ADT 1999 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

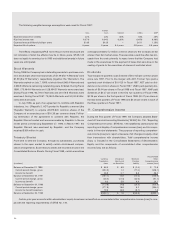

As of September 30, 1999, the Company had approximately

$370 million of net operating loss carryforwards in certain non-U.S.

jurisdictions. Of these, $255 million have no expiration, and the

remaining $115 million will expire in future years through 2014. U.S.

operating loss carryforwards at September 30, 1999 were approxi-

mately $842 million and will expire in future years through 2019. A val-

uation allowance has been provided for operating loss carryforwards

that are not expected to be utilized.

In the normal course, the Company and its subsidiaries’ income

tax returns are examined by various regulatory tax authorities. In con-

nection with such examinations, substantial tax deficiencies have

been proposed. However, the Company is contesting such proposed

deficiencies, and ultimate resolution of such matters is not expected

to have a material adverse effect on the Company’s financial position,

results of operations or liquidity.

8. Key Employee Loan Program

Loans are made to employees of the Company under the Former Tyco

1983 Key Employee Loan Program for the payment of taxes upon the

vesting of shares granted under Former Tyco’s Restricted Stock Own-

ership Plans. The loans are unsecured and bear interest, payable

annually, at a rate which approximates the Company’s incremental

short-term borrowing rate. Loans are generally repayable in ten years,

except that earlier payments are required under certain circum-

stances. During Fiscal 1999, the maximum amount outstanding under

this program was $91.6 million. Loans receivable under this program

were $18.6 million and $22.2 million at September 30, 1999 and 1998,

respectively.

9. Preference Shares

The Company has authorized 125,000,000 preference shares of $1

each, none of which were outstanding at September 30, 1999 or 1998.

Rights as to dividends, return of capital, redemption, conversion, vot-

ing and otherwise may be determined by the Company on or before

the time of issuance. In the event of the liquidation of the Company,

the holders of any preference shares then outstanding would be enti-

tled to payment to them of the amount for which the preference shares

were subscribed and any unpaid dividends, prior to any payment to the

common shareholders.

In November 1996, the Board of Directors of ADT adopted a

shareholder rights plan (the “Plan”). Under the Plan, each common

shareholder received a distribution of rights for each common share

held. Each right entitled the holder to purchase from the Company cer-

tain preference shares, or to purchase from the Company common

shares at one half their market value, upon the occurrence of certain

events, including a person becoming the beneficial owner of 15% or

more of the Company’s common shares. On August 9, 1999, the Board

of Directors amended the Plan to accelerate the Plan’s expiration date

to September 30, 1999. The rights granted under the Plan expired on

that date.

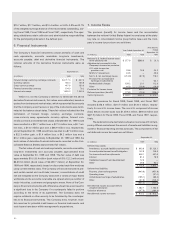

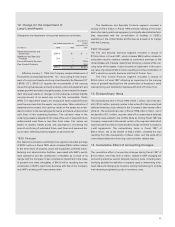

10. Shareholders’ Equity

During the last quarter of Fiscal 1999, the Company announced that

its Board of Directors had declared a two-for-one stock split in the form

of a 100% stock dividend on its common shares. The split was payable

on October 21, 1999 to shareholders of record on October 1, 1999. In

addition, during the last quarter of Fiscal 1997, the Board of Directors

declared a two-for-one stock split effected in the form of a 100% stock

dividend on the Company’s common shares, which was distributed on

October 22, 1997. Per share amounts and share data have been

retroactively adjusted to reflect both stock splits. There was no change

in the par value or the number of authorized shares as a result of these

stock splits.

During the third quarter of Fiscal 1999, in conjunction with the

approval of the merger with AMP, shareholders approved an increase

in the number of authorized common shares from 1,503,750,000 to

2,500,000,000. During the second quarter of Fiscal 1998, sharehold-

ers approved an increase in the number of authorized common shares

from 750,000,000 to 1,503,750,000.

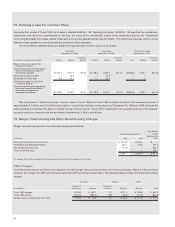

In December 1997 the Company filed a shelf registration

to enable it to offer from time to time unsecured debt securities

or shares of common stock, or any combination of the foregoing, at an

aggregate initial offering price not to exceed $2.0 billion. In March

1998, the Company sold 50.6 million common shares at $25.38

per share. The net proceeds from the sale of approximately

$1,245.0 million were used to repay indebtedness incurred for

previous acquisitions.

In April 1997, USSC redeemed all of the issued and outstanding

shares of its Series A Convertible Preferred Stock by issuing approxi-

mately 12.8 million shares of common stock. In March and April 1997,

Former Tyco sold an aggregate of 46 million shares of common stock

at $14.44 per share. The net proceeds from the sale of $645.2 million

were used to repay indebtedness incurred for previous acquisitions.

Prior to the merger of ADT with Former Tyco, the shareholders of

ADT approved the consolidating of $0.10 par value common shares

into new $0.20 par value common shares and an increase in the num-

ber of authorized common shares to 750,000,000. Per share amounts

and per share data have been retroactively adjusted to reflect the con-

solidation into new par value shares. Information with respect to ADT

common shares and options has been retroactively restated in con-

nection with the merger on July 2, 1997 to reflect the reverse stock

split in the ratio of 0.48133 share (1.92532 after giving effect to the

subsequent stock splits) of ADT for each share or option outstanding

and the issuance of one share (four shares after giving effect to the

subsequent stock splits) for each share of the Former Tyco outstand-

ing (see Note 2). Information with respect to Keystone, Inbrand, USSC

and AMP common shares and options has been retroactively restated

in connection with their mergers with Tyco to reflect their applicable

merger per share exchange ratios of 0.48726, 0.43, 0.7606 and

0.7507, respectively (1.94904, 1.72, 1.5212 and 1.5014, respectively,

after giving effect to the subsequent stock splits).