ADT 1999 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

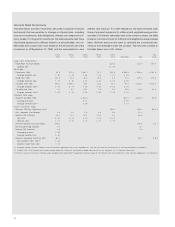

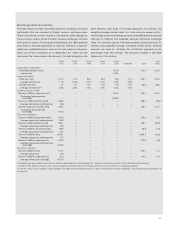

The Company’s merger with USSC, which is included in Tyco

Healthcare, occurred in October 1998. As required under the pooling

of interests method of accounting, USSC’s results have been included

for all periods presented. The following table sets forth sales and oper-

ating profits and margins on the basis described above for the Health-

care and Specialty Products segment:

(unaudited)

Twelve Months

Ended

September 30,

($ in millions) Fiscal 1999 Fiscal 1998 1997

Sales $5,742.7 $4,672.4 $3,733.9

Operating profits $1,386.0 $ 481.8 $ 607.2

Operating margins 24.1% 10.3% 16.3%

The 22.9% increase in sales in Fiscal 1999 over Fiscal 1998, and

the 25.1% increase in Fiscal 1998 over the twelve months ended Sep-

tember 30, 1997, were primarily the result of increased sales of Tyco

Healthcare and, to a lesser extent, of Tyco Plastics and Adhesives and

ADT Automotive. The increases for Tyco Healthcare were due to

acquisitions and, to a lesser extent, organic growth. The acquisitions

primarily responsible for the sales increase in Fiscal 1999 included:

Valleylab, which was acquired in January 1998 and included in results

for all of Fiscal 1999, but only part of Fiscal 1998; Sherwood-Davis &

Geck (“Sherwood”), which was acquired in February 1998 and

included in results for all of Fiscal 1999, but only part of Fiscal 1998;

Confab, which was acquired in April 1998 and included in results for

all of Fiscal 1999, but only part of Fiscal 1998; and Graphic Controls

Corporation, which was acquired in October 1998. Excluding the con-

tributions of Valleylab, Sherwood, Confab and Graphic Controls, sales

for the segment increased an estimated 5.1% in Fiscal 1999 over Fis-

cal 1998.

For Fiscal 1998, the acquisitions primarily responsible for the

sales increase included Sherwood and Confab. Excluding the impact

of these acquisitions, the sales increase for Fiscal 1998 over the

twelve months ended September 30, 1997 was 5.8%.

The substantial increase in operating profits and operating mar-

gins in Fiscal 1999 over Fiscal 1998 was due to improved margins and

increased sales volume at Tyco Healthcare, whose margins were

depressed in Fiscal 1998. The increase in Fiscal 1999 also reflected

higher sales volume and better margins at Tyco Plastics and Adhe-

sives and ADT Automotive. The Fiscal 1998 margins at Tyco Health-

care were brought down by fourth quarter results at USSC, which

lowered sales of higher margin products to reduce excess inventory

levels at distributors, and recorded increased costs, principally a

$105.8 million accrual for special hospital education programs.

Excluding these effects, management estimates that the increase in

operating profits in Fiscal 1999 over Fiscal 1998 would have been

48.6% and the operating margin for the segment in Fiscal 1998 would

have been 19.6%. The increase in margins for Fiscal 1999 above the

19.6% level was primarily attributable to the effects of the cost reduc-

tion programs associated with the USSC merger, including the termi-

nation of 1,282 employees and the consolidation or closure of 20

facilities. The effect of exiting businesses of Tyco Healthcare did not

significantly impact operating margins or profits. For more information

on the cost reduction programs related to the USSC merger, see Note

16 to the Consolidated Financial Statements.

The decrease in operating profits and margins in Fiscal 1998

from the twelve months ended September 30, 1997 reflects decreased

margins at USSC, particularly as a result of the factors impacting the

Fiscal 1998 fourth quarter at USSC referred to above. The decreased

USSC margins were partially offset in Fiscal 1998 by the acquisition

of Sherwood, fixed cost reductions due to the integration of Sherwood,

and increased volume and margins at Tyco Plastics and Adhesives

and ADT Automotive. Excluding the effects of the above on sales and

costs in the Fiscal 1998 fourth quarter at USSC, management esti-

mates that operating profits would have increased by 53.7% in Fiscal

1998 as compared to the 1997 period.

Fire and Security Services

The Company’s Fire and Security Services segment:

• designs, installs and services a broad line of fire detection, pre-

vention and suppression systems worldwide;

• provides electronic security installation and monitoring ser-

vices; and

• manufactures and services fire extinguishers and related

products.

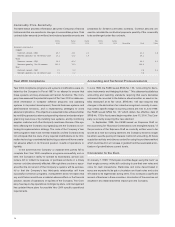

The following table sets forth sales and operating profits and mar-

gins on the basis described above for the Fire and Security Services

segment:

(unaudited)

Twelve Months

Ended

September 30,

($ in millions) Fiscal 1999 Fiscal 1998 1997

Sales $5,534.0 $4,393.5 $3,832.0

Operating profits $ 907.0 $ 630.6 $ 412.5

Operating margins 16.4% 14.4% 10.8%

The 26.0% increase in sales in Fiscal 1999 over Fiscal 1998

reflected increased sales worldwide in both the Company’s electronic

security services and its fire protection businesses. The increases

were due both to a higher volume of recurring service revenues and

the effects of acquisitions in the security services business. The acqui-

sitions included: Holmes Protection, acquired in February 1998 and

included in results for all of Fiscal 1999, but only part of Fiscal 1998;

CIPE S.A. and Wells Fargo Alarm, both acquired in May 1998 and

included in results for all of Fiscal 1999, but only part of Fiscal 1998;

and Entergy Security Corporation and Alarmguard Holdings, acquired

in January and February, 1999, respectively. Excluding the impact of

these acquisitions, the sales increase for the segment in Fiscal 1999

was an estimated 15.4%.

The 14.7% sales increase in Fiscal 1998 over the twelve months

ended September 30, 1997 was due to increased worldwide sales in

the electronic security services business and higher sales volume in

the North American fire protection businesses. The increases reflect a

higher volume of recurring service revenues and, to a lesser extent,

the impact of the Fiscal 1998 acquisitions. Excluding the effects of

Holmes, CIPE and Wells Fargo, the sales increase for the segment in

Fiscal 1998 was an estimated 7.3%.