ADT 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

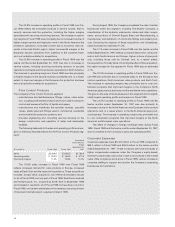

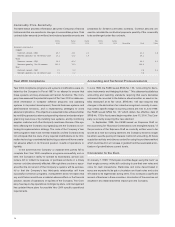

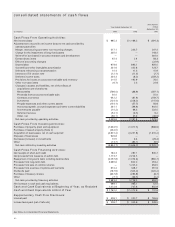

Commodity Price Sensitivity

The table below provides information about the Company’s financial

instruments that are sensitive to changes in commodities prices. Total

contract dollar amounts (in millions) and notional quantity amounts are

presented for forward commodity contracts. Contract amounts are

used to calculate the contractual payments quantity of the commodity

to be exchanged under the contracts.

Fiscal Fiscal Fiscal Fiscal Fiscal Fair

2000 2001 2002 2003 2004 Thereaf terTotal V alue

Forward contract s:

Copper

Contract amount (US$) 25.7 18.6 2.3 46.6 6.8

Contract quantity (in 000 metric tons) 16.1 11.6 1.4 29.1

Gold

Contract amount (US$) 33.0 20.6 53.6 5.6

Contract quantity (in 000 ounces) 120.0 75.0 195.0

Zinc

Contract amount (US$) 3.1 0.7 3.8 0.6

Contract quantity (in 000 metric tons) 3.1 0.7 3.8

Year 2000 Compliance

Year 2000 compliance programs and systems modifications were ini-

tiated by the Company in Fiscal 1997 in an attempt to ensure that

these systems and key processes will remain functional. The Com-

pany has assessed the potential impact of the Year 2000 on date-sen-

sitive information in computer software programs and operating

systems in its product development, financial business systems and

administrative functions, and is implementing strategies to avoid

adverse implications. This objective is expected to be achieved either

by modifying present systems using existing internal and external pro-

gramming resources or by installing new systems, and by monitoring

supplier, customer and other third-party readiness. Review of the sys-

tems affecting the Company is progressing and the Company is con-

tinuing its implementation strategy. The costs of the Company’s Year

2000 program to date have not been material, and the Company does

not anticipate that the costs of any required modifications to its infor-

mation technology or embedded technology systems will have a mate-

rial adverse effect on its financial position, results of operations or

liquidity.

In the event that the Company or material third parties fail to

complete their Year 2000 compliance programs successfully and on

time, the Company’s ability to operate its businesses, service cus-

tomers, bill or collect its revenues or purchase products in a timely

manner could be adversely affected. Although there can be no assur-

ance that the conversion of the Company’s systems will be success-

ful or that the Company’s key third-party relationships will have

successful conversion programs, management does not expect that

any such failure would have a material adverse effect on the financial

position, results of operations or liquidity of the Company. The Com-

pany has day-to-day operational contingency plans, and management

has updated these plans for possible Year 2000 specific operational

requirements.

Accounting and Technical Pronouncements

In June 1998, the FASB issued SFAS No. 133, “Accounting for Deriv-

ative Instruments and Hedging Activities.” This statement establishes

accounting and reporting standards requiring that every derivative

instrument be recorded in the balance sheet as either an asset or lia-

bility measured at its fair value. SFAS No. 133 also requires that

changes in the derivative’s fair value be recognized currently in earn-

ings unless specific hedge accounting criteria are met. In June 1999,

the FASB issued SFAS No. 137 which defers the effective date of

SFAS No. 133 to fiscal years beginning after June 15, 2000. The Com-

pany is currently analyzing this new standard.

In September 1999, the FASB issued an Exposure Draft on

the accounting for “Business Combinations and Intangible Assets.” If

the provisions of the Exposure Draft as currently written were to be

issued as a new accounting standard, the Company would no longer

be able to use the pooling of interests method of accounting. All future

acquisition activity would be accounted for using the purchase method

which could result in an increase in goodwill and the associated amor-

tization of goodwill above current levels.

Conversion to the Euro

On January 1, 1999, 11 European countries began using the “euro” as

their single currency, while still continuing to use their own notes and

coins for cash transactions. Banknotes and coins denominated in

euros are expected to be put in circulation and local notes and coins

will cease to be legal tender during 2002. Tyco conducts a significant

amount of business in these countries. Introduction of the euro has not

resulted in any material adverse impact upon the Company.