ADT 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

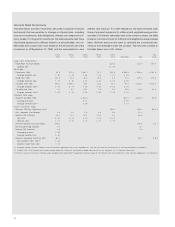

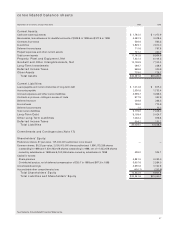

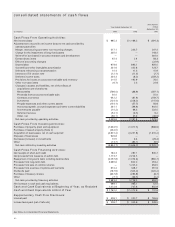

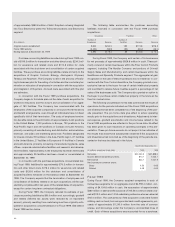

consolidated balance sheets

September 30 (in millions, except share data) 1999 1998

Current Assets:

Cash and cash equivalents $ 1,762.0 $ 1,072.9

Receivables, less allowance for doubtful accounts of $329.8 in 1999 and $317.6 in 1998 4,582.3 3,478.4

Contracts in process 536.6 565.3

Inventories 2,849.1 2,610.0

Deferred income taxes 711.6 797.6

Prepaid expenses and other current assets 721.2 430.7

Total current assets 11,162.8 8,954.9

Property, Plant and Equipment, Net 7,322.4 6,104.3

Goodwill and Other Intangible Assets, Net 12,158.9 7,105.5

Long-Term Investments 269.7 228.4

Deferred Income Taxes 668.8 320.9

Other Assets 779.0 726.7

Total Assets $32,361.6 $23,440.7

Current Liabilities:

Loans payable and current maturities of long-term debt $ 1,012.8 $ 815.0

Accounts payable 2,530.8 1,733.4

Accrued expenses and other current liabilities 3,599.7 3,069.3

Contracts in process

—

billings in excess of costs 977.9 332.9

Deferred revenue 258.8 266.5

Income taxes 798.0 773.9

Deferred income taxes 1.0 15.2

Total current liabilities 9,179.0 7,006.2

Long-Term Debt 9,109.4 5,424.7

Other Long-Term Liabilities 1,236.4 976.8

Deferred Income Taxes 504.2 131.2

Total Liabilities 20,029.0 13,538.9

Commitments and Contingencies (Note 17)

Shareholders’ Equity:

Preference shares, $1 par value, 125,000,000 authorized, none issued

——

Common shares, $0.20 par value, 2,500,000,000 shares authorized; 1,690,175,338 shares

outstanding in 1999 and 1,620,463,428 shares outstanding in 1998, net of 11,432,678 shares

owned by subsidiaries in 1999 and 6,742,006 shares owned by subsidiaries in 1998 338.0 324.1

Capital in excess:

Share premium 4,881.5 4,035.0

Contributed surplus, net of deferred compensation of $30.7 in 1999 and $67.3 in 1998 3,607.6 2,584.0

Accumulated earnings 3,955.6 3,162.6

Accumulated other comprehensive loss (450.1) (203.9)

Total Shareholders’ Equity 12,332.6 9,901.8

Total Liabilities and Shareholders’ Equity $32,361.6 $23,440.7

See Notes to Consolidated Financial Statements.