Abercrombie & Fitch 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

basis begins on the date of initial possession, which is generally when the Company enters the space and

begins to make improvements in preparation for intended use.

Certain leases provide for contingent rents, which are determined as a percentage of gross sales. The

Company records a contingent rent liability in accrued expenses on the Consolidated Balance Sheets and the

corresponding rent expense on the Consolidated Statements of Operations and Comprehensive Income when

management determines that achieving the specified levels during the fiscal year is probable.

Under U.S. generally accepted accounting principles, the Company is considered to be the owner of

certain store locations, primarily related to flagships, in which the Company is deemed to be involved in

structural construction and has substantially all of the risks of ownership during construction of the leased

property. Accordingly, the Company records a construction-in-progress asset which is included in Property

and Equipment, Net and a related lease financing obligation which is included in Long-Term Debt on the

Consolidated Balance Sheets. Once construction is complete, the Company determines if the asset qualifies

for sale-leaseback accounting treatment. If the arrangement does not qualify for sale lease-back treatment, the

Company continues to amortize the obligation over the lease term and depreciates the asset over its useful life.

STORE PRE-OPENING EXPENSES

Pre-opening expenses related to new store openings are charged to operations as incurred.

DESIGN AND DEVELOPMENT COSTS

Costs to design and develop the Company’s merchandise are expensed as incurred and are reflected as a

component of “Marketing, General and Administrative Expense.”

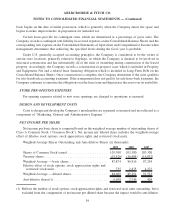

NET INCOME PER SHARE

Net income per basic share is computed based on the weighted-average number of outstanding shares of

Class A Common Stock (“Common Stock”). Net income per diluted share includes the weighted-average

effect of dilutive stock options, stock appreciation rights and restricted stock units.

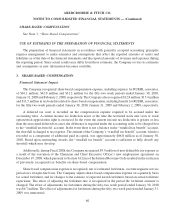

Weighted-Average Shares Outstanding and Anti-dilutive Shares (in thousands):

2009 2008 2007

Shares of Common Stock issued ...................... 103,300 103,300 103,300

Treasury shares ................................... (15,426) (16,484) (16,052)

Weighted-Average — basic shares ..................... 87,874 86,816 87,248

Dilutive effect of stock options, stock appreciation rights and

restricted stock units ............................. 735 2,475 4,275

Weighted-Average — diluted shares .................... 88,609 89,291 91,523

Anti-dilutive shares(1).............................. 6,698 3,746 404

(1) Reflects the number of stock options, stock appreciation rights, and restricted stock units oustanding, but is

excluded from the computation of net income per diluted share because the impact would be anti-dilutive.

59

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)