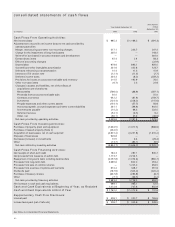

ADT 1999 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

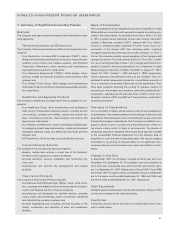

48

maturity of 10.0% per annum, and was originally valued by the Com-

pany at $74.6 million. As of September 30, 1999, the Vendor Note is

included in long-term investments on the Consolidated Balance Sheet

and has been accounted for at its amortized cost of $120.5 million

(which approximates fair value). The fair value of the Vendor Note was

estimated based on the Company’s calculation of an appropriate fair

value interest rate discount. This discount rate was determined based

on an evaluation of current UK market conditions (private placement

rates, discussions with financial sources, etc.) and the continued risk

margin associated with deep discount debentures.

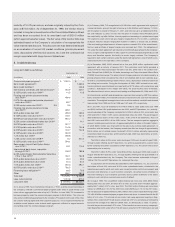

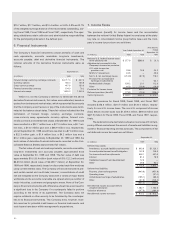

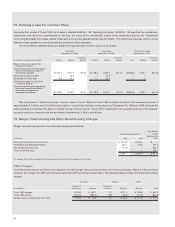

4. Indebtedness

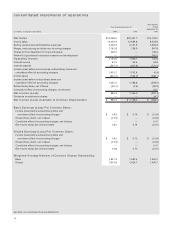

Long-term debt is as follows:

September 30,

(in millions) 1999 1998

Commercial paper program(1) $ 1,392.0 $

—

Bank credit agreement(2)

—

1,359.0

Bank credit facilities(3)

—

206.9

International overdrafts and demand loans(4) 184.9 429.7

8.125% public notes due 1999(5) 10.5 10.5

Floating rate private placement notes

due 2000(6) 499.4

—

0.57% Yen denominated private placement

notes due 2000(6) 89.7

—

8.25% senior notes due 2000(5) 9.5 9.5

Floating rate private placement notes

due 2001(6) 499.1

—

6.5% public notes due 2001 299.3 299.0

6.125% public notes due 2001(7) 748.1 747.0

6.875% private placement notes due 2002(6) 992.2

—

9.25% senior subordinated notes due 2003(5)

—

14.1

5.875% public notes due 2004(8) 397.7

—

6.375% public notes due 2004 104.6 104.6

6.375% public notes due 2005(7) 743.7 742.6

6.125% public notes due 2008(8) 394.9

—

7.2% notes due 2008(9) 398.8

—

7.25% senior notes due 2008(10) 8.2 300.0

6.125% public notes due 2009(11) 394.1

—

Zero coupon Liquid Yield Option Notes

due 2010(12) 49.1 115.3

International bank loans, repayable

through 2013(13) 208.2 188.6

6.25% public Dealer Remarketable Securities

(“Drs.”) due 2013(7) 760.1 762.8

9.5% public debentures due 2022(5) 49.0 49.0

8.0% public debentures due 2023 50.0 50.0

7.0% public notes due 2028(7) 492.4 492.1

6.875% public notes due 2029(11) 780.5

—

Financing lease obligation(14) 69.5 76.5

Other 496.7 282.5

Total debt 10,122.2 6,239.7

Less current portion 1,012.8 815.0

Long-term debt $ 9,109.4 $5,424.7

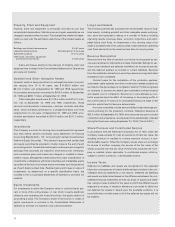

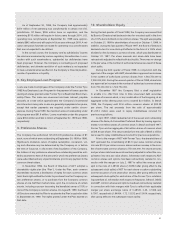

(1) In January 1999, Tyco International Group S.A. (“TIG”), a wholly-owned subsidiary of

the Company, initiated a commercial paper program under which it could initially issue

notes with an aggregate face value of up to $1.75 billion. In June 1999, TIG increased its

borrowing capacity under the commercial paper program to $3.90 billion. The notes are

fully and unconditionally guaranteed by the Company. Proceeds from the sale of the notes

are used for working capital and other corporate purposes. TIG is required to maintain an

available unused balance under its bank credit agreement sufficient to support amounts

outstanding under the commercial paper program.

(2) In February 1999, TIG renegotiated its $2.25 billion credit agreement with a group of

commercial banks, giving it the right to borrow up to $3.40 billion until February 11, 2000,

with the option to extend to February 11, 2001, and to borrow up to an additional $0.5 bil-

lion until February 12, 2003. TIG also has the option to increase the $3.40 billion part of

the credit facility up to $4.0 billion. Interest payable on borrowings is variable based upon

TIG’s option to select a Euro rate plus margins ranging from 0.41% to 0.43%, a certificate

of deposit rate plus margins ranging from 0.535% to 0.555%, or a base rate, as defined.

