Abercrombie & Fitch 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K

(Mark One)

¥ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 30, 2010

OR

nTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-12107

ABERCROMBIE & FITCH CO.

(Exact name of registrant as specified in its charter)

Delaware 31-1469076

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

6301 Fitch Path, New Albany, Ohio

(Address of principal executive offices)

43054

(Zip Code)

Registrant’s telephone number, including area code (614) 283-6500

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which Registered

Class A Common Stock, $.01 Par Value New York Stock Exchange

Series A Participating Cumulative Preferred

Stock Purchase Rights

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¥No n

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes nNo ¥

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes ¥No n

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the

Registrant was required to submit and post such files). Yes nNo n

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. n

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large accelerated filer ¥Accelerated filer nNon-accelerated filer nSmaller reporting company n

(Do not check if a smaller reporting company)

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes nNo ¥

Aggregate market value of the Registrant’s Class A Common Stock (the only outstanding common equity of the Registrant) held by non-affiliates

of the Registrant (for this purpose, executive officers and directors of the Registrant are considered affiliates) as of July 31, 2009: $2,513,290,835.

Number of shares outstanding of the Registrant’s common stock as of March 19, 2010: 88,171,337 shares of Class A Common Stock.

DOCUMENT INCORPORATED BY REFERENCE:

Portions of the Registrant’s definitive proxy statement for the Annual Meeting of Stockholders, to be held on June 9, 2010, are incorporated by

reference into Part III of this Annual Report on Form 10-K.

Table of contents

-

Page 1

... Fitch Path, New Albany, Ohio (Address of principal executive offices) 43054 (Zip Code) Registrant's telephone number, including area code (614) 283-6500 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Class A Common Stock... -

Page 2

..., the Company operates stores and direct-to-consumer operations offering bras, underwear, personal care products, sleepwear and at-home products for women under the Gilly Hicks brand. As of January 30, 2010, the Company operated 1,096 stores in North America, Europe and Asia. On June 16, 2009... -

Page 3

... and personality of each brand. The store design, furniture, fixtures and music are all carefully planned and coordinated to create a shopping experience that reflects the Abercrombie & Fitch, abercrombie kids, Hollister or Gilly Hicks lifestyle. The Company's sales associates and managers are... -

Page 4

... stores and 14 Gilly Hicks stores domestically. The Company also operated four Abercrombie & Fitch stores, two abercrombie kids stores and eight Hollister stores internationally. Direct-to-Consumer Business. During Fiscal 2009, the Company operated, and continues to operate a number of websites... -

Page 5

... New Albany, Ohio where they are received and inspected. The Company also uses a third-party DC in the Netherlands for the distribution of merchandise to stores located in Europe and Asia. The Company uses primarily one contract carrier to ship merchandise and related materials to its North American... -

Page 6

...under "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS" of this Annual Report on Form 10-K. COMPETITION. The sale of apparel and personal care products through brick-and-mortar stores and direct-to-consumer channels is a highly competitive business with... -

Page 7

... appeal of the Company's brands; • the impact of competition and pricing pressures; • inability to achieve acceptable operating profits from the execution of the Company's international expansion as a result of many factors, including the inability to successfully penetrate new markets and the... -

Page 8

• ability to hire, train and retain qualified associates; • ability to develop innovative, high-quality new merchandise in response to changing fashion trends; • availability and market prices of key raw materials; • interruption of the flow of merchandise from key vendors and manufacturers ... -

Page 9

... Loss of the Services of Skilled Senior Executive Officers Could Have a Material Adverse Effect on the Company's Business. The Company's senior executive officers closely supervise all aspects of its business - in particular, the design of its merchandise and the operation of its stores. The Company... -

Page 10

... results of operations. The Company's Market Share may be Adversely Impacted at any Time by a Significant Number of Competitors. The sale of apparel and personal care products through brick-and-mortar stores and direct-to-consumer channels is a highly competitive business with numerous participants... -

Page 11

... prime store locations; negotiating acceptable leases; completing projects on budget; supplying proper levels of merchandise; and successfully hiring and training store managers and sales associates. Additionally, the Company's growth strategy may place increased demands on the Company's operational... -

Page 12

... and customs restrictions against apparel items, as well as U.S. or foreign labor strikes and work stoppages or boycotts, could increase the cost or reduce the supply of apparel available to the Company and adversely affect its business, financial condition or results of operations. The Company Does... -

