ADT 1999 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

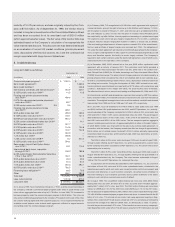

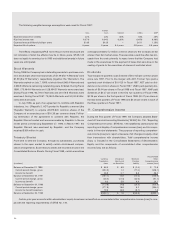

The Company recorded a credit of $15.0 million, including

$11.5 million in the Fire and Security Services segment and $3.5 mil-

lion in the Healthcare and Specialty Products segment referred to

above, representing a revision of estimates related to Tyco’s 1997

restructuring and other non-recurring accruals. Most of the actions

under Tyco’s 1997 restructuring and other non-recurring plans are

completed or near completion and have resulted in total estimated

costs being less than originally anticipated.

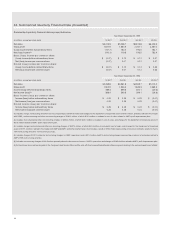

1998 Charges

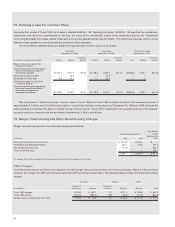

During the fourth quarter of Fiscal 1998, AMP recorded charges of

$185.8 million associated with its profit improvement plan, which

includes the reduction of support staff throughout all its business units

and the consolidation of manufacturing plants and other facilities, in

addition to certain sales growth initiatives. These charges include the

cost of staff reductions of $172.1 million involving the voluntary retire-

ment and involuntary termination of approximately 2,700 staff support

personnel and 700 direct manufacturing employees, and the cost of

consolidation of certain facilities of $13.7 million relating to six plant

and facility closures and consolidations. At September 30, 1999, these

restructuring activities were substantially completed. See Note 18 for

discussion of the voluntary early retirement program.

During the first quarter of Fiscal 1998, AMP recorded a credit of

$21.4 million to merger, restructuring and other non-recurring charges

representing a revision of estimates related to its 1996 restructuring

activities, which were completed in Fiscal 1998.

During the fourth quarter of Fiscal 1998, USSC recorded certain

charges of $80.5 million. These charges include $70.9 million of costs

to exit certain businesses representing the write down of assets from

earlier purchases of technology that had minimal commercial applica-

tion and the adjustment to net realizable value of certain assets. In

addition, merger costs of $9.6 million were recorded that represent

legal and insurance costs related to the merger consummated in the

first quarter of Fiscal 1999. During the first quarter of Fiscal 1998,

USSC recorded restructuring charges of $12.0 million related to

employee severance costs, facility disposals and asset write-downs

as part of USSC’s cost cutting program. USSC substantially com-

pleted its 1998 restructuring activities during Fiscal 1999.

1997 Charges

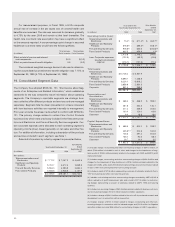

In connection with the mergers consummated in Fiscal 1997 (Note 2),

the Company recorded merger, restructuring and other non-recurring

charges of $917.8 million. These charges include transaction costs of

$239.8 million for legal, accounting, financial advisory services, sev-

erance and other direct costs related to the mergers. Also included are

costs required to combine ADT’s electronic security business, Key-

stone’s valve manufacturing and distribution business and Inbrand’s

disposable medical products business with the related businesses of

Former Tyco. These costs consist of the cost of workforce reductions

of $130.3 million including the elimination of approximately 4,000 posi-

tions; the costs of combining certain facilities of $194.2 million involv-

ing the closure of 18 manufacturing facilities and the consolidation of

sales and service offices, electronic security system monitoring cen-

ters, warehouses and other locations; the costs of disposing of excess

equipment and other assets of $133.5 million; and other costs of

$220.0 million relating to the consolidation of certain product lines, the

satisfaction of certain liabilities and other non-recurring charges.

Approximately $34.6 million of accrued merger and restructuring costs

are included in other current liabilities and $41.1 million in other non-

current liabilities at September 30, 1999. These restructurings are

substantially complete. The remaining accruals primarily relate to

future payments on non-cancelable lease obligations.

During Fiscal 1997, USSC recorded restructuring charges of

$5.8 million related primarily to employee severance costs associated

with the consolidation of manufacturing and certain marketing opera-

tions, which was substantially completed during Fiscal 1998. USSC

also recorded charges of $24.3 million during Fiscal 1997 for litigation

and other related costs relative to patent infringement litigation, which

was settled as of September 30, 1999.

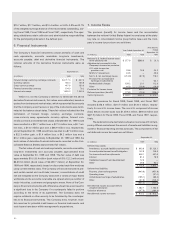

17. Commitments and Contingencies

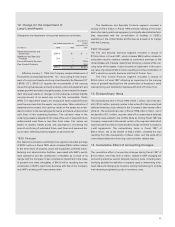

The Company occupies certain facilities under leases that expire at

various dates through the year 2030. Rental expense under these

leases and leases for equipment was $381.0 million, $331.7 million

and $242.9 million for Fiscal 1999, Fiscal 1998 and Fiscal 1997,

respectively. At September 30, 1999, the minimum lease payment

obligations under noncancelable operating leases were as follows:

$405.3 million in Fiscal 2000, $211.6 million in fiscal 2001, $151.3 mil-

lion in fiscal 2002, $117.3 million in fiscal 2003, $82.6 million in fiscal

2004 and an aggregate of $347.9 million in fiscal years 2005 through

2030.

In the normal course of business, the Company is liable for con-

tract completion and product performance. In the opinion of manage-

ment, such obligations will not significantly affect the Company’s

financial position or results of operations.

The Company is involved in various stages of investigation and

cleanup related to environmental remediation matters at a number of

sites. The ultimate cost of site cleanup is difficult to predict given the

uncertainties regarding the extent of the required cleanup, the inter-

pretation of applicable laws and regulations and alternative cleanup

methods. Based upon the Company’s experience with environmental

remediation matters, the Company has concluded that there is at least

a reasonable possibility that remedial costs will be incurred with

respect to these sites in an aggregate amount in the range of

$35.6 million to $124.8 million. At September 30, 1999, the Company

has concluded that the most probable amount that will be incurred