ADT 1999 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1999 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

As a result of the merger with USSC, approximately 14.2 million

options which were not previously exercisable became immediately

exercisable on October 1, 1998. Upon consummation of the merger

with AMP on April 2, 1999, approximately 7.8 million options became

immediately exercisable due to the change in ownership of AMP

resulting from the merger.

Stock-Based Compensation

SFAS No. 123, “Accounting for Stock-Based Compensation”

(“SFAS 123”) allows companies to measure compensation cost in con-

nection with executive share option plans and schemes using a fair

value based method, or to continue to use an intrinsic value based

method which generally does not result in a compensation cost. The

Company has decided to continue to use the intrinsic value based

method and does not recognize compensation expense for the

issuance of options with an exercise price equal to or greater than the

market price at the time of grant. Had the fair value based method

been adopted consistent with the provisions of SFAS 123, the Com-

pany’s pro forma net income (loss) and pro forma net income (loss)

per common share for Fiscal 1999, Fiscal 1998 and Fiscal 1997 would

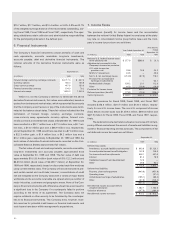

have been as follows:

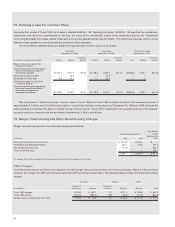

1999 1998 1997

Net income (loss)

—

pro forma

(in millions) $821.6 $1,063.3 $(428.7)

Net income (loss) per common

share

—

pro forma

Basic 0.50 0.67 (0.29)

Diluted 0.49 0.66 (0.29)

The estimated weighted average fair value of Tyco and AMP

options granted during Fiscal 1999 was $12.13 and $7.11, respec-

tively, on the date of grant using the option-pricing model and assump-

tions referred to below. The estimated weighted average fair value of

Tyco, USSC and AMP options granted during Fiscal 1998 was $8.24,

$6.79 and $5.98, respectively, on the date of grant using the

option-pricing model and assumptions referred to below. The esti-

mated weighted average fair value of Tyco, Former Tyco, Inbrand,

USSC and AMP options granted during Fiscal 1997 was $6.08, $4.78,

$18.59, $7.15 and $9.27, respectively, on the date of grant using the

option-pricing model and assumptions referred to below. There were

no stock option grants for Keystone in Fiscal 1997.

The fair value of each option grant was estimated on the date of

grant using the Black-Scholes option-pricing model. The following

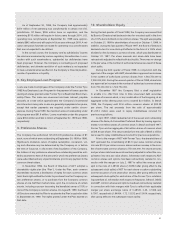

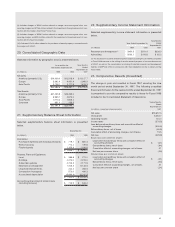

weighted average assumptions were used for Fiscal 1999:

Tyco AMP

Expected stock price volatility 30% 27%

Risk free interest rate 5.15% 5.07%

Expected annual dividend yield per share $0.05 1.25%

Expected life of options 4.2 years 6.5 years

The following weighted average assumptions were used for Fis-

cal 1998:

Tyco USSC AMP

Expected stock price

volatility 22% 39% 27%

Risk free interest rate 5.62% 5.40% 5.50%

Expected annual

dividend yield per share $0.05 $0.11 1.25%

Expected life of options 5 years 4.2 years 6.5 years

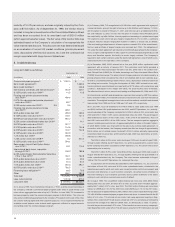

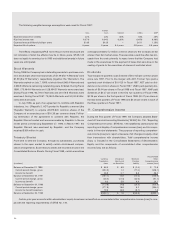

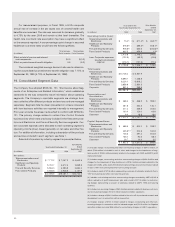

The following table summarizes information about outstanding and exercisable options at September 30, 1999:

Options Outstanding Options Exercisable

Weighted

Weighted Average Weighted

Average Remaining Average

Range of Number Exercise Contractual Number Exercise

Exercise Prices Outstanding Price Life

—

Years Exercisable Price

$ 0.00 to $ 4.98 676,490 $ 4.14 3.7 676,490 $ 4.14

4.99 to 7.44 8,064,944 6.51 5.4 6,345,144 6.46

7.45 to 9.98 1,940,708 8.84 6.0 952,310 8.85

9.99 to 11.76 1,111,392 10.91 6.5 541,908 10.89

11.77 to 14.88 3,803,020 14.02 6.6 2,503,100 13.90

14.89 to 19.97 13,127,514 18.89 7.5 6,474,486 18.56

19.98 to 24.93 11,816,100 21.59 7.3 9,452,060 21.79

24.94 to 29.87 11,129,338 28.17 8.3 3,251,948 28.11

29.88 to 31.80 5,405,046 31.41 7.1 5,363,162 31.41

31.81 to 34.42 2,518,496 32.77 8.7 933,536 32.97

34.43 to 44.62 11,518,704 36.79 9.0 1,727,126 38.63

44.63 to 50.00 9,007,113 49.35 9.3 6,545,044 49.67

50.01 to 52.01 2,957,886 50.99 9.5 2,934,158 51.00

52.02 to 73.30 2,914,516 59.58 5.9 2,078,414 60.90

Total 85,991,267 49,778,886