ADT 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

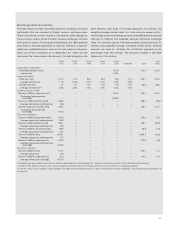

Amortization of Goodwill

Amortization of goodwill, a non-cash charge, increased $84.3 million

to $216.1 million in Fiscal 1999 compared with Fiscal 1998. Fiscal

1998 amortization of goodwill increased to $131.8 million from $90.0

million in the twelve months ended September 30, 1997. The increase

in amortization of goodwill is due to the $6,923.3 million in considera-

tion paid for acquisitions and acquisition related costs in Fiscal 1999,

which resulted in goodwill and other intangibles of $5,807.9 million,

and the $4,559.4 million in consideration paid for acquisitions and

acquisition related costs in Fiscal 1998, which resulted in goodwill and

other intangibles of $3,947.0 million.

Interest Expense, net

Interest expense, net, increased $240.3 million to $485.6 million in

Fiscal 1999, as compared to Fiscal 1998, and increased $74.9 million

to $245.3 million in Fiscal 1998, as compared to the twelve months

ended September 30, 1997. These increases were due to higher aver-

age debt balances, as a result of monies borrowed to pay for acquisi-

tions, partially offset by lower average interest rates. The weighted

average rate of interest on all long-term debt during Fiscal 1999, Fis-

cal 1998 and Fiscal 1997 was 6.2%, 6.4% and 7.2% respectively.

Extraordinary Items

Extraordinary items in Fiscal 1999, Fiscal 1998 and the twelve months

ended September 30, 1997 included net losses amounting to

$45.7 million, $2.4 million and $60.9 million, respectively, relating pri-

marily to the Company’s tender offers for debt and the write-off of net

unamortized deferred financing costs related to the LYONs. Further

details are provided in Notes 4 and 13 to the Consolidated Financial

Statements.

Cumulative Effect of Accounting Changes

The cumulative effect of accounting changes during Fiscal 1997 of

$15.5 million related to the change in accounting practices used by

AMP to develop its inventory costs, including standardizing globally

the definition of capacity used in determining overhead rates and

changing its inventory costing methodology to include manufacturing

engineering costs in inventory costs.

Income Tax Expense

The effective income tax rate, excluding the impact related to merger,

restructuring and other non-recurring charges, was 27.0% during Fis-

cal 1999 as compared to 30.6% in Fiscal 1998 and 32.3% in the twelve

months ended September 30, 1997. The decreases in the effective

income tax rates were primarily due to higher earnings in tax jurisdic-

tions with lower income tax rates. Management believes that the Com-

pany will generate sufficient future income to realize the tax benefits

related to its deferred tax assets. A valuation allowance has been

maintained due to continued uncertainties of realization of certain tax

benefits, primarily tax loss carryforwards. See Note 7 to the Consoli-

dated Financial Statements.

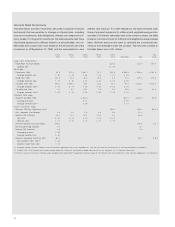

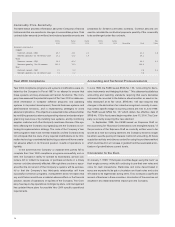

Liquidity and Capital Resources

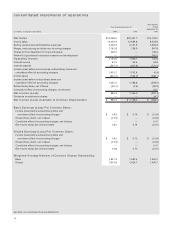

The following table shows the sources of the Company’s cash flow

from operating activities and the use of a portion of that cash in the

Company’s operations in Fiscal 1999. Management refers to the net

amount of cash generated from operating activities less capital expen-

ditures and dividends as “free cash flow.”

(in millions) Fiscal 1999

Operating profit, before certain charges $3,949.6(1)

Depreciation and amortization 1,095.1(2)

Net increase in deferred income taxes 334.3

Less:

Net increase in working capital (85.5)(3)

Interest expense (net) (485.6)

Income tax expense (620.2)

Restructuring expenditures (633.6)(4)

Other (net) (4.3)

Cash flow from operating activities 3,549.8

Less:

Capital expenditures (1,632.5)

Dividends paid (187.9)

Free cash flow $ 1,729.4

(1) This amount is the sum of the operating profits of the four business segments as

set forth above, less certain corporate expenses, and is before merger, restructuring and

other non-recurring charges, charges for the impairment of long-lived assets, and good-

will amortization.

(2) This amount is the sum of depreciation of tangible property ($979.6 million) and amor-

tization of intangible property other than goodwill ($115.5 million).

(3) This amount is net of $50.0 million received on the sale of accounts receivable.

(4) This amount is the sum of all cash paid out for (a) merger, restructuring and other non-

recurring charges in connection with business combinations accounted for on a pooling

of interests basis and (b) other restructuring and non-recurring charges taken by the

pooled companies prior to their combination with the Company.

In addition, during Fiscal 1999 the Company paid out $354.4 mil-

lion in cash that was charged against reserves established in connec-

tion with acquisitions accounted for under the purchase accounting

method. This amount is included in “Acquisition of businesses, net of

cash acquired” in the Consolidated Statement of Cash Flows.

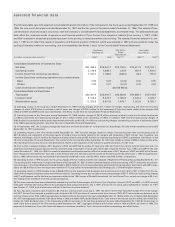

Business combinations are accounted for either on a pooling of

interests basis or under the purchase accounting method. In Fiscal

1999, the Company made two business combinations, USSC and

AMP, that were required to be accounted for on a pooling of interests

basis. Under pooling of interests accounting, the merged companies

are treated as if they had always been part of the Company, and their

financial statements are included in the Company’s Consolidated

Financial Statements for all periods presented.

At the time of each pooling of interests transaction, the Company

establishes a reserve for transaction costs and the costs that the Com-

pany expects to incur in integrating the merged company within the

relevant Tyco business segment. By integrating merged companies

with the Company’s existing businesses, the Company expects to

realize operating synergies and long-term cost savings. Integration

costs, which relate primarily to termination of employees and the clo-

sure of facilities made redundant, are detailed in Note 16 to the Con-

solidated Financial Statements. Reserves for merger, restructuring

and other non-recurring items are taken as a charge against current