XM Radio 2010 Annual Report Download - page 62

Download and view the complete annual report

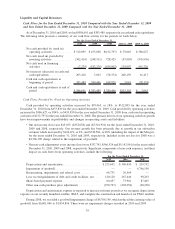

Please find page 62 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cost of Equipment includes costs from the sale of satellite radios, components and accessories and provisions

for inventory allowance attributable to products purchased for resale in our direct to consumer distribution channels.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, cost of equipment was $35,281 and

$40,188, respectively, a decrease of 12%, or $4,907 and decreased as a percentage of total revenue. The

decrease was primarily due to lower inventory write-downs, lower sales through distributors and reduced

costs to produce aftermarket radios.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, cost of equipment was $40,188 and

$46,091, respectively, a decrease of 13%, or $5,903 and decreased as a percentage of total revenue. The

decrease was primarily due to lower sales volume through our direct to consumer channel, lower inventory

related charges and lower product and component sales, partially offset by the inclusion of XM’s cost of

equipment expense as a result of the Merger.

We expect cost of equipment to vary with changes in sales, supply chain management, and inventory

valuations.

Subscriber Acquisition Costs include hardware subsidies paid to radio manufacturers, distributors and

automakers, including subsidies paid to automakers who include a satellite radio and subscription to our service

in the sale or lease price of a new or certified pre-owned vehicle; subsidies paid for chip sets and certain other

components used in manufacturing radios; device royalties for certain radios; commissions paid to retailers and

automakers as incentives to purchase, install and activate satellite radios; product warranty obligations; and

provisions for inventory allowances attributable to inventory consumed in our OEM and retail distribution channels.

The majority of subscriber acquisition costs are incurred and expensed in advance of, or concurrent with, acquiring

a subscriber. Subscriber acquisition costs do not include advertising, loyalty payments to distributors and dealers of

satellite radios and revenue share payments to automakers and retailers of satellite radios.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, subscriber acquisition costs were

$413,041 and $340,506, respectively, an increase of 21%, or $72,535 and increased as a percentage of total

revenue. The increase was primarily a result of the 25% increase in gross subscriber additions and higher

subsidies related to the 49% increase in OEM installations, partially offset by lower OEM subsidies per

vehicle and an $18,275 increase in the benefit to earnings from the amortization of the deferred credit for

acquired executory contracts recognized in purchase price accounting associated with the Merger.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, subscriber acquisition costs were

$340,506 and $371,343, respectively, a decrease of 8%, or $30,837 and decreased as a percentage of total

revenue. The decrease was primarily a result of lower OEM subsidies and chip set costs, decreases in

production of certain radios and lower aftermarket inventory charges in the year ended December 31, 2009

compared to the year ended December 31, 2008, partially offset by the inclusion of XM’s subscriber

acquisition costs as a result of the Merger.

We expect total subscriber acquisition costs to fluctuate with increases or decreases in OEM installations,

which are driven by OEM manufacturing and penetration rates, and changes in our gross subscriber additions.

Declines in the cost of subsidized radio components will also impact total subscriber acquisition costs. The impact

of purchase price accounting adjustments associated with the Merger attributable to the amortization of the deferred

credit for acquired executory contracts will vary, in absolute amount and as a percentage of reported subscriber

acquisition costs, through the expiration of the acquired contracts, primarily in 2013. We intend to continue to offer

subsidies, commissions and other incentives to acquire subscribers.

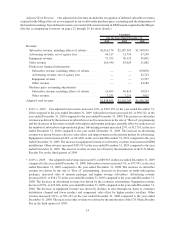

Sales and Marketing includes costs for advertising, media and production, including promotional events and

sponsorships; cooperative marketing; customer retention and personnel. Cooperative marketing costs include fixed

and variable payments to reimburse retailers and automakers for the cost of advertising and other product awareness

activities performed on our behalf.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, sales and marketing expenses were

$215,454 and $228,956, respectively, a decrease of 6%, or $13,502 and decreased as a percentage of total

6