ADT 1999 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

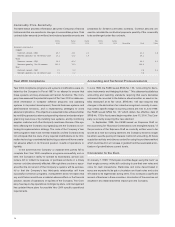

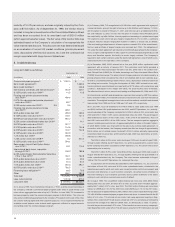

2. Pooling of Interests Transactions

On April 2, 1999, October 1, 1998, August 29, 1997 and August 27,

1997, Tyco merged with AMP, USSC, Keystone and Inbrand, respec-

tively. A total of approximately 329.2 million, 118.4 million, 69.6 million

and 20.4 million Tyco common shares, respectively, were issued to the

former shareholders of these companies.

On July 2, 1997, a wholly-owned subsidiary of ADT merged with

the Former Tyco. Shareholders of ADT, through a reverse stock split,

received 0.48133 shares (1.92532 after giving effect to the subse-

quent stock splits) of the Company’s common stock for each share of

ADT common stock outstanding, and the Former Tyco shareholders

received one share (four shares after giving effect to the subsequent

stock splits) of the Company’s common stock for each share of the

Former Tyco common stock outstanding. On a post-split basis, a total

of approximately 673.6 million Tyco common shares were issued to

the shareholders of Former Tyco in the merger.

Each of the five merger transactions discussed above was

accounted for under the pooling of interests accounting method, which

presents as a single interest common shareholder interests which

were previously independent. The historical consolidated financial

statements for periods prior to the consummation of the combination

are restated as though the companies had been combined during such

periods.

Aggregate fees and expenses related to the mergers and to the

integration of the combined companies have been expensed in the

Consolidated Statements of Operations in the period in which each

transaction was consummated, as required under the pooling of

interests method of accounting. See Notes 12 and 16 for further

discussion.

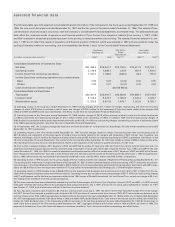

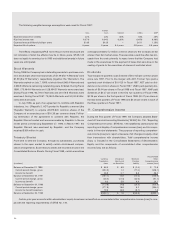

Combined and separate results of Tyco, USSC and AMP for the

periods preceding the mergers were as follows:

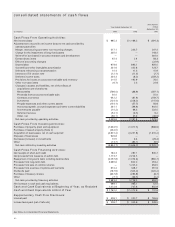

(in millions) Tyco USSC AMP Adjustments Combined

Six Months ended March 31, 1999 (unaudited)(1)

Net sales $ 7,776.8 $

—

$2,675.5 $

—

$10,452.3

Operating income (loss) 877.5

—

(405.2)

—

472.3

Extraordinary items, net of taxes (44.9)

———

(44.9)

Net income (loss) 388.4

—

(376.0) (3.0)(4) 9.4

Year ended September 30, 1998(2)

Net sales 12,311.3 1,225.9 5,524.5

—

19,061.7

Operating income (loss) 1,923.7 (298.5) 322.9

—

1,948.1

Extraordinary items, net of taxes (2.4)

———

(2.4)

Net income (loss) 1,174.7 (212.0) 208.5 (5.0)(4) 1,166.2

Nine months ended September 30, 1997(3)

Net sales 7,588.2 869.6 4,284.7

—

12,742.5

Operating (loss) income (476.5) 100.5 501.8

—

125.8

Extraordinary items, net of taxes (58.3)

———

(58.3)

Cumulative effect of accounting changes, net of taxes

——

15.5

—

15.5

Net (loss) income (835.1) 79.1 345.7 19.0(4) (391.3)

(1) Includes merger, restructuring and other non-recurring charges of $434.9 million and impairment charges of $76.0 million primarily related to the merger with USSC, and restruc-

turing and other non-recurring charges of $444.4 million and impairment charges of $67.6 million related to AMP’s profit improvement plan.

(2) Includes restructuring and other non-recurring charges of $164.4 million primarily related to AMP’s profit improvement plan and $92.5 million principally related to costs incurred by

USSC to exit certain businesses.

(3) Includes merger, restructuring and other non-recurring charges of $917.8 million and impairment charges of $148.4 million primarily related to the mergers and integration of ADT,

Former Tyco, Keystone and Inbrand, and a charge of $361.0 million for the write-off of purchased in-process research and development related to the acquisition of AT&T Corp.’s sub-

marine systems business. Also includes charges of $24.3 million for litigation and other related costs and $5.8 million for restructuring charges in USSC’s operations.

(4) As a result of the combination of Tyco and AMP, an income tax adjustment was recorded to conform tax accounting.

Combined and separate results of ADT, Former Tyco, Keystone and Inbrand for the periods preceding the mergers were as follows:

Former

(in millions) ADT Tyco Keystone Inbrand Combined

Six Months ended June 30, 1997 (unaudited)

Net sales $923.9 $3,505.6 $331.2 $118.7 $4,879.4

Operating income (loss)(1) 99.1 435.3 39.8 (40.5) 533.7

Net income (loss) 47.2 244.6 22.9 (28.9) 285.8

(1) Includes merger, restructuring and other non-recurring charges of $31.4 million incurred by ADT and $25.2 million incurred by Inbrand.

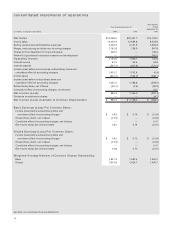

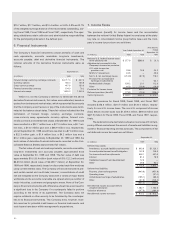

with the settlement of certain other obligations in the amount of

$23 million resulted in the Company acquiring ownership of the North

Haven property for a total cost of $234 million.

In connection with the USSC merger, the Company assumed an

operating lease for USSC’s North Haven facilities. In December 1998,

the Company assumed the debt related to the North Haven property

of approximately $211 million. The assumption of the debt combined