XM Radio 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Footnotes

(1) Average self-pay monthly churn represents the monthly average of self-pay deactivations for the quarter

divided by the average number of self-pay subscribers for the quarter. Average self-pay churn for the year is the

average of the quarterly average self-pay churn.

(2) We measure the percentage of owners and lessees of new vehicles that receive our service and convert to

become self-paying subscribers after the initial promotion period. We refer to this as the “conversion rate.” At

the time satellite radio enabled vehicles are sold or leased, the owners or lessees generally receive trial

subscriptions ranging from three to twelve months. Promotional periods generally include the period of trial

service plus 30 days to handle the receipt and processing of payments. We measure conversion rate three

months after the period in which the trial service ends.

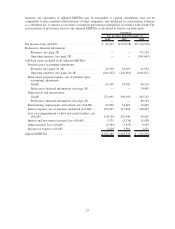

(3) ARPU is derived from total earned subscriber revenue, net advertising revenue and other subscription-related

revenue, net of purchase price accounting adjustments, divided by the number of months in the period, divided

by the daily weighted average number of subscribers for the period. Other subscription-related revenue includes

the U.S. Music Royalty Fee, which was initially charged to subscribers in the third quarter of 2009. Purchase

price accounting adjustments include the recognition of deferred subscriber revenues not recognized in

purchase price accounting associated with the Merger. ARPU is calculated as follows (in thousands, except

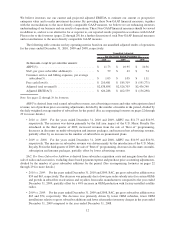

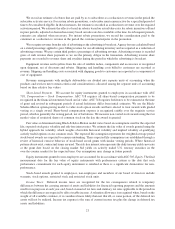

for subscriber and per subscriber amounts):

2010 2009 2008

For the Years Ended December 31,

Unaudited

Subscriber revenue:

GAAP .................................. $ 2,414,174 $ 2,287,503 $ 1,548,919

Predecessor financial information .............. — — 670,870

Net advertising revenue:

GAAP .................................. 64,517 51,754 47,190

Predecessor financial information .............. — — 22,743

Other subscription-related revenue (GAAP) ......... 234,148 48,679 —

Purchase price accounting adjustments ............ 14,655 46,814 38,533

$ 2,727,494 $ 2,434,750 $ 2,328,255

Daily weighted average number of subscribers ...... 19,385,055 18,529,696 18,373,274

ARPU . . .................................. $ 11.73 $ 10.95 $ 10.56

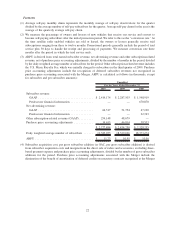

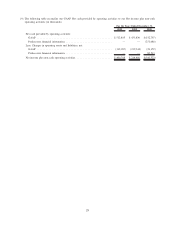

(4) Subscriber acquisition cost, per gross subscriber addition (or SAC, per gross subscriber addition) is derived

from subscriber acquisition costs and margins from the direct sale of radios and accessories, excluding share-

based payment expense and purchase price accounting adjustments, divided by the number of gross subscriber

additions for the period. Purchase price accounting adjustments associated with the Merger include the

elimination of the benefit of amortization of deferred credits on executory contracts recognized at the Merger

22