ADT 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

management’s discussion and analysis

Results of Operations

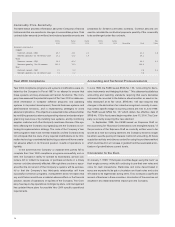

Information for all periods presented below reflects the grouping of the

Company’s businesses into four business segments consisting of

Telecommunications and Electronics, Healthcare and Specialty Prod-

ucts, Fire and Security Services and Flow Control Products.

In September 1997, the Company changed its fiscal year end

from December 31 to September 30. References to Fiscal 1999, Fis-

cal 1998 and Fiscal 1997 are to the twelve month fiscal years ended

September 30, 1999 and 1998, and the transitional nine-month fiscal

period ended September 30, 1997, respectively. The discussion below

of the results of operations compare Fiscal 1999 to Fiscal 1998 and

Fiscal 1998 to the twelve months ended September 30, 1997 (unau-

dited).

In Fiscal 1999, the Company consummated two mergers that

were accounted for under the pooling of interests method of account-

ing. The merger with United States Surgical Corporation closed on

October 1, 1998, and the merger with AMP Incorporated closed on

April 2, 1999. As required by generally accepted accounting princi-

ples, the Company restated its financial statements as if USSC and

AMP had always been a part of the Company. The Company recorded

as expenses during Fiscal 1999 costs directly associated with the

USSC and AMP mergers and the costs of terminating employees and

closing or consolidating facilities as a result of the mergers. The Com-

pany also expensed in Fiscal 1999 the costs of staff reductions and

facility closings that AMP undertook as part of a plan to improve its

profitability unrelated to the Company’s merger with AMP. In Fiscal

1998, the Company expensed charges for staff reductions and facility

closings under the AMP profit improvement plan and charges that

USSC incurred to exit certain of its businesses. These are discussed

in more detail under “Liquidity and Capital Resources” below.

Overview

Sales increased 18.0% during Fiscal 1999 to $22,496.5 million from

$19,061.7 million in Fiscal 1998. Sales in Fiscal 1998 increased 14.4%

compared to the twelve months ended September 30, 1997. Income

(loss) before extraordinary items and cumulative effect of accounting

changes was $1,031.0 million in Fiscal 1999, as compared to

$1,168.6 million in Fiscal 1998 and ($300.5) million in the twelve

months ended September 30, 1997. Income before extraordinary

items for Fiscal 1999 included an after-tax charge of $1,341.5 million

($1,596.7 million pre-tax) related to the mergers with USSC and AMP

and costs associated with AMP’s profit improvement plan. Income

before extraordinary items for Fiscal 1998 included an after-tax charge

of $192.0 million ($256.9 million pre-tax) primarily related to AMP’s

profit improvement plan and costs incurred by USSC to exit certain

businesses. Loss before extraordinary items and cumulative effect of

accounting changes for the twelve months ended September 30, 1997

included an after-tax charge of $1,485.5 million ($1,670.4 million pre-

tax) for merger and transaction costs, write-offs and integration costs

primarily associated with the mergers of ADT, Former Tyco, Keystone

and Inbrand.

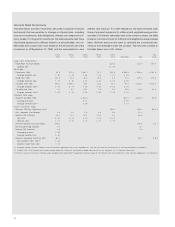

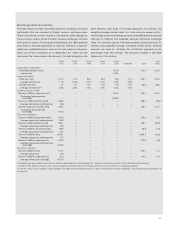

The following table details the Company’s sales and earnings in

Fiscal 1999, Fiscal 1998 and the twelve months ended September 30,

1997.

(unaudited)

Twelve

Months Ended

September 30,

(in millions) Fiscal 1999 Fiscal 1998 1997

Net sales $22,496.5 $19,061.7 $16,657.3

Operating profit, before certain

charges(1) $ 3,949.6(2) $ 2,336.8 $ 2,013.7

Merger, restructuring and other

non-recurring charges (1,261.7) (256.9) (1,283.3)

Impairment of long-lived assets(335.0)

—

(148.4)

Write-off of purchased

in-process research

and development

——

(361.0)

Amortization of goodwill (216.1) (131.8) (90.0)

Operating income 2,136.8 1,948.1 131.0

Interest expense, net (485.6) (245.3) (170.4)

Other income

——

118.4(3)

Pre-tax income before

extraordinary items and

cumulative effect of

accounting changes 1,651.2 1,702.8 79.0

Income taxes (620.2) (534.2) (379.5)

Income (loss) before

extraordinary items and

cumulative effect of

accounting changes 1,031.0 1,168.6 (300.5)

Extraordinary items,

net of taxes (45.7) (2.4) (60.9)

Cumulative effect of

accounting changes,

net of taxes

——

15.5

Net income (loss) $ 985.3 $ 1,166.2 $ (345.9)

(1) This amount is the sum of the operating profits of the Company’s four business seg-

ments set forth in the segment discussion below less certain corporate expenses, and is

before merger, restructuring and other non-recurring charges, impairment of long-lived

assets, write-off of purchased in-process research and development and amortization of

goodwill.

(2) Restructuring charges in the amount of $78.9 million related to the write-down of inven-

tory have been deducted as part of cost of sales in the Consolidated Statement of Oper-

ations for Fiscal 1999. However, they have not been deducted as part of cost of sales for

the purpose of calculating operating profit before certain charges in this table. These

charges are instead included in the total merger, restructuring and other non-recurring

charges.

(3) Amount consists of $65.0 million related to a litigation settlement and $53.4 million

related to the disposal of an equity investment by ADT.

The operating profits and margins for the Company’s four busi-

ness segments that are presented in the following discussion are

stated before deductions for merger, restructuring and other non-

recurring charges related to business combinations accounted for

under the pooling of interests method of accounting, charges for

impairment of long-lived assets, in-process research and develop-

ment charges and goodwill amortization. This is consistent with how

management views the operating results of the individual segments.

Operating profits improved in all segments in each of Fiscal 1999

and Fiscal 1998, with the exception of the Healthcare and Specialty

Products segment in Fiscal 1998 for reasons that are discussed

below. The operating improvements are the result of both increased

revenues and enhanced margins. Increased revenues result from

organic growth and from acquisitions that are accounted for under the

purchase method of accounting. The Company enhances its margins