ADT 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

through improved productivity and cost reductions in the ordinary

course of business, unrelated to acquisition or divestiture activities.

The Company regards charges that it incurs to reduce costs in the

ordinary course of business as recurring charges, which are reflected

in cost of sales and in selling, general and administrative expenses in

the Consolidated Statements of Operations.

When the Company makes an acquisition, the acquired company

is immediately integrated with the Company’s existing operations.

Consequently, the Company does not separately track the financial

results of acquired companies. The year-to-year sales comparisons

that are presented below include estimates of year-to-year sales

growth that exclude the effects of acquisitions. These estimates

assume that the acquisitions were made at the beginning of the

relevant fiscal periods.

Sales and Operating Profits

Telecommunications and Electronics

The Company’s Telecommunications and Electronics segment is com-

prised of:

• Tyco Submarine Systems Ltd. (“TSSL”), which designs, manu-

factures, installs and maintains undersea fiber optic communica-

tions cable systems;

• Tyco Electronics, including AMP, which designs and manufac-

tures connectors, interconnection systems, touch screens and

wireless systems, and Raychem, which develops and manufac-

tures high-performance electronic components; and

• Tyco Printed Circuit Group, which designs and manufactures

printed circuits, backplanes and similar components.

The AMP merger occurred in April 1999, but as required under

the pooling of interests method of accounting, AMP’s results have

been included for all periods presented. The following table sets forth

sales and operating profits and margins on the basis described above

for the Telecommunications and Electronics segment:

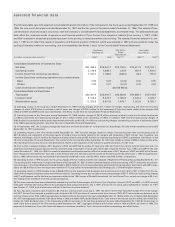

(unaudited)

Twelve Months

Ended

September 30,

($ in millions) Fiscal 1999 Fiscal 1998 1997

Sales $7,711.2 $7,067.3 $6,304.9

Operating profits $1,174.0 $ 835.8 $ 677.8

Operating margins 15.2% 11.8% 10.8%

The 9.1% increase in sales in Fiscal 1999 over Fiscal 1998 for

the Telecommunications and Electronics segment resulted in part

from acquisitions. These included: the acquisition in May 1999 of Tele-

comunicaciones Marinas, S.A. (“Temasa”), included in TSSL; the

acquisition in August 1999 of Raychem, included in Tyco Electronics;

and the acquisition in July 1998 of Sigma Circuits, Inc., whose results

were included in the Tyco Printed Circuit Group for all of Fiscal 1999,

but only the final quarter of Fiscal 1998. Excluding the impact of

Temasa, Raychem and Sigma Circuits, sales increased an estimated

5.1%.

The 12.1% increase in sales in Fiscal 1998 over the twelve

months ended September 30, 1997 was predominantly due to the

acquisition of AT&T Corp.’s submarine systems business. The results

of this business were included in the Company’s operations for all of

Fiscal 1998, but only from July 1997, the date of acquisition, in the

1997 period. Excluding the impact of this acquisition, sales increased

an estimated 1.9%.

The Telecommunications and Electronics segment also experi-

enced organic growth in sales in Fiscal 1999 and Fiscal 1998 at TSSL

and the Tyco Printed Circuit Group. This growth was offset in part by

decreased sales at AMP. Prior to the Company’s merger with AMP,

AMP’s sales had decreased every quarter, compared to the corre-

sponding quarter in the prior year, since the quarter ended June 1997.

AMP’s pre-acquisition sales during the six months ended March 31,

1999 were $2,675.5 million, compared to sales of $2,843.6 million dur-

ing the six months ended September 30, 1999.

The 40.5% increase in operating profits in Fiscal 1999 compared

with Fiscal 1998 was due to improved margins at AMP, the acquisition

of Raychem, and higher sales volume at TSSL and the Tyco Printed

Circuit Group. The improved operating margins in Fiscal 1999 com-

pared with Fiscal 1998 were primarily due to the implementation of

AMP’s profit improvement plan, which was initiated in the fourth quar-

ter of Fiscal 1998, cost reduction programs associated with the AMP

merger, a pension curtailment/settlement gain and the acquisition of

Raychem. For information on the implementation of the AMP profit

improvement plan and the cost reduction programs related to the AMP

merger, see Note 16 (1999 Charges and 1998 Charges) to the Con-

solidated Financial Statements. These improvements were partially

offset by $253.4 million of certain costs in Fiscal 1999 at AMP prior to

the merger with Tyco, including costs to defend the AlliedSignal Inc.

tender offer, the write-off of inventory and other balance sheet write-

offs and adjustments.

The 23.3% increase in operating profits in Fiscal 1998 as com-

pared with the twelve months ended September 30, 1997 was pre-

dominantly attributable to the inclusion of the operating results of the

AT&T Corp.’s submarine systems business in all of Fiscal 1998 but

only for the final three months of the 1997 period. The increase in oper-

ating margins in Fiscal 1998, compared with the 1997 period reflects

higher incremental margins on increased sales at Tyco Printed Circuit

Group. This was offset in part by slightly decreased margins at TSSL

and AMP.

Healthcare and Specialty Products

The Company’s Healthcare and Specialty Products segment is com-

prised of:

• Tyco Healthcare, which manufactures a wide variety of dis-

posable medical products, including woundcare products,

syringes and needles, sutures and surgical staples, incontinence

products, electrosurgical instruments and laparoscopic instru-

ments;

• Tyco Plastics and Adhesives, which manufactures flexible plas-

tic packaging, plastic bags and sheeting, coated and laminated

packaging materials, tapes and adhesives and plastic garment

hangers; and

• ADT Automotive, which provides auto redistribution services.