ADT 1999 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

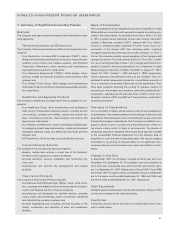

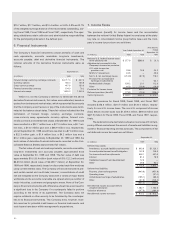

Research and Development

Research and development expenditures are expensed when

incurred and are included in cost of sales in the Consolidated State-

ments of Operations.

Advertising

Advertising costs are expensed when incurred.

Translation of Foreign Currency

Assets and liabilities of the Company’s subsidiaries operating outside

the United States which account in a functional currency other than

U.S. dollars, other than those operating in highly inflationary environ-

ments, are translated into U.S. dollars using year-end exchange rates.

Revenues and expenses are translated at the average exchange rates

effective during the year. Foreign currency translation gains and

losses are included as a component of accumulated other compre-

hensive income (loss) within shareholders’ equity. For subsidiaries

operating in highly inflationary environments, inventories and prop-

erty, plant and equipment, including related expenses, are translated

at the rate of exchange in effect on the date the assets were acquired,

while other assets and liabilities are translated at year-end exchange

rates. Translation adjustments for these operations are included in net

income (loss).

Gains and losses resulting from foreign currency transac-

tions, the amounts of which are not material, are included in net

income (loss).

Financial Instruments

From time to time the Company enters into a variety of forward foreign

currency exchange contracts, cross-currency swaps, currency

options, forward commodity contracts and interest rate swaps in its

management of foreign currency and commodity exposures and inter-

est costs.

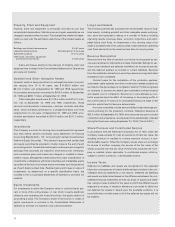

Forward foreign currency exchange contracts and cross-

currency swaps, which mitigate the impact of changes in currency

exchange rates on intercompany cross-border obligations, are

accounted for consistent with the related intercompany transactions.

Under cross-currency swaps, which principally hedge certain net for-

eign currency denominated investments, changes in valuation are

included in the currency translation adjustment component of accu-

mulated other comprehensive income (loss) within shareholders’

equity. The interest differentials on cross-currency swaps are included

in interest expense. Forward foreign currency exchange contracts and

currency options, acquired for the purpose of reducing exposure to

currency fluctuations associated with expected cash flows denomi-

nated in currencies other than the functional currencies, are marked

to market with realized and unrealized gains or losses reflected in sell-

ing, general and administrative expenses.

Under forward commodity contracts, which hedge anticipated

purchases of certain metals and other materials used in manufactur-

ing operations, payments are received or paid based on the differen-

tial between the contract price and the actual price of the underlying

commodity. Gains or losses on forward commodity contracts are

recorded as adjustments to the value of the purchased commodity.

Interest rate swaps hedge interest rates on certain indebtedness

and involve the exchange of fixed and floating rate interest payment

obligations over the life of the related agreement without the exchange

of the notional amount. The interest differentials to be paid or received

under interest rate swaps are recognized over the life of the underly-

ing agreement or indebtedness, respectively, as an adjustment to

interest expense.

Receivables and payables related to unrealized increases and

decreases in the values of derivative financial instruments are

included in other current assets and other current liabilities, respec-

tively, and are not material.

Use of Estimates

The preparation of consolidated financial statements in conformity

with generally accepted accounting principles requires management

to make extensive use of certain estimates and assumptions that

affect the reported amount of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the consolidated finan-

cial statements and the reported amounts of revenues and expenses

during the reported periods. Significant estimates in these consoli-

dated financial statements include merger, restructuring and other

non-recurring charges, purchase accounting reserves, allowances for

doubtful accounts receivable, estimates of future cash flows associ-

ated with assets, asset impairments, useful lives for depreciation and

amortization, loss contingencies, net realizable value of inventories,

estimated contract revenues and related costs, environmental liabili-

ties, income taxes and tax valuation reserves, and the determination

of discount and other rate assumptions for pension and post-retire-

ment employee benefit expenses. Actual results could differ from

those estimates.

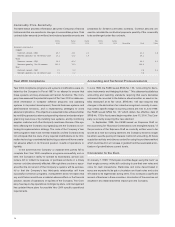

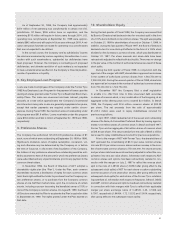

Accounting Pronouncements

In June 1998, the FASB issued SFAS No. 133, “Accounting for Deriv-

ative Instruments and Hedging Activities.” This statement establishes

accounting and reporting standards requiring that every derivative

instrument be recorded on the balance sheet as either an asset or lia-

bility measured at its fair value. SFAS No. 133 also requires that

changes in the derivative’s fair value be recognized currently in earn-

ings unless specific hedge accounting criteria are met. In June 1999,

the FASB issued SFAS No. 137 which defers the effective date of

SFAS No. 133 to fiscal years beginning after June 15, 2000. The Com-

pany is currently analyzing this new standard.

Reclassifications

Certain prior year amounts have been reclassified to conform with cur-

rent year presentation.

Stock Splits

Per share amounts and share data have been retroactively restated to

give effect to the reverse stock split effected in connection with the

merger of ADT and Former Tyco referred to in Note 2, and the two-for-

one stock splits distributed on October 22, 1997 and October 21, 1999,

both effected in the form of a stock dividend (See Note 10 for further

discussion).