ADT 1999 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

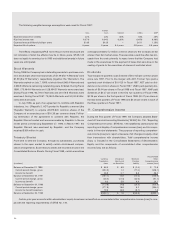

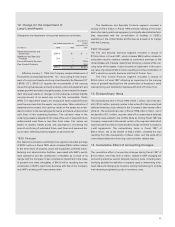

The total compensation cost expensed for all stock-based com-

pensation awards discussed below was $96.9 million, $37.1 million

and $59.9 million for Fiscal 1999, Fiscal 1998 and Fiscal 1997, respec-

tively.

Restricted Stock

The Company maintains a restricted stock ownership plan, which pro-

vides for the award of an initial amount of common shares plus an

amount equal to one-half of one percent of the total shares outstand-

ing at the beginning of each fiscal year. At September 30, 1999, there

were 22,946,562 shares authorized under the plan, of which

8,191,800 shares had been granted. Common shares are awarded

subject to certain restrictions with vesting varying over periods of up

to ten years.

For grants which vest based on certain specified performance cri-

teria, the fair market value of the shares at the date of vesting is

expensed over the period the performance criteria are measured. For

grants that vest through passage of time, the fair market value of the

shares at the time of the grant is amortized (net of tax benefit) to

expense over the period of vesting. The unamortized portion of

deferred compensation expense is recorded as a reduction of share-

holders’ equity. Recipients of all restricted shares have the right to vote

such shares and receive dividends. Income tax benefits resulting from

the vesting of restricted shares, including a deduction for the excess,

if any, of the fair market value of restricted shares at the time of vest-

ing over their fair market value at the time of the grants and from the

payment of dividends on unvested shares, are credited to contributed

surplus.

Employee Stock Purchase Plan

Substantially all full-time employees of the Company’s U.S. sub-

sidiaries and employees of certain qualified non-U.S. subsidiaries are

eligible to participate in an employee stock purchase plan. Eligible

employees authorize payroll deductions to be made for the purchase

of shares. The Company matches a portion of the employee contribu-

tion by contributing an additional 15% of the employee’s payroll

deduction. All shares purchased under the plan are purchased on the

open market by a designated broker.

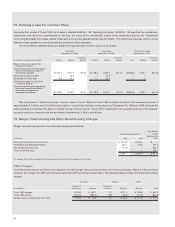

Stock Options

The Company has granted employee share options which were issued

under five fixed share option plans and schemes which reserve com-

mon shares for issuance to the Company’s directors, executives and

managers. The majority of options have been granted under the Tyco

International Ltd. Long Term Incentive Plan (formerly known as the

ADT 1993 Long-Term Incentive Plan

—

the “Incentive Plan”). The

Incentive Plan is administered by the Compensation Committee of the

Board of Directors of the Company, which consists exclusively of inde-

pendent directors of the Company. Options are generally granted to

purchase common shares at prices which are equal to or greater than

the market price of the common shares on the date the option is

granted. Conditions of vesting are determined at the time of grant.

Certain options have been granted in prior years in which participants

were required to pay a subscription price as a condition of vesting.

Options which have been granted under the Incentive Plan to date

have generally vested and become exercisable over periods of up to

five years from the date of grant and have a maximum term of ten

years. The Company has reserved 140.0 million common shares for

issuance under the Incentive Plan. Awards which the Company

becomes obligated to make through the assumption of, or in substitu-

tion for, outstanding awards previously granted by an acquired com-

pany are assumed and administered under the Incentive Plan but do

not count against this limit. At September 30, 1999, there were approx-

imately 46.2 million shares available for future grant under the Incen-

tive Plan. During October 1998, a broad-based option plan for

non-officer employees, the Tyco Long-Term Incentive Plan II (“LTIP

II”), was approved by the Board of Directors. The Company has

reserved 50.0 million common shares for issuance under the LTIP II.

The terms and conditions of this plan are similar to the Incentive Plan.

At September 30, 1999, there were approximately 35.9 million shares

available for future grant under the LTIP II.

In connection with the acquisitions of Raychem in Fiscal 1999

and CIPE S.A. and Holmes Protection in Fiscal 1998, options out-

standing under the respective stock option plans of these companies

were assumed under the Incentive Plan. In connection with the merg-

ers occurring in Fiscal 1999 and Fiscal 1997 (see Note 2), all of the

options outstanding under the Former Tyco, Keystone, Inbrand, USSC

and AMP stock option plans were assumed under the Incentive Plan.

These options are administered under the Incentive Plan but retain all

of the rights, terms and conditions of the respective plans under which

they were originally granted.

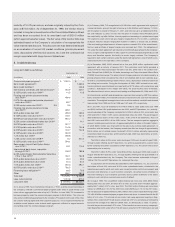

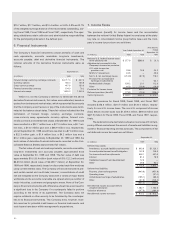

Share option activity for all plans since January 1, 1997 has been

as follows:

Weighted

Average

Exercise

Outstanding Price

At January 1, 1997, as restated 83,752,604 $15.03

Assumed from acquisition 175,600 10.19

Granted 36,196,594 22.07

Exercised (7,264,707) 9.73

Canceled (5,599,019) 27.29

At September 30, 1997 107,261,072 17.03

Assumed from acquisition 87,232 10.23

Granted 32,011,414 23.51

Exercised (37,626,616) 9.20

Canceled (7,281,946) 27.48

At September 30, 1998 94,451,156 24.83

Assumed from acquisitions 8,883,160 37.44

Granted 30,313,362 38.44

Exercised (43,180,390) 22.79

Canceled (4,476,021) 47.83

At September 30, 1999 85,991,267 27.91