Abercrombie & Fitch 2009 Annual Report Download - page 30

Download and view the complete annual report

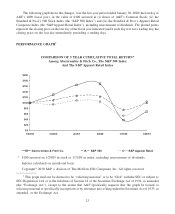

Please find page 30 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CURRENT TRENDS AND OUTLOOK

While 2009 was a challenging year for the Company, it was one in which the Company believes it made

significant progress in laying the foundations for future success. The Company continues to work hard to

improve the performance of its domestic business while continuing to be pleased with the progress of its

international rollout strategy.

The Company’s objective in Fiscal 2010 and subsequent years is to increase its operating margin back

towards historical levels, which the Company believes will require a combination of the following factors.

First, returning gross margin to historic levels. The Company believes the factors in achieving this will

be optimizing its average unit retails, achieving further reductions in average unit cost, and benefiting from

international operations with higher gross margins. In the short-term there may be further erosion of the gross

profit rate, to the extent that the Company believes that further reduction in average unit retail can enable the

Company to improve productivity levels.

Second, improvements in domestic productivity levels and the closure of negative contribution stores.

The Company is in the process of reviewing negative contribution stores and, to the extent it does not foresee a

recovery for applicable stores, plans to address these stores through a combination of natural lease

expirations, rent relief negotiations with landlords and, potentially early closures of certain underperforming

stores.

Third, the Company continues with its plan for accelerated international openings in Fiscal 2010, and

will potentially accelerate further beyond that to achieve profitable international growth. In Fiscal 2010, the

Company remains on track to open Abercrombie & Fitch flagship stores in Fukuoka and Copenhagen. Going

forward, the format of flagship stores is likely to be a combination of the original flagship model and a smaller

store format similar to the template being used in Copenhagen. The Company currently plans to open

approximately 30 international mall-based Hollister stores, including in two or more new countries, in 2010.

The Hollister openings will predominantly be in the third, and particularly the fourth quarters.

The Company is also focusing significant attention on improving the productivity of its Gilly Hicks

brand, which the Company believes is a necessary precursor to expanding the store count for the brand and

having a path to profitability.

Finally, the Company will continue to maintain tight control over expenses and to seek greater

efficiencies in its operations.

In Fiscal 2010, the Company will continue to concentrate on protecting the brands, while seeking to

drive improvement in its domestic business, and continue its international growth.

29