XM Radio 2010 Annual Report Download - page 37

Download and view the complete annual report

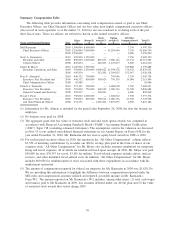

Please find page 37 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.subscribers, cash, revenue, adjusted EBITDA, subscriber acquisition costs per gross addition, churn, operating

expense growth, and other factors that it determines are appropriate. The Compensation Committee intends to

adopt a similar process for determining our named executive officers’ bonuses for 2011 as it has done in the

past.

Long-term Incentive Compensation

Objectives. The Compensation Committee grants long-term incentive awards in the form of stock

options to directly align compensation for our executive officers over a multi-year period with the interests of

our stockholders by motivating and rewarding actions that create or increase long-term stockholder value. The

Compensation Committee determines the level of long-term incentive compensation based on an evaluation of

competitive factors in conjunction with total compensation provided to named executive officers and the

objectives of the compensation program described above.

Process. Our Compensation Committee grants long-term incentive compensation in the form of stock

options because our Compensation Committee believes that our stock option program properly balances the

goals of incentivizing our executives to create and sustain long-term stockholder value and retaining our

executives in a competitive labor environment. Stock options have an exercise price equal to the market price

on the date of grant, and therefore provide value to the executives if the executives create value for our

stockholders. In addition, stock options generally vest over a period of four years, generally subject to the

executive’s continued employment, which incentivizes the executives to sustain increases in stockholder value

over extended periods of time. The specific number of options granted to each of Ms. Altman and Mr. Frear

was determined by the Compensation Committee with the assistance of our Chief Executive Officer and by

using their informed judgement, taking into account the executive’s role and responsibilities within the

company and the overall performance of the company and our common stock, and was not based on any

specific quantitative or qualitative factors. As part of that process, the Compensation Committee considered

the value and structure of the awards, which vest over a four year period, as a retention tool. With respect to

Mr. Donnelly, the number of options granted to him was based on negotiations between us and Mr. Donnelly

as part of the execution of his new employment agreement.

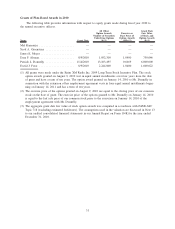

2010 Stock Option Grants. In 2010, we granted long-term incentive compensation, in the form of stock

options, to each of Messrs. Donnelly and Frear and Ms. Altman. The stock options awarded by the

Compensation Committee in 2010 to these three named executive officers are identified in the Grants of Plan-

Based Awards Table for 2010. The option grant to Mr. Donnelly was made in accordance with our practice of

making option grants to named executive officers upon entering into extended employment agreements with

us, and the option grant to each of Ms. Altman and Mr. Frear was made as part of a broad-based option grant

to our employees. The Compensation Committee did not grant any option awards to Messrs. Karmazin,

Greenstein and Meyer in 2010 because they each received grants of options awards as part of entering into

new employment arrangements with us in 2009, and those options are expected to be their primary long-term

incentive compensation during the term of their employment agreements. Messrs. Karmazin, Greenstein,

Meyer and Donnelly did not participate in our broad-based stock option grants in 2010.

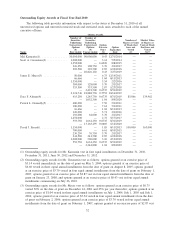

The stock options granted to our named executive officers in 2010 vest in equal installments over four

years, generally subject to the officer’s continued employment through the vesting period, which enhances the

retention value of the award and incentivizes the officers to create and sustain long-term value for our

stockholders.

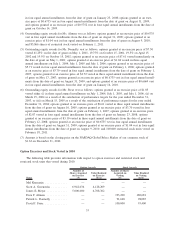

Retirement and Other Employee Benefits

We maintain broad-based benefits for all employees, including health and dental insurance, life and

disability insurance and a 401(k) plan, including the matching component of that plan. Our named executive

officers are eligible to participate in all of our employee benefit plans on the same basis as other employees.

We do not sponsor or maintain any other retirement or deferred compensation plans for any of our employees

in addition to our Sirius XM 401(k) plan.

27