ADT 1999 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

The Company also assumed USSC’s agreement to potentially

pay up to approximately $70.0 million in common stock as of Septem-

ber 30, 1998 as additional purchase price consideration relative to an

acquisition consummated by USSC in 1997, if and when certain addi-

tional milestones and sales objectives are achieved. During March

and April 1999, a total of 140,002 Tyco common shares, valued at

approximately $5.2 million, were issued pursuant to this agreement.

This matter is the subject of pending litigation. The Company does not

expect to issue a material amount of additional shares pursuant to this

agreement.

3. Acquisitions and Divestitures

Fiscal 1999

In addition to the pooling of interests transactions discussed in Note

2, during Fiscal 1999, the Company purchased businesses in each of

its four business segments for an aggregate cost of $6,923.3 million,

consisting of $4,546.8 million in cash, net of cash acquired, the

issuance of 32.4 million common shares valued at $1,449.6 million

and the assumption of $926.9 million in debt. In addition, $354.4 mil-

lion of cash was paid during the year for purchase accounting liabili-

ties related to current and prior years’ acquisitions. The cash portions

of the acquisition costs were funded utilizing cash on hand, the

issuance of long-term debt and borrowings under the Company’s com-

mercial paper program. Each of these acquisitions was accounted for

as a purchase, and the results of operations of the acquired compa-

nies have been included in the consolidated results of the Company

from their respective acquisition dates.

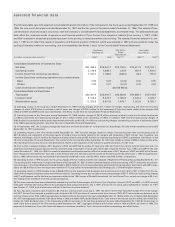

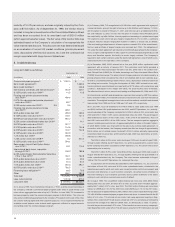

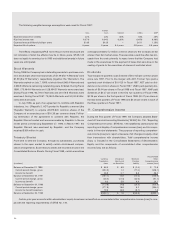

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $525.4 million for transaction costs

and the costs of integrating the acquired companies within the various

Tyco business segments. Details regarding these purchase account-

ing liabilities are set forth below.

At the time each purchase acquisition is made, the Company

records each asset acquired and each liability assumed at its esti-

mated fair value, which amount is subject to future adjustment when

appraisals or other further information is obtained. The excess of

(a) the total consideration paid for the acquired company over (b) the

fair value of assets acquired less liabilities assumed and purchase

accounting liabilities recorded is recorded as goodwill. As a result of

acquisitions completed in Fiscal 1999, and adjustments to the fair val-

ues of assets and liabilities and purchase accounting liabilities

recorded for acquisitions completed prior to Fiscal 1999, the Company

recorded approximately $5,807.9 million in goodwill and other intan-

gibles.

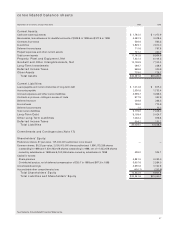

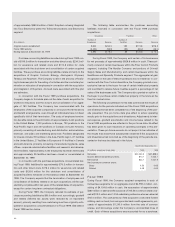

The following table shows the fair values of assets and liabilities

and purchase accounting liabilities recorded for purchase acquisitions

completed in Fiscal 1999, adjusted to reflect changes in fair values of

assets and liabilities and purchase accounting

liabilities recorded for acquisitions completed prior to Fiscal 1999 (in

millions):

Receivables $ 695.0

Inventories 498.3

Prepaid expenses and other current assets 225.9

Property, plant and equipment 988.9

Goodwill and other intangible assets 5,807.9

Other assets 423.8

8,639.8

Accounts payable 335.5

Accrued expenses and other current liabilities 1,186.5

Other long-term liabilities 194.5

1,716.5

$6,923.3

Cash consideration paid (net of cash acquired) $4,546.8

Share consideration paid 1,449.6

Debt assumed 926.9

$6,923.3

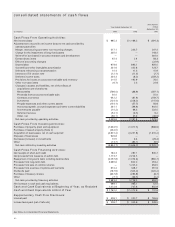

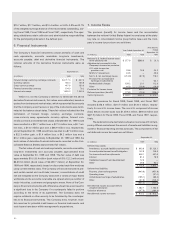

Thus, in Fiscal 1999, the Company spent a total of $4,901.2 mil-

lion in cash related to the acquisition of businesses, consisting of

$4,546.8 million of cash in purchase price for these businesses (net of

cash acquired) plus $354.4 million of cash paid out during the year for

purchase accounting liabilities related to current and prior years’

acquisitions.

Fiscal 1999 purchase acquisitions include, among others, the

acquisition of Graphic Controls Corporation (“Graphic Controls”) in

October 1998, Entergy Security Corporation (“Entergy”) in January

1999, Alarmguard Holdings, Inc. (“Alarmguard”) in February 1999,

certain subsidiaries in the metals processing division of Glynwed

International, plc (“Glynwed”) in March 1999, Telecomunicaciones

Marinas, S.A. (“Temasa”), a wholly-owned subsidiary of Telefonica

S.A., in May 1999 and Raychem Corporation (“Raychem”) in August

1999. Graphic Controls, a leading designer, manufacturer, marketer

and distributor of disposable medical products, was purchased for

approximately $460 million, including the assumption of certain out-

standing debt, and is being integrated within the Healthcare and Spe-

cialty Products segment. Entergy and Alarmguard were purchased for

an aggregate of approximately $430 million and are being integrated

within the electronic security services business of the Fire and Secu-

rity Services segment. Glynwed, which is engaged in the production

of steel tubing, steel electrical conduit and other similar products, was

purchased for approximately $236 million and is being integrated

within the Flow Control Products segment. Temasa installs and main-

tains undersea cable systems and was purchased for approximately

$280 million. Temasa is being integrated into TSSL within the

Telecommunications and Electronics segment. Raychem, a leading

international designer, manufacturer and distributor of high-perfor-

mance electronic products for OEM businesses and for a broad range

of specialized telecommunications, energy and industrial applica-

tions, was purchased for a total of approximately $1,445.9 million in

cash and the issuance of approximately 32.4 million Tyco common

shares valued at approximately $1,449.6 million, plus the assumption