ADT 1999 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

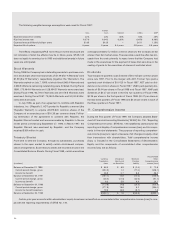

57

The cost of announced workforce reductions of $433.7 million

includes the elimination of 8,585 positions in the United States, 4,216

positions in Europe, 2,019 positions in the Asia-Pacific region and

1,319 positions in Canada and Latin America, consisting primarily of

manufacturing and distribution, administrative, research and develop-

ment and sales and marketing personnel. Included in the severance

charges of $433.7 million are enhanced pension and other post-retire-

ment benefit costs of $136.2 million provided to terminated employ-

ees. The cost of facility closures of $171.2 million includes the

shut-down and consolidation of 60 facilities in the United States, 16

facilities in Europe, 6 facilities in the Asia-Pacific region and 5 facilities

in Canada and Latin America, consisting primarily of manufacturing

plants, distribution centers, administrative buildings, research and

development facilities and sales offices. At September 30, 1999, 8,410

employees had been terminated and 45 facilities had been shut down.

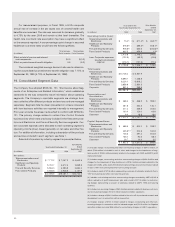

The other charges of $236.9 million consist of transaction costs

of $67.9 million for legal, printing, accounting, financial advisory ser-

vices and other direct expenses related to the AMP merger; $78.9 mil-

lion related to the write-down of inventory used in AMP’s operations

which is included in cost of sales; lease termination costs following the

merger of $9.6 million; a credit of $50.0 million related to a litigation

settlement with AlliedSignal Inc. (Note 26); and other costs of $130.5

million relating to the consolidation of certain product lines and other

non-recurring changes related to the AMP merger.

The remaining balance at September 30, 1999 of $277.9 million

consists of $232.0 million in other current liabilities and $45.9 million

in other non-current liabilities. The Company currently anticipates that

the restructuring and other non-recurring activities to which all of these

charges relate will be substantially completed within Fiscal 2000,

except for certain long-term contractual obligations.

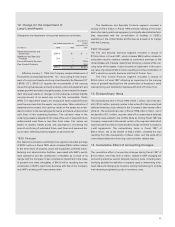

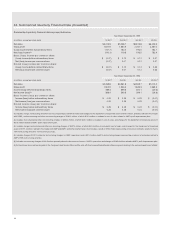

The Healthcare and Specialty Products segment recorded

merger, restructuring and other non-recurring charges of $431.4 mil-

lion, consisting of a $434.9 million charge primarily related to the

merger with USSC and a $3.5 million credit representing a revision of

estimates related to Tyco’s 1997 restructuring/non-recurring accruals

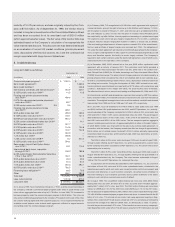

discussed below. The following table provides information about these

charges:

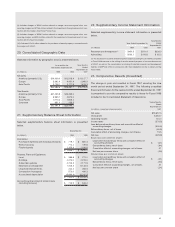

Sever

ance Facili

ties Other

Number of Number of

($ in millions) Employees Reserve Facilities Reserve Reserve Total

Fiscal 1999 charges 1,467 $124.8 45 $ 51.8 $ 258.3 $ 434.9

Fiscal 1999 activity (1,282) (99.3) (20) (18.3) (217.6) (335.2)

Ending balance at September 30, 1999 185 $ 25.5 25 $ 33.5 $ 40.7 $ 99.7

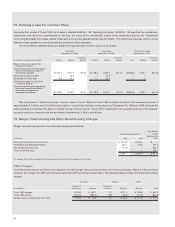

The other charges of $258.3 million consist of transaction costs

of $53.3 million for legal, printing, accounting, financial advisory ser-

vices and other direct expenses related to the USSC merger, lease ter-

mination costs following the merger of $156.8 million and other costs

of $48.2 million relating to the consolidation of certain product lines

and other non-recurring charges primarily related to the USSC

merger.

The remaining balance at September 30, 1999 of $99.7 million is

included in other current liabilities. The Company currently anticipates

that the restructuring and other non-recurring activities to which all of

these charges relate will be substantially completed within Fiscal

2000, except for certain long-term contractual obligations.

The cost of announced workforce reductions of $124.8 million

includes the elimination of 932 positions in the United States, 470 posi-

tions in Europe, 34 positions in Canada and Latin America and 31 posi-

tions in the Asia-Pacific region, consisting primarily of manufacturing

and distribution, sales and marketing, administrative and research

and development personnel. The cost of facility closures of $51.8 mil-

lion includes the shut-down and consolidation of 25 facilities in

Europe, 9 facilities in the United States, 8 facilities in the Asia-Pacific

region and 3 facilities in Canada and Latin America, consisting pri-

marily of manufacturing plants, distribution centers, sales offices,

administrative buildings and research and development facilities. At

September 30, 1999, 1,282 employees had been terminated and 20

facilities had been shut down.