ADT 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

The 43.8% increase in operating profits in Fiscal 1999 over Fis-

cal 1998 reflects the worldwide increase in service volume, both in

security services and fire protection, including the higher margins

associated with recurring monitoring revenue. The increase in operat-

ing margins in Fiscal 1999 was principally due to increased volume of

higher margin service and inspection work in the North American fire

protection operations; increased volume due to economic improve-

ments in the Asia-Pacific region; higher incremental margins in the

European security operations from additions to the customer base;

and cost reductions related to acquisitions.

The 52.9% increase in operating profits in Fiscal 1998 over the

twelve months ended September 30, 1997 was due to increases in

service volume, including recurring monitoring revenue, in security

operations worldwide and fire protection operations in North America.

The increase in operating margins in Fiscal 1998 was due principally

to higher margins in the security business worldwide and, to a lesser

extent, to improved margins in the European fire protection business

and cost reductions related to acquisitions.

Flow Control Products

The Company’s Flow Control Products segment:

• manufactures and distributes pipe, fittings, valves, valve actua-

tors, couplings and related products which are used to transport,

control and measure the flow of liquids and gases;

• manufactures and distributes fire sprinkler devices, specialty

valves, plastic pipe and fittings used in commercial, residential

and industrial fire protection systems; and

• provides engineering and consulting services focusing on the

design, construction and operation of water and wastewater

facilities.

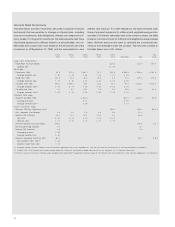

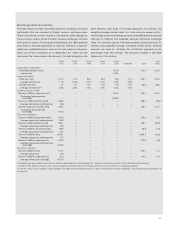

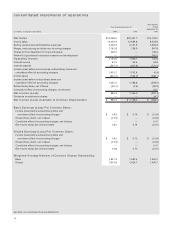

The following table sets forth sales and operating profits and mar-

gins on the basis described above for the Flow Control Products seg-

ment:

(unaudited)

Twelve Months

Ended

September 30,

($ in millions) Fiscal 1999 Fiscal 1998 1997

Sales $3,508.6 $2,928.5 $2,786.5

Operating profits $ 605.5 $ 456.9 $ 373.0

Operating margins 17.3% 15.6% 13.4%

The 19.8% sales increase in Fiscal 1999 over Fiscal 1998

reflects increased demand for valve products in Europe, increased

sales at Earth Tech and the impact of acquisitions. These acquisitions

included: Crosby Valve, acquired in July 1998 and included in results

for all of Fiscal 1999, but only part of Fiscal 1998; Rust Environmental

and Infrastructure, Inc., acquired by Earth Tech in September 1998

and included in results for all of Fiscal 1999, but less than a month in

Fiscal 1998; and certain subsidiaries in the metals processing division

of Glynwed International plc, acquired in March 1999.

During August 1999, the Company completed the sale of certain

businesses within this segment, including The Mueller Company, a

manufacturer of fire hydrants, waterworks, valves and other compo-

nents, and portions of Grinnell Supply Sales and Manufacturing, a

manufacturer and distributor of commodity fittings and related prod-

ucts. Excluding the impacts of these acquisitions and divestitures,

sales increased an estimated 11.3%.

The 5.1% sales increase in Fiscal 1998 over the twelve months

ended September 30, 1997 reflects increased demand for valve prod-

ucts in both North America and Europe, higher volume of pipe prod-

ucts, including those sold by Grinnell, and, to a lesser extent,

the acquisition of Crosby Valve. Excluding the effect of this acquisition,

the sales increase for the segment in Fiscal 1998 was an estimated

4.7%.

The 32.5% increase in operating profits in Fiscal 1999 over Fis-

cal 1998 was primarily due to increased sales in the European flow

control operations, North American valve products and Earth Tech.

The increase in operating margins was principally due to cost con-

tainment programs that improved margins in the Company’s North

American pipe products business and the worldwide valve operations.

The gain on the sale of the businesses in this segment did not signifi-

cantly impact operating profits and margins in Fiscal 1999.

The 22.5% increase in operating profits in Fiscal 1998 over the

twelve months ended September 30, 1997 was due primarily to

increased volume in the North American and European valve product

operations and, to a lesser extent, in the North American pipe prod-

ucts business. The increase in operating margins was principally due

to cost containment programs that improved margins at the North

American and European valve operations.

The effect of changes in foreign exchange rates during Fiscal

1999, Fiscal 1998 and the twelve months ended September 30, 1997

was not material to the Company’s sales and operating profits.

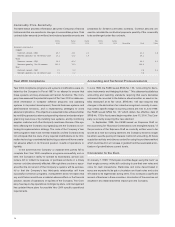

Corporate Expenses

Corporate expenses were $122.9 million in Fiscal 1999 compared to

$68.3 million in Fiscal 1998 and $56.8 million in the twelve months

ended September 30, 1997. These increases were due principally to

higher compensation expense under the Company’s equity-based,

incentive compensation plans due in part to an increase in the market

value of the Company’s stock price in Fiscal 1999, and an increase in

corporate staffing to support and monitor the Company’s expanding

businesses and operations.