Page 13

..., the Company has internally developed and launched new brands that have contributed to sales growth. The Company's most recent brand is Gilly Hicks which offers bras, underwear, personal care products, sleepwear and at-home products for women. Brand concepts such as Gilly Hicks require management... -

Page 14

... on the Success of the Shopping Centers in Which They are Located. In order to generate customer traffic, the Company locates many of its stores in prominent locations within successful shopping centers. The Company cannot control the development of new shopping centers; the availability or cost of... -

Page 15

... 2009. The Company believes that a variety of factors affect comparable store sales results including, but not limited to, fashion trends, actions by competitors, economic conditions, weather conditions, opening and/or closing of Company stores near each other, and the calendar shifts of tax free... -

Page 16

...operations, or cash flows of the Company. The Company's Failure to Adequately Protect Its Trademarks Could Have a Negative Impact on Its Brand Image and Limit Its Ability to Penetrate New Markets. The Company believes its trademarks, Abercrombie & Fitch», abercrombie», Hollister Co.», Gilly Hicks... -

Page 17

... under the current unsecured credit agreement, could adversely impact liquidity and results of operations. Changes in Taxation Requirements Could Adversely Impact Financial Results. The Company is subject to income tax in numerous jurisdictions, including international and domestic locations. In... -

Page 18

...the Company's operations is currently unknown. ITEM 1B. None. ITEM 2. PROPERTIES. UNRESOLVED STAFF COMMENTS The Company's headquarters and support functions occupy 474 acres, consisting of the home office, distribution and shipping facilities centralized on a campus-like setting in New Albany, Ohio... -

Page 19

... stores operated by the Company, as of March 19, 2010, are located in leased facilities, primarily in shopping centers in North America, Europe and Asia. The leases expire at various dates, between 2010 and 2028. The Company's home office, distribution and shipping facilities, design support centers... -

Page 20

... class action, styled Robert Ross v. Abercrombie & Fitch Company, et al., was filed against A&F and certain of its officers in the United States District Court for the Southern District of Ohio on behalf of a purported class of all persons who purchased or acquired shares of A&F's Common Stock... -

Page 21

...2008, Mr. Ramsden served as Chief Financial Officer and a member of the Executive Committee of TBWA Worldwide, a large advertising agency network and a division of Omnicom Group Inc. Prior to becoming Chief Financial Officer of TWBA Worldwide, he served as Controller and Principal Accounting Officer... -

Page 22

... cash position and results of operations. As of March 19, 2010, there were approximately 4,413 stockholders of record. However, when including investors holding shares in broker accounts under street name, active associates of the Company who participate in A&F's stock purchase plan, and associates... -

Page 23

...number of shares of A&F's Common Stock purchased during the quarterly period (thirteen-week period) ended January 30, 2010 were an aggregate of 5,535 shares which were withheld for tax payments due upon the vesting of employee restricted stock units and restricted stock awards. (2) The average price... -

Page 24

The following graph shows the changes, over the five-year period ended January 30, 2010 (the last day of A&F's 2009 fiscal year), in the value of $100 invested in (i) shares of A&F's Common Stock; (ii) the Standard & Poor's 500 Stock Index (the "S&P 500 Index") and (iii) the Standard & Poor's ... -

Page 25

... CO. FINANCIAL SUMMARY Summary of Operations (Information below excludes amounts related to discontinued operations, except where otherwise noted) 2009 2008 2007 2006(1) 2005 (Thousands, except per share and per square foot amounts, ratios and store and associate data) Net Sales ...Gross Profit... -

Page 26

...in comparable store sales when it has been open as the same brand at least one year and its square footage has not been expanded or reduced by more than 20% within the past year. For purposes of this "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS," the... -

Page 27

...associated with 11 Abercrombie & Fitch, six abercrombie kids and three Hollister stores. Net cash provided by operating activities, the Company's primary source of liquidity, was $402.2 million for Fiscal 2009. This source of cash was primarily driven by results from operations adjusted for non-cash... -

Page 28

... of credit of $100.9 million. The following data represents the Company's Consolidated Statements of Operations for the last three fiscal years, expressed as a percentage of net sales: 2009 2008 2007 NET SALES ...Cost of Goods Sold ...GROSS PROFIT ...Stores and Distribution Expense ...Marketing... -

