XM Radio 2010 Annual Report Download - page 97

Download and view the complete annual report

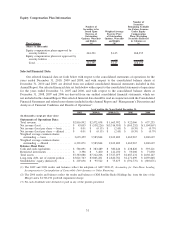

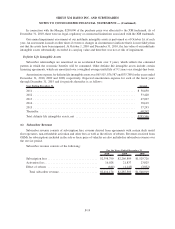

Please find page 97 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollar amounts in thousands, unless otherwise stated)

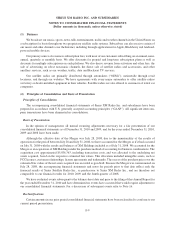

(1) Business

We broadcast our music, sports, news, talk, entertainment, traffic and weather channels in the United States on

a subscription fee basis through our two proprietary satellite radio systems. Subscribers can also receive certain of

our music and other channels over the Internet, including through applications for Apple, Blackberry and Android-

powered mobile devices.

Our primary source of revenue is subscription fees, with most of our customers subscribing on an annual, semi-

annual, quarterly or monthly basis. We offer discounts for prepaid and long-term subscription plans as well as

discounts for multiple subscriptions on each platform. We also derive revenue from activation and other fees, the

sale of advertising on select non-music channels, the direct sale of satellite radios and accessories, and other

ancillary services, such as our weather, traffic, data and Backseat TV services.

Our satellite radios are primarily distributed through automakers (“OEMs”); nationwide through retail

locations; and through our websites. We have agreements with every major automaker to offer satellite radios

as factory or dealer-installed equipment in their vehicles. Satellite radios are also offered to customers of rental car

companies.

(2) Principles of Consolidation and Basis of Presentation

Principles of Consolidation

The accompanying consolidated financial statements of Sirius XM Radio Inc. and subsidiaries have been

prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). All significant intercom-

pany transactions have been eliminated in consolidation.

Basis of Presentation

In the opinion of management, all normal recurring adjustments necessary for a fair presentation of our

consolidated financial statements as of December 31, 2010 and 2009, and for the years ended December 31, 2010,

2009 and 2008 have been made.

Although the effective date of the Merger was July 28, 2008, due to the immateriality of the results of

operations for the period between July 28 and July 31, 2008, we have accounted for the Merger as if it had occurred

on July 31, 2008 with the results and balances of XM Holdings included as of July 31, 2008. We accounted for the

Merger as an acquisition of XM Holdings under the purchase method of accounting for business combinations. The

acquisition cost approximated $5,836,363, including transaction costs, and was allocated to the underlying net

assets acquired, based on the respective estimated fair values. This allocation included intangible assets, such as

FCC licenses, customer relationships, license agreements and trademarks. The excess of the purchase price over the

estimated fair values of the net assets acquired was recorded as goodwill. Because the Merger was consummated on

July 28, 2008, the accompanying financial statements and notes for periods prior to that date reflect only the

financial results of Sirius Satellite Radio Inc., as predecessor to Sirius XM Radio Inc., and are therefore not

comparable to our financial results for 2010, 2009 and the fourth quarter of 2008.

We have evaluated events subsequent to the balance sheet date and prior to the filing of this Annual Report for

the year ended December 31, 2010 and have determined no events have occurred that would require adjustment to

our consolidated financial statements. For a discussion of subsequent events refer to Note 16.

Reclassifications

Certain amounts in our prior period consolidated financial statements have been reclassified to conform to our

current period presentation.

F-9