Abercrombie & Fitch 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Assuming no changes in the Company’s financial structure as it stood at January 30, 2010, if the average

market interest rates increased 100 basis points over the fifty-two week period for Fiscal 2010 compared to the

interest rates incurred during the fifty-two week period ended January 30, 2010, there would be an immaterial

change in interest expense. This amount was determined by calculating the effect of the average hypothetical

interest rate increase on the Company’s variable rate unsecured Amended Credit Agreement. This hypo-

thetical increase in interest rate for the fifty-two week period ended January 29, 2011 may be different from

the actual increase in interest expense due to varying interest rate reset dates under the Company’s unsecured

Amended Credit Agreement.

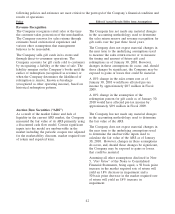

Foreign Exchange Rate Risk

The Company has exposure to changes in currency exchange rates associated with foreign currency

transactions, including inter-company transactions and foreign denominated assets and liabilities. Such

foreign currency transactions are denominated in Euros, Canadian Dollars, Japanese Yen, Danish Krones,

Swiss Francs, Hong Kong Dollars and British Pounds. The Company has established a program that primarily

utilizes foreign currency forward contracts to partially offset the risks associated with the effects of certain

foreign currency exposures. Under this program, increases or decreases in foreign currency exposures are

partially offset by gains or losses on forward contracts, to mitigate the impact of foreign currency gains or

losses. The Company does not use forward contracts to engage in currency speculation. All outstanding

foreign currency forward contracts are recorded at fair value at the end of each fiscal period.

47