Page 29

...: 2009 2008 2007 Net sales by brand (thousands) ...Abercrombie & Fitch ...abercrombie kids ...Hollister ...Gilly Hicks** ...Increase (decrease) in net sales from prior year ...Abercrombie & Fitch ...abercrombie kids ...Hollister ...Gilly Hicks** ...Decrease in comparable store sales* ...Abercrombie... -

Page 30

... of the original flagship model and a smaller store format similar to the template being used in Copenhagen. The Company currently plans to open approximately 30 international mall-based Hollister stores, including in two or more new countries, in 2010. The Hollister openings will predominantly be... -

Page 31

...past year; • Direct-to-consumer sales growth; • International and flagship store performance; • Store productivity; • Initial Mark Up ("IMU"); • Markdown rate; • Gross profit rate; • Selling margin, defined as sales price less original cost, by brand and by product category; • Stores... -

Page 32

... and $42.9 million in Fiscal 2008. The direct-to-consumer business, including shipping and handling revenue, accounted for 9.9% of total net sales in Fiscal 2009 compared to 8.8% of total net sales in Fiscal 2008. Gross Profit Gross profit during Fiscal 2009 decreased to $1.884 billion from $2.331... -

Page 33

... Chief Executive Officer's new employment agreement, which resulted in certain non-deductible amounts pursuant to Section 162(m) of the Internal Revenue Code. Net Loss from Discontinued Operations The Company completed the closure of its RUEHL branded stores and related direct-to-consumer operations... -

Page 34

... store sales. Additionally, stores and distribution expense in Fiscal 2008 also included additional direct expenses related to flagship pre-opening rent expenses, as well as minimum wage and manager salary increases and an $8.3 million non-cash impairment charge associated with store-related... -

Page 35

... diluted share associated with the impairment of store-related assets. Fiscal 2007 included $0.26 of net loss per diluted share from discontinued operations. FINANCIAL CONDITION Liquidity and Capital Resources The Company had $680.1 million in cash and equivalents available as of January 30, 2010... -

Page 36

... mall-based store openings in Fiscal 2009. The Company also had cash inflows from the sale of marketable securities. Cash outflows from investing activities in Fiscal 2008 were used for capital expenditures related primarily to new store construction, store remodels and refreshes and information... -

Page 37

... the related excess tax benefits. A&F's Board of Directors will review the Company's cash position and results of operations and address the appropriateness of future dividend amounts. A&F did not repurchase any shares of A&F's Common Stock in the open market during Fiscal 2009. During Fiscal 2008... -

Page 38

... related to the closure of RUEHL branded stores, construction debt, capital leases, asset retirement obligations, and information technology contracts for Fiscal 2010. See Note 12, "Long-Term Debt", of the Notes to Consolidated Financial Statements, for further discussion on the letters of credit... -

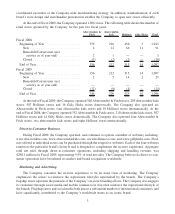

Page 39

... 11. EXECUTIVE COMPENSATION" of this Annual Report on Form 10-K. Store count and gross square footage by brand were as follows for the fifty-two weeks ended January 30, 2010 and January 31, 2009, respectively: Store Activity Abercrombie & Fitch abercrombie kids Hollister Gilly Hicks Total January... -

Page 40

...Hollister stores, two Gilly Hicks stores, and a number of outlet stores in the United States. The Company also plans to open approximately 30 international Hollister mall-based stores in Fiscal 2010, including locations in two or more new countries. CLOSURE OF RUEHL BRANDED STORES AND RELATED DIRECT... -

Page 41

... branded stores and related direct-to-consumer operations (in thousands): Fifty-Two Weeks Ended January 30, 2010 Beginning Balance...Cash Charges ...Interest Accretion ...Cash Payments ... ... $ - 68,363 358 (22,635) Ending Balance(1) ... $ 46,086 (1) Ending balance primarily reflects the net... -

Page 42

... Net Loss from Discontinued Operations on the Consolidated Statements of Operations and Comprehensive Income for fiscal years ended January 30, 2010, January 31, 2009 and February 2, 2008. 2009 2008 2007 NET SALES ...Cost of Goods Sold ...GROSS PROFIT ...Stores and Distribution Expense ...Marketing... -

