Abercrombie & Fitch 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

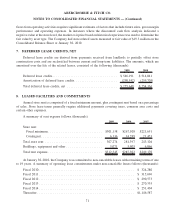

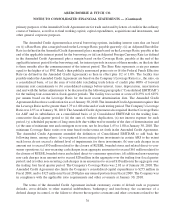

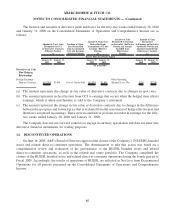

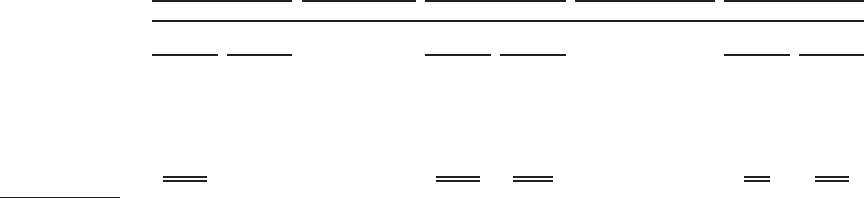

The location and amounts of derivative gains and losses for the fifty-two weeks ended January 30, 2010

and January 31, 2009 on the Consolidated Statements of Operations and Comprehensive Income are as

follows:

January 30,

2010

January 31,

2009

January 30,

2010

January 31,

2009

January 30,

2010

January 31,

2009

For the Fifty-Two Weeks Ended

Location of (Gain)

Loss Reclassified

from Accumulated

OCI into Earnings

(Effective Portion)

Location of Gain

Recognized in Earnings

on Derivative (Ineffective

Portion and Amount

Excluded from

Effectiveness

Testing)

Amount of (Loss) Gain

Recognized in OCI

on Derivative Contracts

(Effective Portion)

(a)

Amount of (Gain) Loss

Reclassified from

Accumulated OCI into

Earnings (Effective

Portion)

(b)

Amount of Gain

Recognized

in Earnings on Derivative

(Ineffective Portion and

Amount Excluded from

Effectiveness Testing)

(c)

(In thousands)

Derivatives in Cash

Flow Hedging

Relationships

Foreign Exchange

Forward Contracts . . $(3,790) $3,406 Cost of Goods Sold $(3,074) $1,893

Other Operating

(Income) Loss, Net $(74) $(219)

(a) The amount represents the change in fair value of derivative contracts due to changes in spot rates.

(b) The amount represents reclassification from OCI to earnings that occurs when the hedged item affects

earnings, which is when merchandise is sold to the Company’s customers.

(c) The amount represents the change in fair value of derivative contracts due to changes in the difference

between the spot price and forward price that is excluded from the assessment of hedge effectiveness and

therefore recognized in earnings. There were no ineffective portions recorded in earnings for the fifty-

two weeks ended January 30, 2010 and January 31, 2009.

The Company does not use forward contracts to engage in currency speculation and does not enter into

derivative financial instruments for trading purposes.

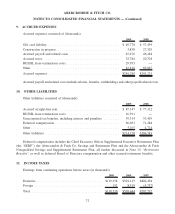

14. DISCONTINUED OPERATIONS

On June 16, 2009, A&F’s Board of Directors approved the closure of the Company’s 29 RUEHL branded

stores and related direct-to-consumer operations. The determination to take this action was based on a

comprehensive review and evaluation of the performance of the RUEHL branded stores and related

direct-to-consumer operations, as well as the related real estate portfolio. The Company completed the

closure of the RUEHL branded stores and related direct-to-consumer operations during the fourth quarter of

Fiscal 2009. Accordingly, the results of operations of RUEHL are reflected in Net Loss from Discontinued

Operations for all periods presented on the Consolidated Statements of Operations and Comprehensive

Income.

80

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)