If the outstanding principal amount of loans equals or exceeds 25% of the commitments,

the Euro and certificate of deposit margins are increased by 0.125%. The obligations of

TIG under the credit agreement are fully and unconditionally guaranteed by the Company.

TIG is using the credit agreement to fully support its commercial paper program discussed

above and therefore expects this facility to remain largely undrawn. The Company is

required to meet certain covenants under the bank credit agreement, none of which is con-

sidered restrictive to the operations of the Company.

(3) In December 1995, USSC entered into a five year, $325 million syndicated credit

agreement with a maturity of January 2001. The syndicated credit facility provided a

choice of interest rates based upon the banks’ CD rate, prime rate or the London Inter-

bank Offered Rate (LIBOR) for US dollar borrowings and Tokyo Interbank Offered Rate

(TIBOR) for yen borrowings. The actual interest charges paid were to be determined by a

pricing schedule which considered the ratio of consolidated debt at each calendar quar-

ter end to consolidated earnings before interest, taxes, depreciation and amortization for

the trailing twelve months. During the third quarter of 1996, USSC entered into an addi-

tional conditional committed bank term loan facility of $175 million, with similar terms and

conditions. Subsequent to the merger with USSC, the credit facilities were terminated.

The effective interest rate on amounts outstanding as of September 30, 1998 was 5.91%.

(4) International overdrafts and demand loans represent borrowings by AMP from various

banks and other holders. All overdrafts and loans mature within one year from the balance

sheet date. The weighted-average interest rate on all international overdrafts and demand

loans during Fiscal 1999 and Fiscal 1998 was 5.3% and 4.2%, respectively.

(5) In July 1997, Tyco US tendered for its $145.0 million 8.125% public notes due 1999

and $200.0 million 9.5% public debentures due 2022, and ADT Operations, Inc., a wholly-

owned subsidiary of the Company, tendered for its $250.0 million 8.25% senior notes due

2000 and $294.1 million 9.25% senior subordinated notes due 2003. The percentage of

debt tendered was 92.8% of the 8.125% notes, 75.5% of the 9.5% debentures, 96.2% of

the 8.25% notes and 95.2% of the 9.25% notes. The two companies paid an aggregate

amount, including accrued interest, of approximately $900.8 million to the debt holders,

of which $800.0 million was financed from the previously existing credit agreement. In

connection with the tenders, the Company recorded an after-tax charge of approximately

$58.3 million, net of related income tax benefit of $33.0 million, primarily representing

unamortized debt issuance fees and the premium paid, which was reported as an extra-

ordinary loss (Note 13).

The $250.0 million 8.25% senior notes due August 2000 were issued in August 1993,

through a public offering, by ADT Operations, Inc. and are guaranteed on a senior basis

by the Company and certain subsidiaries of ADT Operations, Inc. The senior notes are not

redeemable prior to maturity.

The $294.1 million 9.25% senior subordinated notes due August 2003 were issued in

August 1993 by ADT Operations, Inc., through a public offering and are guaranteed on a

senior subordinated basis by the Company. The notes became redeemable in August

1998 at 103.75% and ADT Operations, Inc. redeemed the notes.

In conjunction with the tenders described above, ADT Operations, Inc., by consent of

the holders of the 8.25% senior and 9.25% senior subordinated notes, eliminated in the

indentures pursuant to which such notes were issued (a) certain restrictive covenants and

provisions and references to such restrictive covenants, (b) certain events of default to

the extent relating to such restrictive covenants and (c) certain definitions to the extent

relating to such restrictive covenants and events of default.

(6) In August 1999, TIG issued $500 million floating rate notes due 2000, $500 million

floating rate notes due 2001, $1 billion 67¼8% notes due 2002 and ¥ 10 billion (approxi-

mately $89.7 million) 0.57% notes due 2000. The $500 million floating rate notes bear

interest at LIBOR plus 0.6% for the 2000 notes and LIBOR plus 0.7% for the 2001 notes.

The net proceeds of approximately $2,080.3 million were used to repay borrowings under

TIG’s $3.90 billion commercial paper program discussed above. In connection with the $1

billion 67¼8% notes, TIG entered into an interest rate swap agreement expiring in Sep-

tember 2002, under which TIG will receive a fixed rate of 67¼8% and will pay a floating rate

based on the average of two different LIBOR rates, as defined, plus 3.755%. In connec-

tion with the yen denominated 0.57% notes, TIG entered into a cross-currency swap expir-

ing in September 2000, under which TIG will receive a payment of ¥ 10 billion plus accrued