ADT 1999 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

on to customers.

Ruffies®brand trash bags enjoyed sizable

market share gains, emerging as the clear leader in

the United States. Retail demand was spurred by

the introduction of our new wing-tie and Ocean

Scent bags, as well as a cross-promotion involving

ADT Security. That promotion, in which a consumer

who purchased specially marked packages of

Ruffies®or Film-Gard®Plastic Sheeting could get

free installation of an ADT system, was successful

for both Tyco Plastics and ADT.

The acquisition of Sunbelt Plastics will take

us into the institutional trash-can liner market and

solidify our leading position in the construction plas-

tic sheeting market. Our purchase of Batts, Incorpo-

rated makes us the global market share leader in

plastic garment hangers, and will help us expand

throughout Europe.

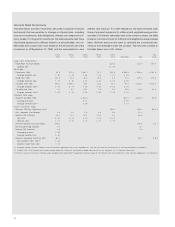

Fire and Security Services

In Tyco's Fire and Security Services segment, earn-

ings increased 44 percent to $907 million, from

$631 million last year. Sales reached $5.5 billion,

compared to last year's $4.4 billion.

ADT Security sales rose rapidly through

internal growth, supplemented by acquisitions. We

increased the number of participants in our suc-

cessful dealer program by 40 percent and are now

rolling out the program globally. It is crucial, of

course, to keep the customers you get. Last year

we reduced customer attrition from 8.7 percent to

just 8 percent—and we want to reduce it further.

We are constantly looking for new and innovative

ways to provide the highest levels of service to all of

our customers.

Security system penetration remains

relatively low worldwide, giving us ample room to

grow. In Germany, small business use of security

systems was virtually nonexistent—until last year,

when growth exploded. Such cultural shifts,

combined with growing affluence, suggest

the industry's double-digit growth rate should

be sustainable.

In fire protection, we widened our global

lead. Growth came from an increase in service con-

tracts, new construction, a rise in retrofitting pro-

jects and added regulation (as municipalities and

governments become more safety-conscious).

Margins in fire protection improved, aided

by strong increases in our high-margin service busi-

ness. Our worldwide fire extinguisher servicing

business grew substantially. We are also generating

significant cross-selling revenue by targeting ADT

commercial customers who do not yet rely on us for

fire protection, and vice versa.

Fire protection sales were robust in South-

east Asia and Europe, a result of strengthening

local economies and the growing desire of large

companies to use vendors who supply global solu-

tions. As customers expand around the world, our

global footprint gives us a competitive advantage.

Flow Control Products

Earnings in Tyco's Flow Control Products segment

rose to $606 million, a 33 percent increase over the

$457 million earned last year. Sales for the year

grew by 20 percent to $3.5 billion from $2.9 billion

in 1998.

Tyco Flow Control Products had a strong

year, led by international expansion and increasing

service revenue. We saw growing demand for

valve reconditioning in the United Kingdom,

the Asia/Pacific region, and in portions of Europe.

We recondition valves for oil companies operating

in the North Sea and for nuclear power plants

in Germany, as well as for many other industrial

customers.

Acquisitions helped drive international

expansion. Our purchase of the metals processing

division of U.K.-based Glynwed International repre-

sents the first step in our plan to expand our steel

pipe and tubular business globally, and gives us the

chance to transfer our competitive advantages in

global product sourcing and operating efficiencies

to Europe.