ADT 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tional equity stakes this fiscal year.

Likewise, our push into electronics is a nat-

ural extension for Tyco. We

were already very familiar

with interconnect products

through our fire and securi-

ty, undersea fiber optic

cable, and printed circuit

board operations. By using

that as a platform to expand

our presence into electrical

connectors, we can capture

an exciting growth opportu-

nity—particularly in

telecommunications and automotive products—with

worldwide sales expected to rise 6–7 percent annu-

ally.

The electronic interconnect products

made by AMP, Raychem and Siemens are more

ubiquitous than computer chips, but carry less risk

of obsolescence. All three companies are set to

prosper from the introduction of new technologies.

You can find AMP components, for example, in a

majority of the world's cellular phones. The state of

Pennsylvania recently granted AMP a large contract

to build its emergency wireless communications

network, and many other states are looking at simi-

lar systems. Raychem, which makes

fiber optic wires, fiber management systems

and telecom closures, is also a major force in

telecommunications.

AMP, Raychem and Siemens are also in the

driver's seat in the automotive market. In a power-

ful global trend, mechanical automotive systems

are being replaced by electronics. As advanced

new electronically controlled seats, navigation sys-

tems, air bags and electronics to lower fuel con-

sumption proliferate, our electronics sales should

enjoy continued growth.

Execution

Given a choice between brilliant strategic vision and

top-flight execution, I would choose great execution

every time. For us, great execution means an

unflinching focus on manufacturing efficiency. Every

year, we challenge managers to make more and

better units for less money. We don't have a fancy

name for our continuous improvement program. It's

just a way of life.

And corporate headquarters doesn't tell

each business unit how to become more efficient.

We think our managers know much more about how

to promote efficiency within their business than we

do at the corporate level. Our role is to encourage

them to buy new equipment and develop new sys-

tems to improve productivity, and then evaluate per-

formance based on strict return-on-investment hur-

dles.

Cutting costs is not the same as cutting cor-

ners. When ADT Security makes acquisitions, it fre-

quently consolidates monitoring centers to save

money. As it happens, consolidating business at our

state-of-the-art monitoring centers actually

improves service.

We even seek efficiency in ways that seem-

ingly run counter to our corporate culture. Tyco is

extremely entrepreneurial and decentralized. We

believe that a large headquarters staff is unneces-

sary and that almost any function can be handled

better locally. But centralizing certain functions, like

tax, accounting and treasury services, does save

money, so we do it.

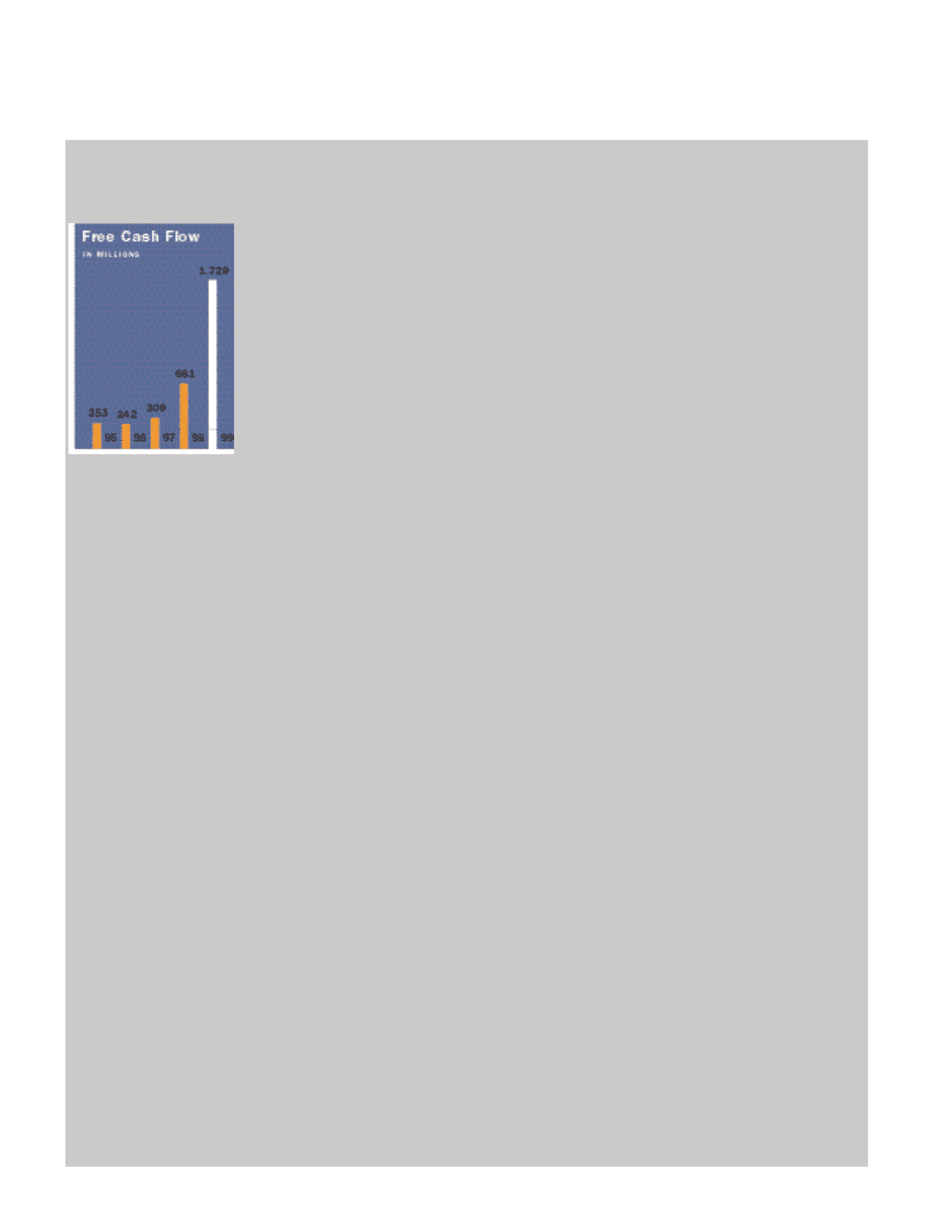

We believe the Company is extremely well

positioned. We are world leaders in our markets;

our business segments enjoy powerful, sustainable

tailwinds; abundant opportunities exist for organic

growth, strategic acquisitions and margin expan-

sion; and, with an estimated $7 billion in free cash

flow in the next two years, we think we can

continue to invest in Tyco's long-term success.

Tyco's sales, earnings and cash flow over

time have been, and will continue to be, the most

powerful proof of Tyco's fundamental strengths.

Telecommunications and Electronics

At Tyco's Telecommunications and Electronics

group, earnings rose 57 percent to $1.4 billion, up

from $894 million last year. Sales for the group

20