Abercrombie & Fitch 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

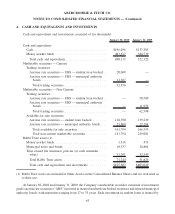

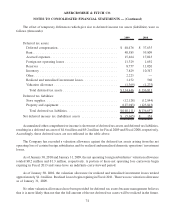

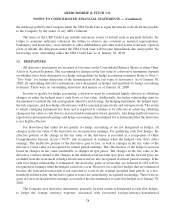

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows:

2009 2008

Unrecognized tax benefits, beginning of year ..................... $43,684 $38,894

Gross addition for tax positions of the current year ................ 222 5,539

Gross addition for tax positions of prior years .................... 2,167 8,754

Reductions of tax positions of prior years for:

Changes in judgment/excess reserve .......................... (10,744) (4,206)

Settlements during the period. . ............................. (5,444) (1,608)

Lapses of applicable statutes of limitations ..................... (448) (3,689)

Unrecognized tax benefits, end of year ......................... $29,437 $43,684

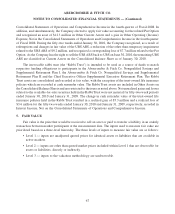

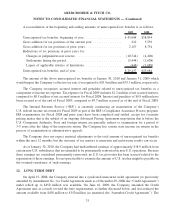

The amount of the above unrecognized tax benefits at January 30, 2010 and January 31, 2009 which

would impact the Company’s effective tax rate, if recognized is $29.4 million and $33.3 million, respectively.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits as a

component of income tax expense. Tax expense for Fiscal 2009 includes $1.2 million of net accrued interest,

compared to $0.5 million of net accrued interest for Fiscal 2008. Interest and penalties of $9.9 million have

been accrued as of the end of Fiscal 2009, compared to $9.7 million accrued as of the end of Fiscal 2008.

The Internal Revenue Service (“IRS”) is currently conducting an examination of the Company’s

U.S. federal income tax return for Fiscal 2009 as part of the IRS’s Compliance Assurance Process program.

IRS examinations for Fiscal 2008 and prior years have been completed and settled, except for a transfer

pricing matter that is the subject of an ongoing Advanced Pricing Agreement negotiation that is before the

U.S. Competent Authority. State and foreign returns are generally subject to examination for a period of

3-5 years after the filing of the respective return. The Company has various state income tax returns in the

process of examination or administrative appeals.

The Company does not expect material adjustments to the total amount of unrecognized tax benefits

within the next 12 months, but the outcome of tax matters is uncertain and unforeseen results can occur.

As of January 30, 2010, the Company had undistributed earnings of approximately $18.9 million from

certain non-U.S. subsidiaries that are intended to be permanently reinvested in non-U.S. operations. Because

these earnings are considered permanently reinvested, no U.S. tax provision has been accrued related to the

repatriation of these earnings. It is not practicable to estimate the amount of U.S. tax that might be payable on

the eventual remittance of such earnings.

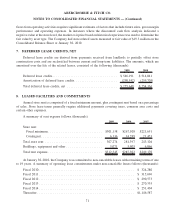

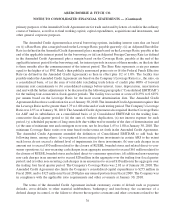

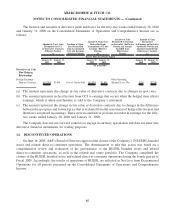

12. LONG-TERM DEBT

On April 15, 2008, the Company entered into a syndicated unsecured credit agreement (as previously

amended by Amendment No. 1 to Credit Agreement made as of December 29, 2008, the “Credit Agreement”)

under which up to $450 million was available. On June 16, 2009, the Company amended the Credit

Agreement and, as a result, revised the ratio requirements, as further discussed below, and also reduced the

amount available from $450 million to $350 million (as amended, the “Amended Credit Agreement”). The

75

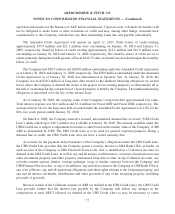

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)