ADT 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

time to time in the open market to satisfy certain stock-based com-

pensation arrangements, such as the exercise of stock options. In

November 1999, the Company announced the authorization by its

Board of Directors to reacquire up to 20 million of its common shares

in the open market.

The Company received proceeds of $926.8 million from the sale

of certain businesses in the Flow Control Products and Healthcare and

Specialty Products segments and $872.4 million from the exercise of

common share options.

The source of the cash used for acquisitions was primarily an

increase in total debt and cash flows from operations. Goodwill and

other intangible assets were $12,158.9 million at September 30, 1999,

compared to $7,105.5 million at September 30, 1998. At Septem-

ber 30, 1999, the Company’s total debt was $10,122.2 million, as com-

pared to $6,239.7 million at September 30, 1998. This increase

resulted principally from borrowings under the Company’s commercial

paper program, net proceeds of approximately $791.7 million from the

issuance of private placement notes in October 1998, net proceeds

received of approximately $1,173.7 million from the issuance of pub-

lic debt in January 1999 and net proceeds received of approximately

$2,080.3 million from the issuance of notes in August 1999. This

increase was partially offset by the Company’s tender offers for out-

standing debt instruments with higher interest rates and the repay-

ment of indebtedness under its bank credit agreement. For a full

discussion of debt activity, see Note 4 to the Consolidated Financial

Statements.

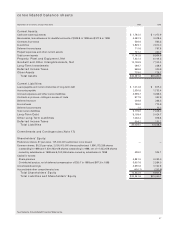

Shareholders’ equity was $12,332.6 million, or $7.30 per share,

at September 30, 1999, compared to $9,901.8 million, or $6.11 per

share, at September 30, 1998. The increase in shareholders’ equity

was due primarily to the issuance of approximately 32.4 million com-

mon shares valued at approximately $1,449.6 million for the acquisi-

tion of Raychem, net income of $985.3 million and proceeds of

$872.4 million from the exercise of options and warrants. Total debt as

a percent of total capitalization (total debt and shareholders’ equity)

was 45% at September 30, 1999 and 39% at September 30, 1998. Net

debt (total debt less cash and cash equivalents) as a percent of total

capitalization was 37% at September 30, 1999 and 32% at Septem-

ber 30, 1998.

The Company believes that its cash flow from operations,

together with its existing credit facilities and other credit arrange-

ments, is adequate to fund its operations.

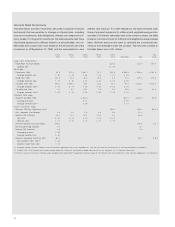

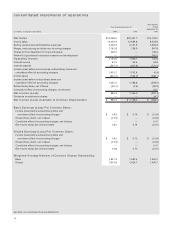

Backlog

At September 30, 1999, the Company had a backlog of unfilled orders

of approximately $7,581.1 million, compared to a backlog of approxi-

mately $5,118.2 million at September 30, 1998. Backlog by industry

segment is as follows:

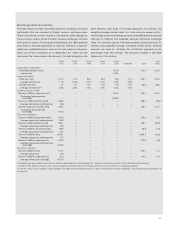

September 30,

(in millions) 1999 1998

Telecommunications and Electronics $4,974.5 $2,951.1

Flow Control Products 1,516.5 1,129.2

Fire and Security Services 986.6 965.4

Healthcare and Specialty Products 103.5 72.5

$7,581.1 $5,118.2

Backlog increased in each of the Company’s business segments.

Within the Telecommunications and Electronics segment, backlog

increased principally due to contracts awarded to TSSL due to contin-

ually increasing demands for undersea fiber optic cable capacity.

Within the Flow Control Products segment, backlog increased princi-

pally due to an increase in backlog at Earth Tech related to its water

and wastewater facilities contracts. Within the Fire and Security Ser-

vices segment, backlog increased principally due to an increase in

backlog at the Company’s worldwide security and European fire pro-

tection businesses. Within the Healthcare and Specialty Products seg-

ment, the increase resulted principally from an increase in demand for

the products sold by Tyco Plastics and Adhesives.

Quantitative and Qualitative Disclosures

About Market Risk

The Company is subject to market risk associated with changes in

interest rates, foreign currency exchanges rates and certain com-

modity prices. In order to manage the volatility relating to its more sig-

nificant market risks, the Company enters into forward foreign

currency exchange contracts, cross-currency swaps, foreign currency

options, commodity swaps and interest rate swaps. The Company

does not anticipate any material changes in its primary market risk

exposures in Fiscal 2000.

The Company utilizes risk management procedures and controls

in executing derivative financial instrument transactions. The Com-

pany does not execute transactions or hold derivative financial

instruments for trading purposes. Derivative financial instruments

related to interest rate sensitivity of debt obligations, intercompany

cross-border transactions and anticipated non-functional currency

cash flows, as well as commodity price exposures, are used with the

goal of mitigating a significant portion of these exposures when it

is cost effective to do so. Counter-parties to derivative financial

instruments are limited to financial institutions with at least an AA long-

term credit rating.