ADT 1999 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

of approximately $580.8 million of debt. Raychem is being integrated

into Tyco Electronics within the Telecommunications and Electronics

segment.

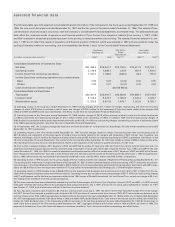

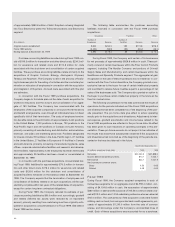

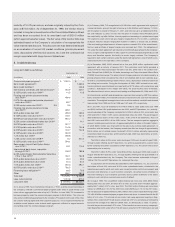

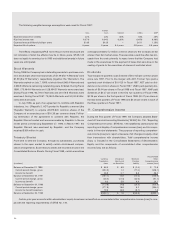

The following table summarizes the purchase accounting

liabilities recorded in connection with the Fiscal 1999 purchase

acquisitions:

Severance Facilities Other

Number of Number of

($ in millions) Employees Reserve Facilities Reserve Reserve

Original reserve established 5,620 $234.3 183 $174.8 $116.3

Fiscal 1999 activity (3,230) (55.9) (95) (48.2) (46.0)

Ending balance at September 30, 1999 2,390 $178.4 88 $126.6 $ 70.3

During Fiscal 1999, the Company sold certain of its businesses

for net proceeds of approximately $926.8 million in cash. These pri-

marily consist of certain businesses within the Flow Control Products

segment, including The Mueller Company and portions of Grinnell

Supply Sales and Manufacturing, and certain businesses within the

Healthcare and Specialty Products segment. The aggregate net gain

recognized on the sale of these businesses was not material. In con-

nection with the Flow Control divestiture, the Company granted a non-

exclusive license to the buyer for use of certain intellectual property

and is entitled to receive future royalties equal to a percentage of net

sales of the businesses sold. The Company also granted an option to

the buyer to purchase certain intellectual property in the future at the

then fair market value.

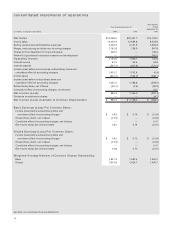

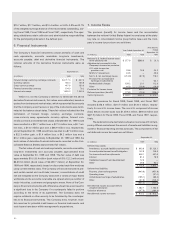

The following unaudited pro forma data summarize the results of

operations for the periods indicated as if the Fiscal 1999 acquisitions

and divestitures had been completed as of the beginning of the peri-

ods presented. The pro forma data give effect to actual operating

results prior to the acquisitions and divestitures. Adjustments to inter-

est expense, goodwill amortization and income taxes related to the

Fiscal 1999 acquisitions are reflected in the pro forma data. No effect

has been given to cost reductions or operating synergies in this pre-

sentation. These pro forma amounts do not purport to be indicative of

the results that would have actually been obtained if the acquisitions

and divestitures had occurred as of the beginning of the periods pre-

sented or that may be obtained in the future.

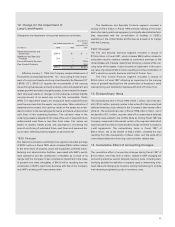

Year Ended September 30,

(in millions, except per share data) 1999 1998

Net sales $24,244.3 $21,858.0

Income before extraordinary items 870.7 1,023.7

Net income 824.7 1,021.9

Net income per common share:

Basic 0.53 0.65

Diluted 0.49 0.63

Fiscal 1998

During Fiscal 1998, the Company acquired companies in each of

its business segments for an aggregate cost of $4,559.4 million, con-

sisting of $4,154.8 million in cash, the assumption of approximately

$260 million in debt and the issuance of 765,544 common shares val-

ued at $19.2 million and 1,254 subsidiary preference shares valued at

$125.4 million. The cash portions of the acquisition costs were funded

utilizing cash on hand, borrowings under bank credit agreements, pro-

ceeds of approximately $1,245.0 million from the sale of common

shares, and borrowings under the Company’s uncommitted lines of

credit. Each of these acquisitions was accounted for as a purchase,

Purchase accounting liabilities recorded during Fiscal 1999 con-

sist of $116.3 million for transaction and other direct costs, $234.3 mil-

lion for severance and related costs and $174.8 million for costs

associated with the shut down and consolidation of certain acquired

facilities. These purchase accounting liabilities relate primarily to the

acquisitions of Graphic Controls, Entergy, Alarmguard, Glynwed,

Temasa and Raychem. The Company is still in the process of finaliz-

ing its business plan for the exiting of activities and the involuntary ter-

mination or relocation of employees in connection with the acquisition

and integration of Raychem. Accrued costs associated with this plan

are estimates.

In connection with the Fiscal 1999 purchase acquisitions, the

Company began to formulate plans at the date of each acquisition for

workforce reductions and the closure and consolidation of an aggre-

gate of 183 facilities. The Company has communicated with the

employees of the acquired companies to announce the terminations

and benefit arrangements, even though all individuals have not been

specifically told of their termination. The costs of employee termina-

tion benefits relate to the elimination of approximately 3,440 positions

in the United States, 1,220 positions in Europe, 730 positions in the

Asia-Pacific region and 230 positions in Canada and Latin America,

primarily consisting of manufacturing and distribution, administrative,

technical, and sales and marketing personnel. Facilities designated

for closure include 78 facilities in the Asia-Pacific region, 67 facilities

in the United States, 27 facilities in Europe and 11 facilities in Canada

and Latin America, primarily consisting of manufacturing plants, sales

offices, corporate administrative facilities and research and develop-

ment facilities. Approximately 3,230 employees had been terminated

and approximately 95 facilities had been closed or consolidated at

September 30, 1999.

In connection with the purchase acquisitions consummated dur-

ing Fiscal 1999, liabilities for approximately $70.3 million in transac-

tion and other direct costs, $178.4 million for severance and related

costs and $126.6 million for the shutdown and consolidation of

acquired facilities remained on the balance sheet at September 30,

1999. The Company expects that the termination of employees and

consolidation of facilities related to all such acquisitions will be sub-

stantially complete within two years of the related dates of acquisition,

except for certain long-term contractual obligations.

During Fiscal 1999, the Company reduced its estimate of pur-

chase accounting liabilities by $90.0 million and, accordingly, goodwill

and related deferred tax assets were reduced by an equivalent

amount, primarily resulting from costs being less than originally antic-

ipated for acquisitions consummated prior to Fiscal 1999. See table in

Fiscal 1998 section below.