ADT 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

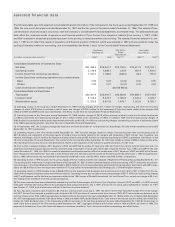

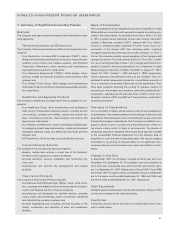

notes to consolidated financial statements

1. Summary of Significant Accounting Policies

Business

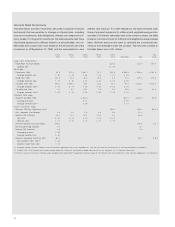

The Company manages its business based on the following four oper-

ating segments:

Telecommunications and Electronics

The Company’s Telecommunications and Electronics segment is com-

prised of:

• Tyco Electronics, including AMP Incorporated (“AMP”), which

designs and manufactures electrical connectors, interconnection

systems, touch screens and wireless systems, and Raychem

Corporation (“Raychem”), which develops and manufactures

high-performance electronic components;

• Tyco Submarine Systems Ltd. (“TSSL”), which designs, manu-

factures, installs and services undersea communications cable

systems; and

• Tyco Printed Circuit Group, which designs and manufactures

multi-layer printed circuit boards, backplane assemblies and sim-

ilar components.

Healthcare and Specialty Products

The Company’s Healthcare and Specialty Products segment is com-

prised of:

• Tyco Healthcare Group, which manufactures and distributes a

wide variety of disposable medical products, including wound-

care products, syringes and needles, sutures and surgical sta-

plers, incontinence products, electrosurgical instruments and

laparoscopic instruments;

• Tyco Plastics and Adhesives, which manufactures flexible plas-

tic packaging, plastic bags and sheeting, coated and laminated

packaging materials, tapes and adhesives and plastic garment

hangers; and

• ADT Automotive, which provides auto redistribution services.

Fire and Security Services

The Company’s Fire and Security Services segment:

• designs, installs and services a broad line of fire detection,

prevention and suppression systems worldwide;

• provides electronic security installation and monitoring ser-

vices; and

• manufactures and services fire extinguishers and related

products.

Flow Control Products

The Company’s Flow Control Products segment:

• manufactures and distributes pipe, fittings, valves, valve actua-

tors, couplings and related products which are used to transport,

control and measure the flow of liquids and gases;

• manufactures and distributes fire sprinkler devices, specialty

valves, plastic pipe and fittings used in commercial, residential

and industrial fire protection systems; and

• provides engineering and consulting services focusing on the

design, construction and operation of water and wastewater

facilities.

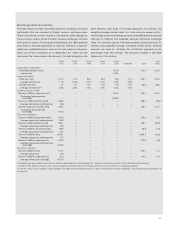

Basis of Presentation

The consolidated financial statements have been prepared in United

States dollars in accordance with generally accepted accounting prin-

ciples in the United States. As described more fully in Note 2, on July

2, 1997, a wholly-owned subsidiary of what was formerly called ADT

Limited, a Bermuda company (“ADT”), merged with Tyco Interna-

tional Ltd., a Massachusetts corporation (“Former Tyco”). Upon con-

summation of the merger, ADT (the continuing public company)

changed its name to Tyco International Ltd. (the “Company” or “Tyco”).

Former Tyco became a wholly-owned subsidiary of the Company and

changed its name to Tyco International (US) Inc. (“Tyco US”). In addi-

tion, as more fully described in Note 2, Tyco merged with Inbrand Cor-

poration (“Inbrand”), Keystone International, Inc. (“Keystone”), United

States Surgical Corporation (“USSC”) and AMP on August 27, 1997,

August 29, 1997, October 1, 1998 and April 2, 1999, respectively.

These transactions are referred to herein as the “mergers.” The con-

solidated financial statements include the consolidated accounts of

Tyco, a company incorporated in Bermuda, and its subsidiaries. They

have been prepared following the pooling of interests method of

accounting for the mergers and, therefore, reflect the combined finan-

cial position, operating results and cash flows of ADT, Former Tyco,

Keystone, Inbrand, USSC and AMP as if they had been combined for

all periods presented.

Principles of Consolidation

Tyco is a holding company whose assets consist of its investments in

its subsidiaries, intercompany balances and holdings of cash and cash

equivalents. The businesses of the consolidated group are conducted

through the Company’s subsidiaries. The Company consolidates com-

panies in which it owns or controls more than fifty percent of the vot-

ing shares unless control is likely to be temporary. The results of

companies acquired or disposed of during the fiscal year are included

in the consolidated financial statements from the effective date of

acquisition or up to the date of disposal except in the case of mergers

accounted for as pooling of interests (Note 2). All significant inter-

company balances and transactions have been eliminated in consoli-

dation.

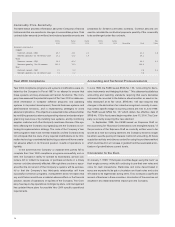

Change in Year End

In September 1997, the Company changed its fiscal year end from

December 31 to September 30. The change in year end resulted in a

short fiscal year covering the nine-month transition period from Janu-

ary 1 to September 30, 1997. References to Fiscal 1999, Fiscal 1998

and Fiscal 1997 throughout these consolidated financial statements

are to the twelve months ended September 30, 1999 and 1998, and

the nine months ended September 30, 1997, respectively.

Cash Equivalents

All highly liquid investments purchased with a maturity of three months

or less are considered to be cash equivalents.

Inventories

Inventories are recorded at the lower of cost (primarily first-in, first-

out) or market value.