Page 43

... on historical experience and various other assumptions that management believes to be reasonable. The Company sells gift cards in its stores and through direct-to-consumer operations. The Company accounts for gift cards sold to customers by recognizing a liability at the time of sale. The liability... -

Page 44

... for impairment or whenever events or changes in circumstances indicate that full recoverability of net asset balances through future cash flows is in question. The Company's impairment calculation requires management to make assumptions and judgments related to factors used in the evaluation for... -

Page 45

...February 2, 2003, the Company established a Chief Executive Officer Supplemental Executive Retirement Plan (the "SERP") to provide additional retirement income to its Chairman and Chief Executive Officer ("CEO"). Subject to service requirements, the CEO will receive a monthly benefit equal to 50% of... -

Page 46

... varies by security. The credit ratings may change over time and would be an indicator of the default risk associated with the ARS and could have a material effect on the value of the ARS. If the Company expects that it will not recover the entire cost basis of the available-for-sale ARS, intends to... -

Page 47

... restricted as to their use as noted above. Net unrealized gains or losses related to the available-for-sale securities held in the Rabbi Trust were not material for the fifty-two week periods ended January 30, 2010 and January 31, 2009, respectively. The change in cash surrender value of the trust... -

Page 48

... to varying interest rate reset dates under the Company's unsecured Amended Credit Agreement. Foreign Exchange Rate Risk The Company has exposure to changes in currency exchange rates associated with foreign currency transactions, including inter-company transactions and foreign denominated assets... -

Page 49

... STATEMENTS AND SUPPLEMENTARY DATA. ABERCROMBIE & FITCH CO. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME 2009 2008 2007 (Thousands, except per share amounts) NET SALES ...$2,928,626 Cost of Goods Sold ...1,045,028 GROSS PROFIT ...Stores and Distribution Expense ...Marketing... -

Page 50

...' EQUITY: Class A Common Stock - $.01 par value: 150,000,000 shares authorized and 103,300,000 shares issued at January 30, 2010 and January 31, 2009, respectively ...Paid-In Capital ...Retained Earnings ...Accumulated Other Comprehensive Loss, net of tax ...Treasury Stock, at Average Cost 15... -

Page 51

... & FITCH CO. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Common Stock Shares Outstanding Par Value (Thousands) Paid-In Capital Retained Earnings Treasury Stock Other Total Comprehensive At Average Shareholders' (Loss) Income Shares Cost Equity Balance, February 3, 2007 ...FIN 48 Impact ...Net... -

Page 52

ABERCROMBIE & FITCH CO. CONSOLIDATED STATEMENTS OF CASH FLOWS 2009 2008 (Thousands) 2007 OPERATING ACTIVITIES: Net Income ...Impact of Other Operating Activities on Cash Flows: Depreciation and Amortization ...Non-Cash Charge for Asset Impairment ...Amortization of Deferred Lease Credits ...Share-... -

Page 53

... current year presentation. SEGMENT REPORTING The Company determines its operating segments on the same basis that it uses to evaluate performance internally. The operating segments identified by the Company are Abercrombie & Fitch, abercrombie kids, Hollister and Gilly Hicks. The operating segments... -

Page 54

... sales through stores and direct-to-consumer operations, including shipping and handling revenue. Net sales are reported by geographic area based on the location of the customer. Fifty-Two Weeks Ended January 30, January 31, 2010 2009 (In thousands): United States ...$2,566,118 International... -

Page 55

...capitalized at the store opening date. In lieu of amortizing the initial balances over their estimated useful lives, the Company expenses all subsequent replacements and adjusts the initial balance, as appropriate, for changes in store quantities or replacement cost. The Company believes this policy... -

Page 56

... 11 Abercrombie & Fitch stores, six abercrombie kids stores and three Hollister stores and was reported in Stores and Distribution Expense on the Consolidated Statement of Operations and Comprehensive Income for the fifty-two weeks ended January 31, 2009. The Company also incurred a non-cash pre-tax... -

Page 57

...net operating loss of certain foreign subsidiaries, for capital loss carryovers related to sales of securities and for unrealized losses on certain securities. No other valuation allowances have been provided for deferred tax assets. The effective tax rate utilized by the Company reflects management... -

