cost basis, even if there is no intent to sell the security. As of January 30, 2010, the Company

had not incurred any credit-related losses on available-for-sale ARS. Furthermore, as of January 30, 2010, the

issuers continued to perform under the obligations, including making scheduled interest payments, and the

Company expects that this will continue going forward.

On November 13, 2008, the Company entered into an agreement (the “UBS Agreement”) with UBS AG

(“UBS”), a Swiss corporation, relating to ARS (“UBS ARS”) with a par value of $76.5 million, of which

$37.1 million, at par value, are still held as of January 30, 2010. By entering into the UBS Agreement, UBS

received the right to purchase these UBS ARS at par, at any time, commencing on November 13, 2008 and the

Company received the right to sell (“Put Option”) the UBS ARS back to UBS at par, commencing on June 30,

2010. Upon acceptance of the UBS Agreement, the Company no longer had the intent to hold the UBS ARS

until maturity. Therefore, the impairment could no longer be considered temporary. As a result, the Company

transferred the UBS ARS from available-for-sale securities to trading securities and recognized an

other-than-temporary impairment of $14.0 million in Other Operating (Income) Expense, Net in the

66

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)