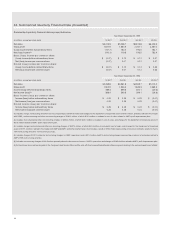

ADT 1999 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

The effects of applying SFAS 123 in this pro forma disclosure are

not indicative of what the effects may be in future years. SFAS 123

does not apply to awards prior to 1995 and additional awards in future

years are anticipated.

Stock Warrants

During 1999 the Company had outstanding warrants to purchase com-

mon stock at per share exercise prices of $1.49 (the “A Warrants”) and

$1.99 (the “B Warrants”), respectively (together, the “Warrants”). The

Warrants expired on July 7, 1999, at which time 6,960 A Warrants and

4,638 B Warrants remaining outstanding were forfeited. During Fiscal

1999, 175,464 A Warrants and 128,494 B Warrants were exercised.

During Fiscal 1998, 62,794 A Warrants and 29,078 B Warrants were

exercised. During Fiscal 1997, 73,064 A Warrants and 50,000 B War-

rants were exercised.

In July 1996, as part of an agreement to combine with Republic

Industries, Inc. (“Republic”), ADT granted to Republic a warrant (the

“Republic Warrant”) to acquire 28,879,800 common shares of the

Company at an exercise price of $10.39 per common share. Follow-

ing termination of the agreement to combine with Republic, the

Republic Warrant vested and was exercisable by Republic in the six

month period commencing September 27, 1996. In March 1997, the

Republic Warrant was exercised by Republic, and the Company

received $300 million in cash.

Treasury Shares

From time to time the Company, through its subsidiaries, purchases

shares in the open market to satisfy certain stock-based compen-

sation arrangements. Such treasury shares are recorded at cost in the

Consolidated Balance Sheets. During Fiscal 1998, certain executives

sold approximately 5.2 million common shares to the Company at the

shares’ then fair market value. The executives used the after-tax pro-

ceeds from this sale primarily to repay loans that the Company had

made to the executives for the payment of taxes that were due on the

vesting of grants to the executives of shares of restricted stock.

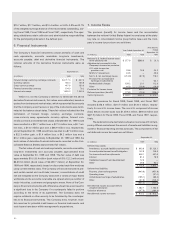

Dividends

Tyco has paid a quarterly cash dividend of $0.0125 per common share

since July 1997. Prior to the merger with ADT, Former Tyco paid a

quarterly cash dividend of $0.0125 in Fiscal 1997. ADT paid no divi-

dends on its common shares in Fiscal 1997. USSC paid quarterly div-

idends of $0.04 per share in Fiscal 1998 and Fiscal 1997. AMP paid

dividends of $0.27 per share in the first two quarters of Fiscal 1999,

$0.26 per share in the first quarter of Fiscal 1998, $0.27 per share in

the last three quarters of Fiscal 1998 and $0.26 per share in each of

the three quarters in Fiscal 1997.

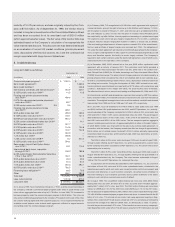

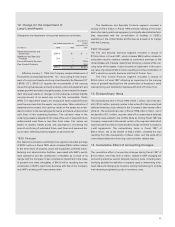

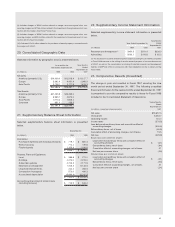

11. Comprehensive Income

During the first quarter of Fiscal 1999, the Company adopted State-

ment of Financial Accounting Standards (“SFAS”) No. 130, “Reporting

Comprehensive Income.” SFAS No. 130 establishes standards for the

reporting and display of comprehensive income (loss) and its compo-

nents in financial statements. The purpose of reporting comprehen-

sive income (loss) is to report a measure of all changes in equity, other

than transactions with shareholders. Total comprehensive income

(loss) is included in the Consolidated Statements of Shareholders’

Equity, and the components of accumulated other comprehensive

income (loss) are as follows:

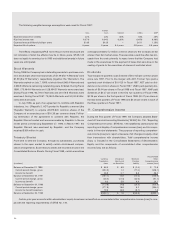

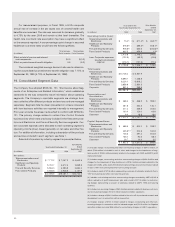

The following weighted average assumptions were used for Fiscal 1997:

Former

Tyco Tyco Inbrand USSC AMP

Expected stock price volatility 22% 22% 55% 34% 25%

Risk free interest rate 6.07% 6.34% 6.26% 6.45% 6.49%

Expected annual dividend yield per share $0.05 $0.05

—

$0.11 1.25%

Expected life of options 5 years 5 years 6.4 years 3.8 years 6.5 years

Accumulated

Currency Unrealized Minimum Other

Translation Gain (Loss) Pension Comprehensive

(in millions) Items on Securities Liability Income (Loss)

Balance at December 31, 1996 $ 66.3 $ 8.9 $ (2.4) $ 72.8

Current period change, gross (230.3) 1.2 (17.0) (246.1)

Income tax benefit 26.9 0.7 8.8 36.4

Balance at September 30, 1997 (137.1) 10.8 (10.6) (136.9)

Current period change, gross (45.0) (21.5) (24.6) (91.1)

Income tax benefit 8.3 5.9 9.9 24.1

Balance at September 30, 1998 (173.8) (4.8) (25.3) (203.9)

Current period change, gross (277.8) 18.6 5.2 (254.0)

Income tax benefit (expense) 19.5 (6.0) (5.7) 7.8

Balance at September 30, 1999 $(432.1) $ 7.8 $(25.8) $(450.1)

Certain prior year amounts within shareholders’ equity have been reclassified as accumulated other comprehensive income (loss) to com-

ply with the reporting requirements of SFAS No. 130.