Page 58

... at January 30, 2010, January 31, 2009 and February 2, 2008, respectively. The Company sells gift cards in its stores and through direct-to-consumer operations. The Company accounts for gift cards sold to customers by recognizing a liability at the time of sale. Gift cards sold to customers do not... -

Page 59

... and media ads; store marketing; home office payroll, except for those departments included in stores and distribution expense; information technology; outside services such as legal and consulting; relocation, as well as recruiting, samples and travel expenses. OTHER OPERATING INCOME, NET Other... -

Page 60

...-opening expenses related to new store openings are charged to operations as incurred. DESIGN AND DEVELOPMENT COSTS Costs to design and develop the Company's merchandise are expensed as incurred and are reflected as a component of "Marketing, General and Administrative Expense." NET INCOME PER SHARE... -

Page 61

... may develop. Additionally, during Fiscal 2008, the Company recognized $9.9 million of non-deductible tax expense as a result of the execution of the Chairman and Chief Executive Officer's new employment agreement on December 19, 2008, which pursuant to Section 162(m) of the Internal Revenue Code... -

Page 62

... & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) A&F issues shares of Common Stock for stock option and stock appreciation right exercises and restricted stock unit vestings from treasury stock. As of January 30, 2010, A&F had sufficient treasury stock available to settle stock... -

Page 63

... assumptions used in calculating such fair values, on the date of grant, were as follows: Fifty-Two Weeks Ended January 30, January 31, February 2, 2010 2009 2008 Grant date market price ...Exercise price ...Fair value ...Assumptions: Price volatility ...Expected term (Years) ...Risk-free interest... -

Page 64

... Ended January 30, 2010 Executive Officers (excluding Chairman Chairman and and Chief Executive Chief Executive Officer) Officer Fifty-Two Weeks Ended January 31, 2009 Chairman and Chief Executive Officer All Other Associates Grant date market price ...Exercise price...Fair value ...Assumptions... -

Page 65

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As of January 30, 2010, there was $45.5 million of total unrecognized compensation cost, net of estimated forfeitures, related to stock appreciation rights. The unrecognized cost is expected to be recognized over a weighted-average period of 1.9 years... -

Page 66

... FINANCIAL STATEMENTS - (Continued) 4. CASH AND EQUIVALENTS AND INVESTMENTS Cash and equivalents and investments consisted of (in thousands): January 30, 2010 January 31, 2009 Cash and equivalents: Cash...Money market funds ...Total cash and equivalents ...Marketable securities - Current... -

Page 67

...not expect to recover the security's entire amortized cost basis, even if there is no intent to sell the security. As of January 30, 2010, the Company had not incurred any credit-related losses on available-for-sale ARS. Furthermore, as of January 30, 2010, the issuers continued to perform under the... -

Page 68

... Sheets and are restricted to their use as noted above. Net unrealized gains and losses related to the available-for-sale securities held in the Rabbi Trust were not material for fifty-two week periods ended January 30, 2010 and January 31, 2009. The change in cash surrender value of the trust-owned... -

Page 69

... term is identified as the time the Company believes the principal will become available to the investor. The Company utilized a term of five years to value its securities. The Company also included a marketability discount which takes into account the lack of activity in the current ARS market. 68 -

Page 70

... the corresponding gains and losses within Other Operating Income, Net on the accompanying Consolidated Statements of Operations and Comprehensive Income. The table below includes a roll forward of the Company's level 3 assets from January 31, 2009 to January 30, 2010. When a determination is made... -

Page 71

... 11 Abercrombie & Fitch stores, six abercrombie kids stores and three Hollister stores and was reported in Stores and Distribution Expense on the Consolidated Statement of Operations and Comprehensive Income for the fifty-two weeks ended January 31, 2009. The Company also incurred a non-cash pre-tax... -

Page 72

...factors that include future sales, gross margin performance and operating expenses. In instances where the discounted cash flow analysis indicated a negative value at the store level, the market exit price based on historical experience was used to determine the fair value by asset type. The Company... -

Page 73

ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 9. ACCRUED EXPENSES Accrued expenses consisted of (thousands): 2009 2008 Gift card liability ...Construction in progress ...Accrued payroll and related costs ...Accrued taxes...RUEHL lease termination costs...Other ...... -

