Abercrombie & Fitch 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

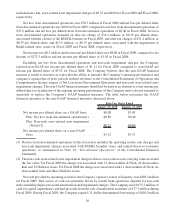

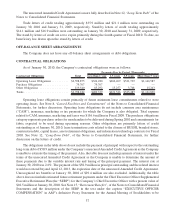

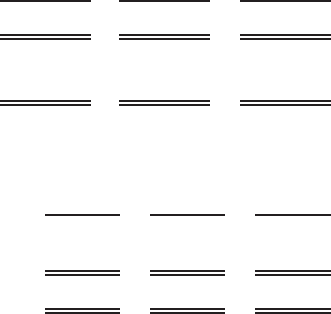

A summary of the Company’s working capital (current assets less current liabilities) and capitalization at

the end of each of the last three fiscal years follows (thousands):

2009 2008 2007

Working capital ............................ $ 786,474 $ 622,213 $ 585,575

Capitalization:

Shareholders’ equity ........................ $1,827,917 $1,845,578 $1,618,313

The Company considers the following to be measures of its liquidity and capital resources for the last

three fiscal years:

2009 2008 2007

Current ratio (current assets divided by current

liabilities) .................................. 2.75 2.38 2.08

Net cash provided by operating activities (thousands) .... $402,200 $490,836 $817,524

Operating Activities

Net cash provided by operating activities, the Company’s primary source of liquidity, was $402.2 million

for Fiscal 2009 compared to $490.8 million for Fiscal 2008. In Fiscal 2009, the decrease in cash provided by

operating activities was primarily driven by a reduction in net income for Fiscal 2009 compared to Fiscal

2008, adjusted for non-cash impairment charges. Operating cash flows for Fiscal 2009 included payments of

approximately $22.6 million related primarily to lease termination agreements associated with the closure of

RUEHL branded stores and related direct-to-consumer operations. Additionally, Fiscal 2009 operating cash

flows benefited from a reduction in inventory in reaction to the declining sales trend, partially offset by an

increase in lease related assets, including lease deposits and prepaid rent, associated with new flagship stores.

In Fiscal 2008, the decrease in cash provided by operating activities compared to Fiscal 2007 was driven by a

decrease in net income and incremental cash outflow associated with changes in assets and liabilities.

Investing Activities

Cash outflows from investing activities in Fiscal 2009 were used primarily for capital expenditures

related to new store construction and information technology investments. The decrease in capital expen-

ditures compared to Fiscal 2008 related primarily to a reduction in new domestic mall-based store openings in

Fiscal 2009. The Company also had cash inflows from the sale of marketable securities.

Cash outflows from investing activities in Fiscal 2008 were used for capital expenditures related

primarily to new store construction, store remodels and refreshes and information technology. Cash flows

from investing activities included sales and purchases of marketable securities.

Cash outflows from investing activities in Fiscal 2007 were used primarily for purchases of marketable

securities and trust-owned life insurance policies, and capital expenditures related primarily to new store

construction; store remodels and refreshes; the purchase of an airplane; and other various store, home office

and DC projects, partially offset by cash inflows related to proceeds from the sale of marketable securities.

35