ADT 1999 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

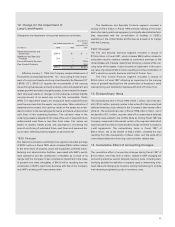

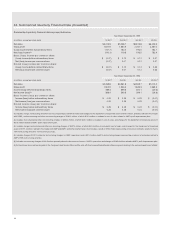

25. Tyco International Group S.A.

Tyco International Group S.A. (“TIG”), a wholly-owned subsidiary of

the Company, indirectly owns a substantial portion of the operating

subsidiaries of the Company. During Fiscal 1999 and Fiscal 1998, TIG

issued public debt securities (Note 4) which are fully and uncondition-

ally guaranteed by the Company. The Company has not included sep-

arate financial statements and footnotes for TIG because of the full

and unconditional guarantee by the Company and the Company’s

belief that such information is not material to holders of the debt secu-

rities. The following presents unaudited consolidated summary finan-

cial information for TIG and its subsidiaries, as if TIG and its current

organizational structure were in place for all periods presented.

September 30,

(in millions) 1999 1998

Total current assets $ 7,618.4 $ 6,639.5

Total non-current assets 24,008.4 12,090.0

Total current liabilities 6,845.1 5,519.5

Total non-current liabilities 10,553.9 6,401.5

Nine Months

Ended

Year Ended September 30,

September 30,

(in millions) 1999 1998 1997

Net sales $16,668.5 $13,535.3 $8,457.8

Gross profit 6,451.4 4,800.4 2,950.7

Income (loss) before

extraordinary items 631.7(1) 693.9(2) (642.2)(3)

Net income (loss)(4) 586.0 691.5 (700.5)

(1) Income before extraordinary items in Fiscal 1999 includes a credit of $15.0 million rep-

resenting a revision of estimates related to Tyco's 1997 restructuring and other non-recur-

ring accruals, and merger, restructuring and other non-recurring charges of $434.9 million

and charges for the impairment of long-lived assets of $76.0 million, primarily related to

the USSC merger.

(2) Income before extraordinary items in Fiscal 1998 includes non-recurring charges of

$80.5 million and restructuring charges of $12.0 million related to USSC's operations.

(3) Loss before extraordinary items in Fiscal 1997 includes charges related to merger,

restructuring and other non-recurring costs of $816.8 million and impairment of long-lived

assets of $148.4 million, primarily related to the mergers and integration of ADT, Former

Tyco, Keystone and Inbrand. Fiscal 1997 also includes a charge of $361.0 million for the

write-off of purchased in-process research and development costs and charges of $24.3

million for litigation and other related costs, and $5.8 million for restructuring charges

related to USSC's operations.

(4) Extraordinary items relate principally to the Company's debt tender offers and the write-

off of net unamortized deferred refinancing costs relating to the early extinguishment of debt.

26. Unsolicited Tender Offer and Defense

In August 1998, AlliedSignal Inc. announced its intention to commence

an offer to purchase all outstanding shares of AMP’s common stock.

This offer was rejected by the Board of Directors of AMP. AlliedSignal’s

offer was then amended twice in September 1998 to reduce the num-

ber of shares sought to be purchased. AMP incurred $15.9 million in

fees in defending against AlliedSignal’s bid, relating primarily to legal,

public relations and financial consulting costs. In April 1999, AlliedSig-

nal converted its AMP stock into Tyco common shares and reached a

settlement with Tyco and AMP, under which AlliedSignal paid $50 mil-

lion to AMP, and all parties released all claims against each other

related to AMP. This amount was recorded as a credit in the merger,

restructuring and other non-recurring charges line in the Consolidated

Statement of Operations for Fiscal 1999. See Note 16.

In addition, in September 1998, AMP’s Board of Directors autho-

rized the establishment of a Flexitrust, a grantor trust, to hold shares

of AMP’s common stock. AMP expected to sell to the Flexitrust an

aggregate of 25 million authorized but unissued shares of common

stock. AMP also announced its intention to commence a self-tender

offer for 30 million shares of its common stock. AMP estimated that the

total funds required to complete the self-tender would have been

approximately $1.7 billion, which AMP intended to source from a pro-

posed $2.6 billion credit facility.

In November 1998, AMP announced its intention to merge with

Tyco, and at that time AMP’s Board of Directors rescinded its autho-

rization for a self-tender offer and the establishment of the Flexitrust.

In addition, the debt intended to fund the self-tender was never used.

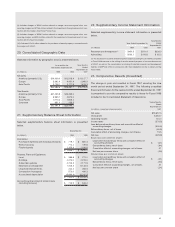

27. Subsequent Events (Unaudited)

On November 3, 1999, the Company announced that the Board of

Directors had authorized the Company to reacquire up to 20 million of

its common shares.

On November 22, 1999, the Company consummated its acquisi-

tion of AFC Cable Systems, Inc. (“AFC Cable”), a manufacturer of

prewired armor cable. AFC Cable shareholders received one Tyco

share for each share of AFC Cable. The Company issued approxi-

mately 12.8 million common shares in this transaction valued at

approximately $562.6 million. AFC Cable is being integrated within the

Company’s Flow Control Products segment. The Company is account-

ing for the acquisition as a purchase.

On November 23, 1999, the Company consummated its acquisi-

tion of Siemens Electromechanical Components GmbH & Co. KG

(“Siemens EC”) from Siemens AG for approximately $1.1 billion in

cash. Siemens EC, with annual sales of approximately $900.0 million,

is the world market leader for relays and one of the world’s leading

providers of components to the communications, automotive, con-

sumer and general industry sectors. Siemens EC is being integrated

within the Company’s Telecommunications and Electronics segment.

The Company is accounting for the acquisition as a purchase.