Page 74

ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The provision for income taxes from continuing operations consisted of (thousands): 2009 2008 2007 Currently Payable: Federal...$ 33,212 State ...4,003 Foreign ...5,086 $ 42,301 Deferred: Federal...$ 10,055 State ...(... -

Page 75

... FINANCIAL STATEMENTS - (Continued) The effect of temporary differences which give rise to deferred income tax assets (liabilities) were as follows (thousands): 2009 2008 Deferred tax assets: Deferred compensation ...$ 48,476 Rent...40,585 Accrued expenses ...15,464 Foreign net operating losses... -

Page 76

ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows: 2009 2008 Unrecognized tax benefits, beginning of year ...Gross addition for tax positions of the current year ...Gross ... -

Page 77

... (e) other non-recurring cash charges in an amount not to exceed $10 million in the aggregate over the trailing four fiscal quarter period. The Company's Coverage Ratio was 2.10 as of January 30, 2010. The Amended Credit Agreement also limits the Company's consolidated capital expenditures to $275... -

Page 78

...to $26.3 million was available at January 30, 2010. The amount available under the UBS Credit Line is subject to adjustment from time-to-time based on the market value of the Company's UBS ARS as determined by UBS. The UBS Credit Line is to be used for general corporate purposes. Being a demand line... -

Page 79

ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) the interest payable by the Company under the UBS Credit Line to equal the interest or dividend rate payable to the Company by the issuer of any ARS Collateral. The terms of the UBS Credit Line include customary events ... -

Page 80

... gains or losses related to foreign denominated intercompany inventory sales that have occurred as of January 30, 2010 will be recognized in costs of goods sold over the following two months at the values at the date the inventory was sold to the respective subsidiary. The Company nets derivative... -

Page 81

... 30, January 31, 2010 2009 2010 2009 (In thousands) Derivatives in Cash Flow Hedging Relationships Foreign Exchange Forward Contracts . . $(3,790) $3,406 Cost of Goods Sold $(3,074) $1,893 Other Operating (Income) Loss, Net $(74) $(219) (a) The amount represents the change in fair value of... -

Page 82

... FINANCIAL STATEMENTS - (Continued) Costs associated with exit or disposal activities are recorded when the liability is incurred. Below is a roll forward of the liabilities recognized on the Consolidated Balance Sheet as of January 30, 2010 related to the closure of the RUEHL branded stores... -

Page 83

... Net Loss from Discontinued Operations on the Consolidated Statements of Operations and Comprehensive Income for fiscal years ended January 30, 2010, January 31, 2009 and February 2, 2008. 2009 2008 2007 NET SALES ...Cost of Goods Sold ...GROSS PROFIT ...Stores and Distribution Expense ...Marketing... -

Page 84

... class action, styled Robert Ross v. Abercrombie & Fitch Company, et al., was filed against A&F and certain of its officers in the United States District Court for the Southern District of Ohio on behalf of a purported class of all persons who purchased or acquired shares of A&F's Common Stock... -

Page 85

... Stock after a Distribution Date occurs. The "Distribution Date" generally means the earlier of (i) the close of business on the 10th day after the date (the "Share Acquisition Date") of the first public announcement that a person or group (other than A&F or any of A&F's subsidiaries or any employee... -

Page 86

... TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) benefit plan of A&F or of any of A&F's subsidiaries) has acquired beneficial ownership of 20% or more of A&F's outstanding shares of Common Stock (an "Acquiring Person"), or (ii) the close of business on the 10th business day (or such later date as... -

Page 87

... quarterly financial results for Fiscal 2009 and Fiscal 2008 follows (thousands, except per share amounts): Fiscal 2009 Quarter(1) First Second Third Fourth Net sales ...Gross profit ...Net (loss) income from continuing operations ...Net loss from discontinued operations, net of tax ...Net (loss... -

Page 88

...for our opinions. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles... -

Page 89

... control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or... -

Page 90

... and Chief Executive Officer of A&F and the Executive Vice President and Chief Financial Officer of A&F, management evaluated the effectiveness of A&F's internal control over financial reporting as of January 30, 2010 using criteria established in the Internal ControlIntegrated Framework issued by... -

Page 91

...2010 that materially affected, or are reasonably likely to materially affect, A&F's internal control over financial reporting. ITEM 9B. None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. OTHER INFORMATION. Information concerning directors, executive officers and persons... -

