Abercrombie & Fitch 2009 Annual Report Download - page 79

Download and view the complete annual report

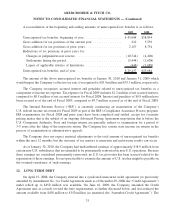

Please find page 79 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the interest payable by the Company under the UBS Credit Line to equal the interest or dividend rate payable

to the Company by the issuer of any ARS Collateral.

The terms of the UBS Credit Line include customary events of default such as payment defaults, the

failure to maintain sufficient collateral, the failure to observe any covenant or material representation,

bankruptcy and insolvency, cross-defaults to other indebtedness and other stated events of default. Upon an

event of default, the obligations under the UBS Credit Line will become immediately due and payable. No

borrowings were outstanding under the UBS Credit Line as of January 30, 2010.

13. DERIVATIVES

All derivative instruments are recorded at fair value on the Consolidated Balance Sheets as either Other

Assets or Accrued Expenses. The accounting for changes in the fair value of a derivative instrument depends

on whether it has been designated as a hedge and qualifies for hedge accounting treatment. Refer to Note 5,

“Fair Value” for further discussion of the determination of the fair value of derivatives. As of January 30,

2010, all outstanding derivative instruments were designated as hedges and qualified for hedge accounting

treatment. There were no outstanding derivative instruments as of January 31, 2009.

In order to qualify for hedge accounting, a derivative must be considered highly effective at offsetting

changes in either the hedged item’s cash flows or fair value. Additionally, the hedge relationship must be

documented to include the risk management objective and strategy, the hedging instrument, the hedged item,

the risk exposure, and how hedge effectiveness will be assessed prospectively and retrospectively. The extent

to which a hedging instrument has been and is expected to continue to be effective at achieving offsetting

changes in fair value or cash flows is assessed and documented at least quarterly. Any hedge ineffectiveness is

reported in current period earnings and hedge accounting is discontinued if it is determined that the derivative

is not highly effective.

For derivatives that either do not qualify for hedge accounting or are not designated as hedges, all

changes in the fair value of the derivative are recognized in earnings. For qualifying cash flow hedges, the

effective portion of the change in the fair value of the derivative is recorded as a component of Other

Comprehensive Income (Loss) (“OCI”) and recognized in earnings when the hedged cash flows affect

earnings. The ineffective portion of the derivative gain or loss, as well as changes in the fair value of the

derivative’s time value are recognized in current period earnings. The effectiveness of the hedge is assessed

based on changes in fair value attributable to changes in spot prices. The changes in the fair value of the

derivative contract related to the changes in the difference between the spot price and the forward price are

excluded from the assessment of hedge effectiveness and are also recognized in current period earnings. If the

cash flow hedge relationship is terminated, the derivative gains or losses that are deferred in OCI will be

recognized in earnings when the hedged cash flows occur. However, for cash flow hedges that are terminated

because the forecasted transaction is not expected to occur in the original specified time period, or a two-

month period thereafter, the derivative gains or losses are immediately recognized in earnings. There were no

gains or losses reclassified into earnings as a result of the discontinuance of cash flow hedges as of January 30,

2010.

The Company uses derivative instruments, primarily forward contracts designated as cash flow hedges,

to hedge the foreign currency exposure associated with forecasted foreign-currency-denominated

78

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)