Abercrombie & Fitch 2009 Annual Report Download - page 61

Download and view the complete annual report

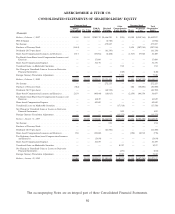

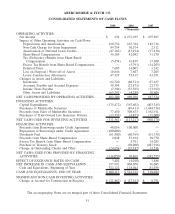

Please find page 61 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SHARE-BASED COMPENSATION

See Note 3, “Share-Based Compensation”.

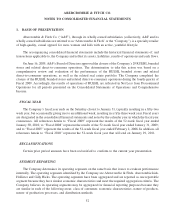

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL STATEMENTS

The preparation of financial statements in accordance with generally accepted accounting principles

requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. Since actual results may differ from those estimates, the Company revises its estimates

and assumptions as new information becomes available.

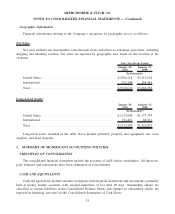

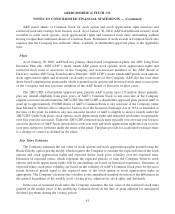

3. SHARE-BASED COMPENSATION

Financial Statement Impact

The Company recognized share-based compensation expense, including expense for RUEHL associates,

of $36.1 million, $42.0 million and $31.2 million for the fifty-two week periods ended January 30, 2010,

January 31, 2009 and February 2, 2008, respectively. The Company also recognized $12.8 million, $15.4 million

and $11.5 million in tax benefits related to share-based compensation, including benefit for RUEHL associates,

for the fifty-two week periods ended January 30, 2010, January 31, 2009 and February 2, 2008, respectively.

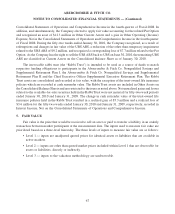

A deferred tax asset is recorded on the compensation expense required to be accrued under the

accounting rules. A current income tax deduction arises at the time the restricted stock unit vests or stock

option/stock appreciation right is exercised. In the event the current income tax deduction is greater or less

than the associated deferred tax asset, the difference is required under the accounting rules to be charged first

to the “windfall tax benefit” account. In the event there is not a balance in the “windfall tax benefit” account,

the shortfall is charged to tax expense. The amount of the Company’s “windfall tax benefit” account, which is

recorded as a component of additional paid in capital, was approximately $86.0 million as of January 30,

2010. Based upon outstanding awards, the “windfall tax benefit” account is sufficient to fully absorb any

shortfall which may develop.

Additionally, during Fiscal 2008, the Company recognized $9.9 million of non-deductible tax expense as

a result of the execution of the Chairman and Chief Executive Officer’s new employment agreement on

December 19, 2008, which pursuant to Section 162(m) of the Internal Revenue Code resulted in the exclusion

of previously recognized tax benefits on share-based compensation.

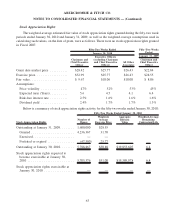

Share-based compensation expense is recognized, net of estimated forfeitures, over the requisite service

period on a straight-line basis. The Company adjusts share-based compensation expense on a quarterly basis

for actual forfeitures and for changes to the estimate of expected award forfeitures based on actual forfeiture

experience. The effect of adjusting the forfeiture rate is recognized in the period the forfeiture estimate is

changed. The effect of adjustments for forfeitures during the fifty-two week period ended January 30, 2010

was $6.7 million. The effect of adjustments for forfeitures during the fifty-two week period ended January 31,

2009 was immaterial.

60

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)