ADT 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

and the results of operations of the acquired companies were included

in the consolidated results of the Company from their respective acqui-

sition dates. As a result of the acquisitions, the Company recorded

approximately $3,947.0 million in goodwill and other intangibles.

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $498.7 million for transaction costs

and the costs of integrating the acquired companies within the various

Tyco business segments. Details regarding these purchase account-

ing liabilities are set forth below. During Fiscal 1998, the Company

spent a total of $4,251.8 million in cash related to the acquisition of

businesses, consisting of $4,154.8 of purchase price (net of cash

acquired) plus $97.0 million of cash for purchase accounting liabilities

related to current and prior years’ acquisitions.

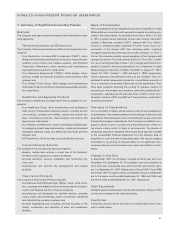

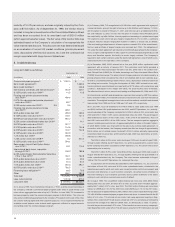

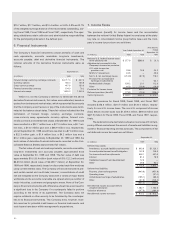

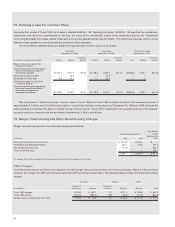

The following table summarizes the purchase accounting

liabilities recorded in connection with the Fiscal 1998 purchase acqui-

sitions:

Severance Facilities Other

Number of Number of

($ in millions) Employees Reserve Facilities Reserve Reserve

Original reserve established 4,800 $159.7 90 $278.9 $ 60.1

Fiscal 1998 activity (1,600) (33.4) (70) (14.2) (51.7)

Fiscal 1999 activity (1,050) (67.0) (3) (48.7) (8.4)

Reversal to goodwill (1,150) (20.4) (4) (69.6)

—

Ending balance at September 30, 1999 1,000 $ 38.9 13 $146.4 $

—

ance Sheets. Cash dividends accumulate on a preferred basis,

whether or not earned or declared, at the rate of $3,750 per share per

annum. Upon liquidation, the holders of shares are entitled to receive

an amount equal to $100,000 per share, plus any unpaid dividends.

These preference shares may be redeemed by the subsidiary at any

time on or after December 31, 2008 at a price per share of $100,000,

plus unpaid dividends, adjusted for certain increases in the value of

Tyco’s stock, as defined.

Fiscal 1997

In addition to the mergers discussed in Note 2, in Fiscal 1997 the Com-

pany acquired companies in each of its business segments for an

aggregate of $1,523.7 million, consisting of $1,415.2 million in cash,

the issuance of approximately 3.8 million common shares valued at

$92.8 million and the assumption of approximately $15.7 million in

debt. The cash portions of the acquisition costs were funded utilizing

cash on hand, net proceeds from the sale of common shares of

$645.2 million, and borrowings under the Company’s uncommitted

lines of credit. Each of these acquisitions was accounted for as a pur-

chase, and the results of operations of the acquired companies were

included in the consolidated results of the Company from their respec-

tive acquisition dates. As a result of the acquisitions, approximately

$708.7 million in goodwill and other intangibles, net of the write-off of

purchased in-process research and development, was recorded by

the Company. In connection with the acquisition of AT&T Corp.’s sub-

marine systems business, the Company allocated $361.0 million of

the purchase price to in-process research and development projects

that had not reached technological feasibility and had no probable

alternative future uses. As of September 30, 1999, the payout for

employee severance and consolidation of facilities related to these

acquisitions was substantially complete.

In 1995, as a result of the sale of a business in the United King-

dom, the Company holds a subordinated, non-collateralized zero

coupon loan note maturing in 2004 (“Vendor Note”), together with a

10% interest in the ordinary share capital of the issuer. The Vendor

Note has a £120.8 million ($199.2 million) aggregate principal amount

at maturity with an issue price of $83.9 million, reflecting a yield to

Purchase accounting liabilities recorded during Fiscal 1998 con-

sist of $60.1 million for transaction and other direct costs, $159.7 mil-

lion for severance and related costs and $278.9 million for costs

associated with the shut down and consolidation of certain acquired

facilities. The $159.7 million of severance and related costs covers

employee termination benefits for approximately 4,800 employees

located throughout the world, consisting primarily of manufacturing

employees to be terminated as a result of the shut down and consoli-

dation of production facilities and, to a lesser extent, technical, sales

and administrative employees. At September 30, 1999, approximately

2,650 employees had been terminated and $38.9 million in severance

and related costs remained on the balance sheet. The Company

expects that the remaining employee terminations will be completed

in Fiscal 2000.

The $278.9 million of exit costs are associated with the closure

and consolidation of facilities involving approximately 90 facilities

located primarily in the United States and Europe. These facilities

include manufacturing plants, warehouses, office buildings and sales

offices. Included within these costs are accruals for non-cancelable

leases associated with certain of these facilities. Approximately

73 facilities, mainly office buildings and sales offices, had been

shut down as of September 30, 1999. The remaining facilities primarily

include large manufacturing plants, which are expected to be shut

down in Fiscal 2000. Expenses in connection with the closure of these

remaining facilities, as well as the expiration of non-cancelable leases

(less any expected sublease income for facilities already closed),

comprise the approximately $146.4 million for facility related costs

remaining on the balance sheet as of September 30, 1999.

In July 1998, the Company acquired the U.S. operations of

Crosby Valve, Inc. in exchange for 1,254 cumulative dividend prefer-

ence shares of a newly created subsidiary, valued at $125.4 million.

The subsidiary has authorized 2,000 cumulative dividend preference

shares. The holders of these preference shares have the option to

require the Company to repurchase the preference shares at par value

plus unpaid dividends at any time after July 2001. The outstanding

preference shares were issued at $100,000 par value each and have

been classified in other long-term liabilities on the Consolidated Bal-