Page 92

... BENEFICIAL OWNERS AND MANAGEMENT" in A&F's definitive Proxy Statement for the Annual Meeting of Stockholders to be held on June 9, 2010. Information regarding the number of securities to be issued and remaining available under equity compensation plans as of January 30, 2010 is incorporated by... -

Page 93

...(a) The following documents are filed as a part of this Annual Report on Form 10-K: (1) Consolidated Financial Statements: Consolidated Statements of Operations and Comprehensive Income for the fiscal years ended January 31, 2010, January 31, 2009 and February 2, 2008. Consolidated Balance Sheets as... -

Page 94

... First Chicago Trust Company of New York, incorporated herein by reference to Exhibit 2 to A&F's Form 8-A (Amendment No. 1), dated April 23, 1999 and filed April 26, 1999 (File No. 001-12107). Certificate of adjustment of number of Rights associated with each share of Class A Common Stock, dated May... -

Page 95

... Quarterly Report on Form 10-Q for the quarterly period ended May 2, 2009 (File No. 001-12107). Amendment No. 2 to Credit Agreement, made as of June 16, 2009, by and among Abercrombie & Fitch Management Co., as a borrower; Abercrombie & Fitch Europe SA, Abercrombie & Fitch (UK) Limited, AFH Canada... -

Page 96

... 10.2 to A&F's Annual Report on Form 10-K for the fiscal year ended January 29, 2000 (File No. 001-12107). 1998 Restatement of the Abercrombie & Fitch Co. 1996 Stock Plan for Non-Associate Directors (reflects amendments through January 30, 2003 and the two-for-one stock split distributed June 15... -

Page 97

... reference to Exhibit 10.17 to A&F's Quarterly Report on Form 10-Q for the quarterly period ended October 30, 2004 (File No. 001-12107). Form of Restricted Shares Award Agreement used for grants under the Abercrombie & Fitch Co. 2002 Stock Plan for Associates after November 28, 2004 and before March... -

Page 98

...Employees used for grants under the Abercrombie & Fitch Co. 2005 Long-Term Incentive Plan prior to March 6, 2006, incorporated herein by reference to Exhibit 99.5 to A&F's Current Report on Form 8-K dated and filed August 19, 2005 (File No. 001-12107). Summary of Terms of the Annual Restricted Stock... -

Page 99

... to A&F's Current Report on Form 8-K dated and filed February 17, 2009 (File No. 001-12107). Form of Stock Appreciation Right Agreement to be used to evidence the Semi-Annual Grants of stock appreciation rights to Michael S. Jeffries under the Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan as... -

Page 100

... 10.1(b) to A&F's Current Report on Form 8-K dated and filed March 11, 2009 (File No. 001-12107). 10.50 Addendum to Credit Line Account Application and Agreement, effective March 6, 2009, among Abercrombie & Fitch Management Co., UBS Bank USA and UBS Financial Services Inc., incorporated herein... -

Page 101

...executed by each on January 28, 2010, incorporated herein by reference to Exhibit 10.1 to A&F's Current Report on Form 8-K dated and filed January 28, 2010 (File No. 001-12107). Computation of Leverage Ratio and Coverage Ratio for the year ended January 30, 2010. Abercrombie & Fitch Code of Business... -

Page 102

... authorized. ABERCROMBIE & FITCH CO. Date: March 26, 2010 By /s/ JONATHAN E. RAMSDEN Jonathan E. Ramsden, Executive Vice President and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 103

Appendix - Additional Information Regarding Abercrombie & Fitch Co. Not Filed as Part of Annual Report on Form 10-K for the Fiscal Year Ended January 30, 2010 -

Page 104

... Abercrombie & Fitch Headquarters, 6301 Fitch Path, New Albany, Ohio 43054. STOCK EXCHANGE LISTING New York Stock Exchange (Trading Symbol "ANF"), commonly listed in newspapers as AberFit. INDEPENDENT AUDITORS PricewaterhouseCoopers LLP Columbus, Ohio OUR COMMITMENT TO INCLUSION INVESTOR RELATIONS... -

Page 105

... for Administration and Chief Financial Officer, Vanderbilt University President and Chief Executive Officer, The Ohio State University Alumni Association, Inc. Owner, John W. Kessler Company (real estate development company) Head of School, Columbus School for Girls in Columbus, Ohio Senior Vice...